The psychedelic field shifted from fringe to frontier in the recent period. The taboo category has become essential for producing groundbreaking mental health treatment research that addresses depression along with PTSD and addiction. A growing number of investors now follow scientific investigations about psychedelic medicine as they fund forward-thinking minds who bring transformative change to this field.

The market for psychedelic innovation now catches the attention of venture capital firms who see both social value and market potential in this area. In this article, we focus on the leading venture capital firms that actively fund psychedelic innovation. These companies provide more than financial resources because they actively shape the mental health framework of tomorrow.

what’s in the article

- Why Psychedelic Startups Are Attracting Investors?

- Top Psychedelic Venture Capital Firms

- How to Secure Funding for a Psychedelic Startup?

- How Funding Accelerated Their Growth?

- Conclusion

Why Psychedelic Startups Are Attracting Investors?

Psychedelic startup companies capture investor interest because they solve major mental health problems through innovative scientific research-based methods. The worldwide increase in depression, anxiety, PTSD, and addiction cases continues to exceed the effectiveness of traditional treatments. Psychiatric researchers now study psychedelics after they spent decades as a subculture drug.

Investors find this space attractive because it unites several key components which include medical needs that remain unsatisfied, growing public approval, and regulatory adjustments that show progress in becoming more favorable. Enhanced FDA Breakthrough Therapy designations along with rising academic research have elevated psychedelics to their highest level of credibility in history.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Top Psychedelic Venture Capital Firms

A limited group of psychedelic venture capital firms functions as essential drivers in guiding the psychedelic market transformation from taboos to scientific acceptance. These firms go beyond company funding because they direct the development of future mental health advancements and scientific consciousness research. The following list presents venture capital firms that are actively influencing psychedelic development.

Prime Movers Lab

Prime Movers Lab directs its investing to scientific startups that seek to disrupt entire psychedelic compound business domains including the psychedelic industry. The company demonstrates a strong interest in biotech and health innovation through its pursuit of companies that develop psychedelics for mental health transformation. The mental health crisis and other major human problems can be solved through science according to their portfolio investments.

Palo Santo

Palo Santo operates as a specialized venture fund dedicated to backing psychedelic medicine during the current mental health transformation. The firm operates a diverse portfolio of above 20 companies that prioritize pharmaceutical development and the infrastructure required to deliver psychedelic-assisted therapies. Palo Santo combines industry knowledge to provide secure and efficient mental healthcare that remains affordable for all.

What If Ventures

What If Ventures serves as a psychedelic venture capital organization that dedicates itself to investing in mental health solutions which include psychedelic-based startups. The company prioritizes human-centered solutions by investing in treatments for depression, anxiety disorders, substance abuse problems, and additional mental health concerns. What If Ventures stands out because it assesses potential companies by their evidence-driven scalable strategies rather than market hype.

PsyMed Ventures

PsyMed Ventures dedicates its resources to supporting emerging technologies that combine psychedelic substances, precise psychiatric care, and digital healthcare programs. The companies in their portfolio work on developing both treatments and entire care ecosystems for early-stage development. The company PsyMed Ventures prioritizes ethical development methods, science-based strategies, and sustained therapeutic outcomes.

Synaptic Ventures

The investment approach of Synaptic Ventures bases its psychedelic funding on scientific principles. The company concentrates on neurotechnologies alongside psychedelics and cognitive health research to discover startup ventures that transform brain diagnostic and therapeutic methods. Synaptic Ventures merges established venture capital knowledge with its pursuit of novel mental expansion treatments.

Noetic Fund

Noetic Fund operates as one of the leading investors in the psychedelic markets. Noetic Fund operates from Canada to invest in first-stage companies that create innovative mental health solutions through psychedelic medicine and additional approaches. Their investment strategy focuses on complete patient care by evaluating treatment, and complete patient pathway from discovery to market distribution.

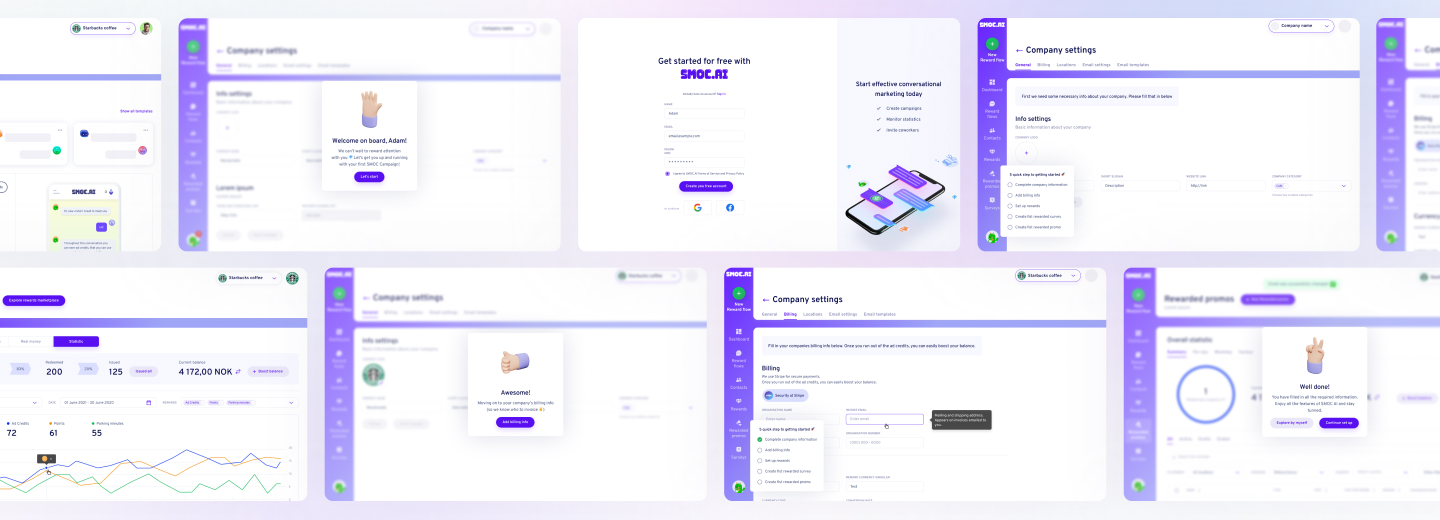

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

How to Secure Funding for a Psychedelic Startup?

The entry into the psychedelic industry offers great promise yet establishing psychedelic investment funds requires specific strategic steps. The market competition intensified due to increased venture capitalist interest. Founders need to show that their solution extends beyond a promising concept by showing its scientific basis while proving its ethical viability and commercial viability. Your psychedelic startup needs funding growth support which can be obtained through these strategies.

What Investors Look for in Psychedelic Startups

Investors in this space are driven by both impact and potential returns, so they look for startups that blend strong science with smart business. Here’s what typically grabs their attention:

- Scientific credibility: The investment criteria include strong scientific backing, valid research, expert advisors, existing clinical data, or a predictable path to obtain it.

- Regulatory strategy: An investor needs to understand the intricate regulatory framework as well as develop a roadmap for navigating it.

- Scalability: The ability to expand consistently defines a successful business structure regardless of operating as a biotech, therapeutic clinic, or digital platform.

- Team expertise: Founders with a blend of scientific, medical, and business backgrounds instill confidence. You can consult with fundraising services on this topic to get more insightful information.

- Ethical foundation: It includes a dedication to protecting safety, and equity in addition to responsible innovation because personal and cultural elements maintain crucial significance.

Pitching Your Psychedelic Innovation to Investors

For successful pitch presentations, psychedelic startups need to remain both clearly understood and passionately engaged. Investors understand the potential of psychedelics yet they need to understand why your solution stands out above all others as an investment choice.

- Tell a compelling story: Begin by explaining the issue your solution solves. The strength of personal motivation reaches its peak specifically in mental health matters.

- Highlight your scientific edge: Present your scientific achievements by developing research progress along with clinical procedures that maintain comprehension for both scientists and non-scientists.

- Show traction: The market will respond favorably to any type of early evidence including preclinical research findings, developing waitlists, or strategic business relationships.

- Address the risks upfront: Before proceeding with your plan address all regulatory along with ethical and social risks by demonstrating how you will solve them.

- Present a clear financial vision: A clear financial outlook should demonstrate your understanding of revenue strategies, market projections, and exit strategies.

How Funding Accelerated Their Growth?

Many psychedelic startups reached breakthrough momentum because of their initial funding acquisitions that brought more than just financial support. The psychedelic investments provided founders with the capability to increase their workforce and construct important infrastructure which enabled faster development of new mental health solutions.

The funding from investors enabled therapy delivery startups to build new treatment centers and digital health and wellness platforms to create mobile apps and therapist development programs for expanding their operations. Mental health has emerged as a worldwide concern so these companies received timely investments which allowed them to connect with more individuals at speed.

Strategic value accompanies venture capital investments because firms help their companies by supplying mentorship and networking access while guiding business development and regulatory compliance. The financial support from venture capital establishes credibility for an emerging field such as psychedelics which results in sustained development.

Ultimately, funding doesn’t just provide a runway – it gives startups the tools and confidence to turn bold ideas into real-world impact.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

The psychedelic industry is at a pivotal moment – one where science, mental health, and investment are converging to reshape how we approach healing and well-being. The recognition by venture capital firms of this industry transformation supports the development of future mental health solutions while serving as instrumental drivers for the establishment and growth of this movement.

The investors operate via two routes to create meaningful change by funding research-based therapies, and fostering platforms that expand treatment availability. Startup companies that possess clear direction, ethical principles, and robust implementation strategies will continue obtaining needed financial support for their growth.

The bright future of psychedelics exists because the right investment collaborators help translate this future into reality for founders, researchers, and anyone interested in this emerging field.

Yes, psychedelic investing is legal when they concentrate on studying and treating mental health or practicing wellness practices. A thorough assessment of local laws is required because different nations have different regulations for psychedelic products.

Select investment firms that have established experience either in biotech research, mental healthcare, or psychedelic markets. Investors should examine their company portfolio and mission goals to make warm introductions and pitch their business ideas at events.

Returns vary widely. Early-stage companies have a high potential for substantial rewards in this high-risk industry sector if regulatory and market situations keep improving.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers