Early-stage funding is still essential for entrepreneurial success as the startup ecosystem is thriving. Affluent people who take on the role of angel investors maintain a vital position in fostering innovative startups and accelerating their initial growth. Digital platforms today provide unprecedented ease for founders and investors to find each other anywhere in the world.

In this article, we’ll explore the leading angel investing platforms that have established their leadership position in 2025. These platforms allow startups to find investors for emerging early-stage business opportunities through their simple access systems, comprehensive solutions, and vibrant networking communities. Let’s dive into the best options shaping the future of startup investing this year.

what’s in the article

- What is angel investment?

- Best Angel Investing Websites and Platforms in 2025

- How to Choose the Best Startup Investing Platform

- Benefits of Using an Angel Investing Platform

- Conclusion

What is angel investment?

High-net-worth individuals, often called angel investors, support pre-seed and seed-stage companies by investing their funds in exchange for equity ownership or convertible debt. Angel investor sites provide capital using their funds because they combine financial gain with a desire to support both innovative startups and specific business sectors.

Investors at this stage of company development focus on assisting businesses in developing their product features or testing market potential. Apart from money, they supply crucial mentorship, industry contacts, and strategic guidance that directly shape the path of new startups.

The combination of bootstrapping and institutional funding makes angel investment an essential resource that enables new ventures to achieve their goals of growth and success.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Best Angel Investing Websites and Platforms in 2025

Digital platforms enable easy access to angel investing by connecting investors directly with startup businesses. Both established investors looking for high-growth opportunities alongside new investors interested in backing innovative ventures can access various tools through the platforms.

Wefunder

Wefunder maintains its position as one of the most popular crowdfunding platforms across the United States. Through this platform, investors from all backgrounds can support startup ventures while making small minimum investments. Wefunder improves its platform with robust financial data, educational resources, and streamlined vetting systems. Through its social platform and intuitive design, Wefunder serves as a great starting point for beginners and experienced angel investors at the same time.

AngelList

AngelList is a distinguished benchmark platform. The syndicate framework of the platform enables investors to share deals with prominent venture capitalists and seasoned angel investors while obtaining well-selected investment opportunities unavailable to public participants. The extensive set of backend features within AngelList, such as deal tracking, performance dashboards, automated legal, and tax services, makes portfolio management effortless.

Crowdcube

Crowdcube is one of the top equity crowdfunding platform across Europe, which provides access to promising startups throughout the UK and EU. Users can start investing in startups through Crowdcube by contributing a minimum of £10, which enables broad investor participation. Crowdcube has upgraded its platform by adding detailed company profiles, video pitches, and financial data, to enhance opportunity assessment for users. Investors find the platform dynamic through secondary market features and regular updates from founders that create an interactive experience.

iAngels

The platform stands out by combining a thorough investment screening system with extensive connections to Israel’s globally renowned tech startup community. iAngels provides individually selected investment deals that undergo intensive due diligence and frequently receive co-investments from established venture capital firms. The company iAngels maintains its priority on investing in technology-driven startups specifically in the fintech, cybersecurity, and AI sectors. The platform gives investors international market access through high-quality investment opportunities that show promise for strong growth.

StartEngine

StartEngine has become one of the biggest equity crowdfunding platforms in the United States, offering investment opportunities across startup companies, digital assets an,d collectibles. StartEngine stands out through its extensive accessibility toward both accredited and non-accredited investors, coupled with its comprehensive educational resources to teach new investors about startup investment benefits and potential risks. In 2025, regulatory integration of Reg A+ and Reg CF options at StartEngine enables investors to access companies at different development phases, including those planning for IPOs.

Republic

Republic serves as an all-inclusive crowdfunding system which includes startup investment options, real estate ventures, blockchain technology, and video game investments. Investors can support mission-driven companies through Republic through its focus on community engagement and its low minimum investment requirements. The platform’s expansion into new sectors and global markets positions Republic as an appealing investment platform for investors who want to spread their wealth across different asset types.

Gust

The professional investment platform Gust serves primarily the activities of the best angel investors websites, angel groups, and venture funds. The platform provides investors with a systematic investment process through tools that help manage opportunities, team collaboration, and maintain startup information. Detailed business plans, financial statements, and founder profiles help investors conduct due diligence.

OurCrowd

OurCrowd serves high-quality startup investment opportunities that typically target institutional investors. The platform offers its services to accredited investors while maintaining a reputation for detailed analysis of investment opportunities combined with worldwide reach and robust support systems after deals close. Through its hands-on approach, OurCrowd helps portfolio companies grow while investors gain access to individual deals or funds. The platform maintains its appeal to technology-focused investors who invest primarily in medtech innovations, robotics solutions, and enterprise software products, while delivering educational webinars and investor updates to members.

NEXEA

The NEXEA platform stands out as the premier choice for investors looking into Southeast Asian startup opportunities. NEXEA operates out of Malaysia and provides funding, mentorship and accelerator programs to ensure startups thrive in the long run. The platform provides investors with entry to startups in their initial stages that demonstrate promising potential for regional business growth. The model of NEXEA functions powerfully to unite funding with advisory services by letting investors actively participate in startup development.

EquityNet

EquityNet brings together unique features by providing entrepreneurs and investors with a strong analytics platform for business viability assessment. EquityNet provides investors with equity, debt, and royalty-based funding options, which provide better financing choices when compared to alternative crowdfunding sites. The business plan analysis tools combined with financial scoring models are beneficial for assessing a startup’s potential growth.

Crowdwise

The platform is a primary platform for educational investing, which makes it optimal for new equity crowdfunding participants. Through the platform, users can find detailed guidelines with strategy tips and risk management resources while being shown curated investment opportunities. Crowdwise combines educational content with active participation to deliver users’ understanding of what it means to be an angel investor. The platform expanded its educational offerings through webinars, community forums, and additional educational content.

Leapfunder

European startups heavily rely on Leapfunder because its convertible note system simplifies their early-stage investment process. Leapfunder delivers complete transparency through regular updates to investors, direct founder access, which creates high levels of interaction. The platform Leapfunder maintains its support for early-stage tech and SaaS companies through its investor-friendly process. Its straightforward structure makes Leapfunder an ideal platform for investors who want personal connections with supported startups.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

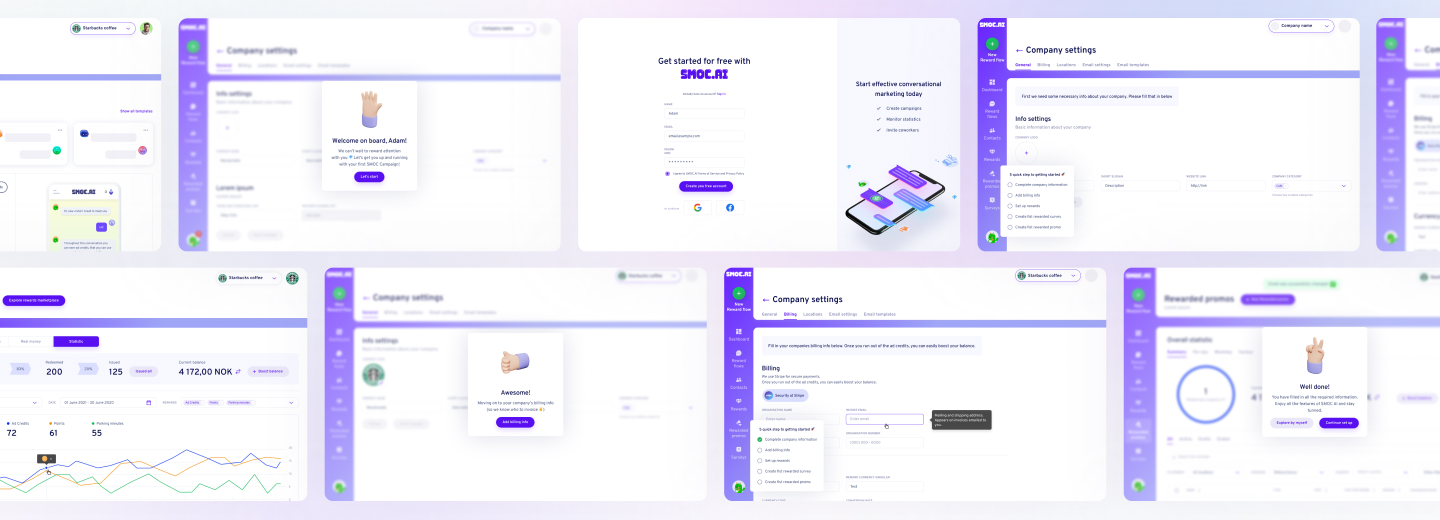

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

How to Choose the Best Startup Investing Platform

The best startup investment sites for you depends on your investment targets, tolerance to risk, experience level, and the specific startup sector that interests you. To make an informed decision, it is important to check if it offers high-quality investment opportunities, clear contractual conditions, trusted tools, and ongoing support during your investment experience.

