Financial App Development Company

EVNE Developers delivers smart, user-friendly, and secure personal finance app development for numerous platforms like Android, iOS, hybrid app or custom app development services. We will help to transform all your buisness ideas into reality with ease to take a competitive advantage on the FinTech market.

clients already take benefits from their custom FinTech apps

The benefits of creating a financial mobile app

The financial apps are easy to use and cost effective. Customers are also likely to receive payment notifications and reminders from banks. Because the apps are completely secure with Privacy by Default and by Design requiremnts, all of the personal data are kept safe and encrypted. Besides, finance mobile app development has the following benefits:

Better customer retention

You are developing a financial app to retain existing users while also adding new ones. When a user becomes a regular or long-term customer, you can begin offering more products to them and provide better services.

App promotion via push notifications

The push notification feature in the on-demand financial app is a useful asset that can increase sales via in-app marketing. You can send your users messages based on what they're looking for. This is where you may break through and win the game by offering tailored services and interesting offers.

Customers analytics

With mobile app, you can identify and analyze your customer’s preferences and priorities. It is up to you to decide how to cash them out. You have valuable data that can be used to better target users while also developing better corporate policies, identifying customer behavior profiling, and so on.

New customers

Customer data and analytics will also be helpful in gaining new clients. Furthermore, customers are always changing apps in order to acquire better technology support and the best features for their needs. The goal of your app is to grab their attention so that they stay with you on a long-term basis.

An enhanced customer support

The financial application development results in improved customer service with the specialized app. In addition to the FAQ, support and bug-report sections, some apps provide a chatbot where clients may get answers to their questions without any human involvement.

Award-winning designs featured by

3x Innovation

3x Best UI/UX

1x Mobile Excelence

Our services / solutions

From design to deployment, we offer full-cycle finance mobile app development. Our UI/UX Designers and App Developers will provide your users a native experience and ensure they achieve their goals in a matter of taps.

Electronic Trading Platforms

An electronic trading platform is a computer software that enables users to place orders for financial products with a fund manager across a network. The examples of these products are stocks, bonds, currencies, commodities, and derivatives.

Digital Wallets

Customers enjoy the convenience and security of digital wallets. They enhance your customer experience by speeding the checkout process and securing sensitive financial information. You can provide your clients with alternative payment choices. Customers may not always like to pay with credit cards, and with digital wallets, you can take alternative payments such as Bitcoin or direct PayPal payments.

Analytics and BI

Behavioral analytics comes to the rescue in recognizing fraudulent activity besides marketing and PR tasks. Analytics can track and discover patterns that show fraudsters' actions. Banks and other fin-tech companies might then put in place safeguards against such attempts.

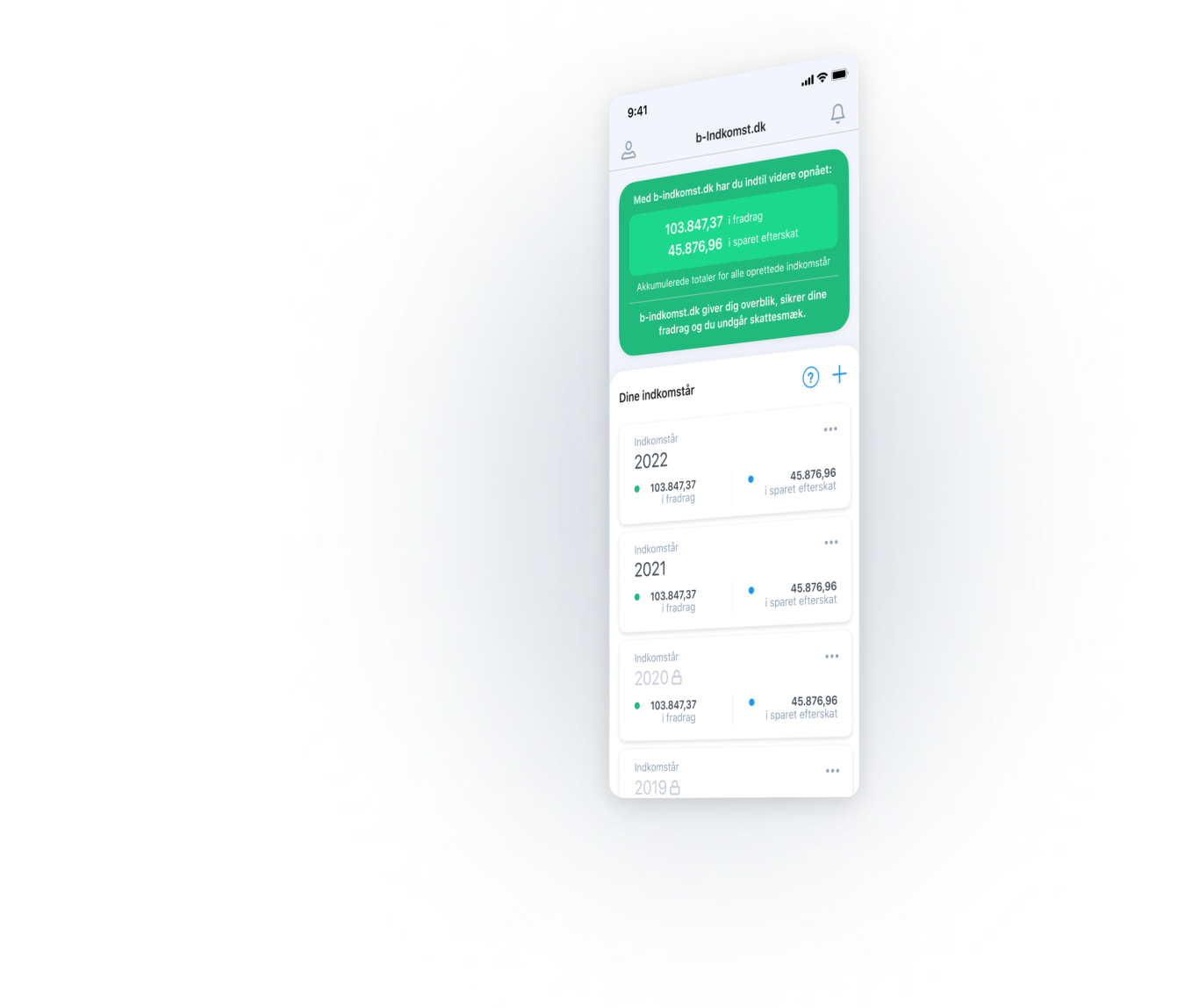

Financial Planning

Financial planning is vital for controlling the flow of finances and income inside your organization. It keeps you up to date on the future and present status of your company's finances while also allowing you to make the most of your money.

Fintech UX/UI

FinTech creates great potential by applying the power of UX not only into app development but also into a company's DNA. Users will not become clients if they find your website or app annoying or frustrating. Creating the appropriate user experience might mean the difference between success and failure in today's competitive FinTech market.

CRM for Banks

CRM software is a customized solution that assists banks in implementing customer-focused strategies. Bank tellers and workers can keep customer data such as contact information, products used, and interactions in a single system. You'll also be able to set up appointments, send personalized emails, and manage leads in their sales pipeline.

Fintech Software Development

FinTech software development enables you to offer your consumers the best online payment experience possible. It employs technologically advanced approaches to improve the efficiency of financial processes by introducing traditional methods.

Why our company?

EVNE Developers is a value-driven financial app development company with extensive experience in custom finance app development.

- Our skilled fintech app developers will meet all of your business requirements.

- We leverage cutting-edge technology to deliver you world-class fintech software solutions.

- Because we employ proven frameworks and technologies to assure high-end financial services app development, our fintech software solutions are compliant with all fintech requirements.

- 11 years of experience in the FinTech industry.

- 100% job success rating at Upwork.

- When it comes to our processes, workflow, or your project, you can rely on complete transparency.

- Outsourcing allows you to save time and money. Create a powerful solution that meets your requirements without the need to hire or retain a permanent team.

- Post development support and consulting.

40%

20

Cases

We bring real solutions to each client’s problems through a deep understanding of their market, solution, and vision.

Interactive mortgage calculator web app

FinTech App

Web application with the primary goal to calculate the mortgage on the housing with numerous variables of payment options.

View case study

Meeting room booking and scheduling system

Business Tool

Web application with the primary goal to calculate the mortgage on the housing with numerous variables of payment options.

View case studyRelated blog posts

Stay ahead of the curve by reading our latest blogs, which are based on practical experience and cutting-edge technology

Testimonials

200+

Clients Already Served

EVNE Developers developed a financial management app for a fintech company. They built native versions for Android and iOS devices and worked on security features to protect the end users' personal data. The Android and iOS apps were successfully launched in the market, allowing the company to gather initial feedback for future ideation. EVNE Developers performed well and was reliable throughout the process. The team managed the project effectively and had truly excellent communication skills.

Randal Woodard

CEO, Fintech CompanyA real estate agency registry has hired EVNE Developers, LLC to build a сustom portal allowing users to get real estate information in their area. The team also performs intermediate user and manual testing. Since launching the platform built by EVNE Developers, LLC, the client started getting more than 1,000 users monthly with a retention rate of more than 70%. The unique features and the clear UX make users stay longer. The team clearly understands the client's vision for the platform and delivers.

Aidan Perkins

Managing Director, Real Estate Agency RegistryEVNE Developers, LLC has developed an e-learning app for an educational facility. The team has been involved designing the app's UI/UX and functions and implementing the company's key vision for the product. The product has allowed the facility to provide education for their target audience, allowing them to expand faster. EVNE Developers, LLC has an effective project management approach, guiding the company at every step. They facilitate weekly status meetings and communicate closely with the client.

Philipp Nacht

Director, Educational FacilityFAQ

Find answers to the most common questions we receive before development initialization

The process of fintech software development services is typically organized in the following way:

Research

The finance app development company brainstorms useful features, technologies, and other implementations. Once this information is acquired, the project scope may be established, outlining the overall project timeline.

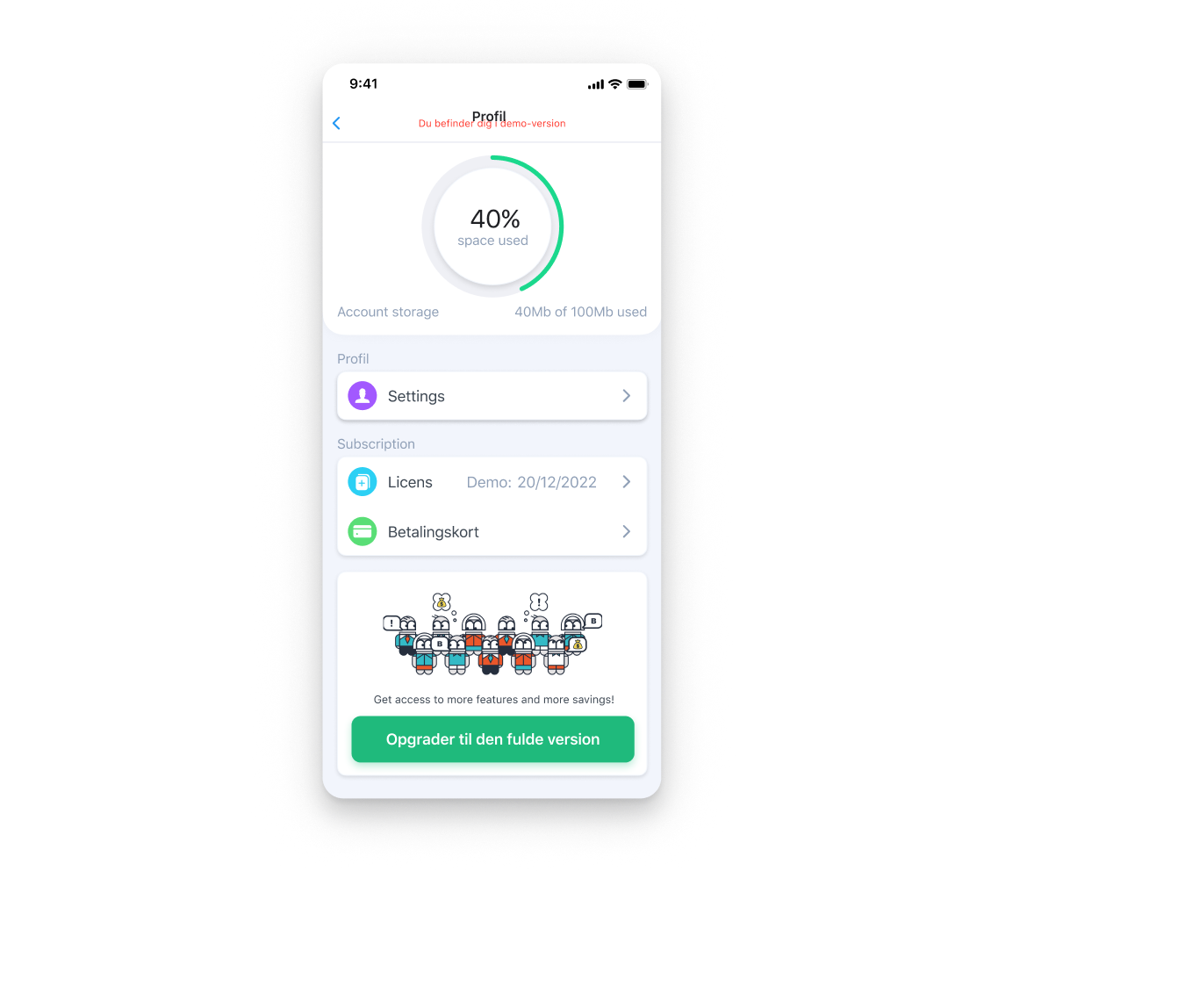

Prototype creation

We can start working on your product’s prototype or MVP as soon as the features are specified. This will assist you in determining the market viability of your product.

Design and development

The next stage is to work on the application’s UI and UX. Fintech app developers guarantee that the app has easy navigational qualities and provides a fantastic user experience by properly implementing the necessary set of features.

Testing

Testing is an important step of the app development process since it ensures that the app is free of bugs and flaws. Only after thorough end-to-end testing your financial app can be released.

Deployment

This is the final stage of the financial app development process, in which you are finally ready to launch your app in app stores after all testing processes have been completed successfully.

Some popular methods for retaining user engagement include:

- Gamification in finance: Providing badges, points, or other game-based rewards can help maintain high levels of engagement.

- Personalization: Personalized content and recommendations make it more likely that users will return.

- Surveys and other means of collecting feedback keep customers in the loop and help encourage confidence that app developments will continue.

- Timely content creation: Creating regular and relevant information provides users a reason to return and see what’s new.

Common mistakes to avoid while developing FinTech applications are the following:

- Not mapping target audiences

- Poor and sluggish UX/UI practices

- Congesting elements and components

- Not following security approaches

- In-built data cleansing model

- Failing with precise accessibility

- Setting unrealistic performance goals

- Insufficient and unsatisfactory testing

- Incompatible development and deployment

EVNE Developers will make sure the FinTech app development goes as smooth as possible.

Before starting any FinTech app development project, you should be informed of state or country government legal requirements, as well as those of industry authorities. Meanwhile, specific states may have FinTech app requirements. Failure to comply with these rules may lead to legal consequences. Besides, identify your target audience, business goals, mission,, vision, budget, and choose the team which will develop your product.