Choose the best startup investing platforms based on both anticipated financial returns, your individual values system, and investment plan.

Questions to ask before joining an Angel Platform

Investors need to determine whether startup investing platforms fit their investment goals and tolerance for risk before they invest time and money. The right questions asked at the beginning help avoid costly surprises in future periods. You should ask these important questions before joining an Angel Platform:

Is the platform open to both accredited and non-accredited investors? Understanding eligibility helps determine whether you can legally participate.

- What is the minimum investment amount per deal? This tells you how accessible the platform is and how diversified your portfolio can be.

- How does the platform select and vet startups? A strong due diligence process is a good sign of quality deal flow.

- What are the fees involved, and who pays them? Some platforms charge investors, others charge startups – or both. Transparency here is critical.

- Does the platform offer post-investment support? Tools like dashboards, updates, and portfolio tracking enhance your investing experience.

- Can I communicate directly with startup founders? If you’re a hands-on investor, you’ll want platforms that allow this level of engagement.

- What investment structure does the platform use (e.g., equity, convertible notes, revenue share)? Different structures come with various risks, returns, and liquidity options.

- Is there a secondary market or exit strategy available? Knowing how and when you might get your money back is essential for long-term planning.

Benefits of Using an Angel Investing Platform

Modern investment platforms have revolutionized how people participate in funding early-stage businesses. These platforms emerge from their traditional exclusive nature to welcome investors of all backgrounds who want to fund upcoming startup ventures. The platform uses digital systems, organized investment opportunities, and member expertise to make investing more straightforward and accessible to all participants. Using a platform delivers vital strategic benefits that regular investors cannot achieve when operating independently.

Large Network of Angel Investors

An angel investing website allows investors to gain access to a large active network of fellow investors, which serves as a major advantage. A wide community membership provides investors with access to collective wisdom, potential co-investment opportunities, and experienced angel-led syndication programs. Investors in these networks serve as an informal advisory group through which they discuss founder assessments, market insights, and emerging technologies. New investors find significant value in the support network provided by angel investing platforms, which helps them learn risk assessment, spotting opportunities, and building their decision-making abilities.

Lower Entry Barriers

Before startup investing platforms emerged, startup funding was accessible only to wealthy individuals and financial institutions. The current investing landscape enables users to initiate investments with only $100, which opens startup funding opportunities to wider investor participation. Through portfolio diversification, anyone can invest without having to possess substantial financial resources. Through their platform infrastructure, these systems conduct legal paperwork, manage compliance tasks, and reporting duties, which simplifies the onboarding process.

Faster Fundraising Process

The primary objective remains fast-paced for startup investors and founders. The fundraising process on angel investing platforms becomes more efficient because they use standardized documentation, online payments, and real-time deal monitoring capabilities. Startups can tap into worldwide angel investor network through their platform within days, while investors gain access to approved deals through a few simple screens. Startups leverage this fast process to get funding faster for developing their products, hiring new talent, or expanding operations. Through these platforms, investors can speed up their investment timing by choosing from fast-paced enterprises that deliver better opportunities for participation.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

Today’s angel investing platforms create streamlined processes that enable people to support groundbreaking startup ventures. Every investor can find suitable angel investment platforms through the combination of popular options, Wefunder, Republic, iAngels, and NEXEA. Different investment angel investing websites feature specific features that match individual investor needs, including low thresholds for entering trades, extensive international investment options, and community-focused networks.

Your investment success depends on choosing an investment platform that fits both your goals and tolerance for risk. The smooth processes on these platforms lower entry barriers, which democratizes early-stage investment access so more people can invest in exciting startups. Research-based platform selection enables you to create a diverse investment portfolio, which may lead to beneficial financial outcomes.

The success rate of funding through angel investment varies, but typically only a small percentage of startups receive funding. Successful investments lead to substantial financial returns. Most angel investors for startups spread their investments across multiple opportunities as a risk management strategy.

Yes, many angel investing platforms let international startups fundraise through their platforms yet different country-specific regulations apply to each platform. International startups can find funding opportunities through platforms such as OurCrowd and AngelList.

The typical area of investment for angel investors encompasses technology startups, healthcare ventures, fintech companies, consumer products, and SaaS solutions during their early development phase. The investors search for both transformative solutions and solid leadership teams of founders.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers