Numerous founders are eager to build a company combining numerous features from technology, finance and decentralised communities. But they all find one hindrance – where should they find funding for their endeavours? Funding in the Web3 ecosystem carries its own set of opportunities, norms, and hurdles. Drawing on ten years immersed in development and business consulting, working with talent from this sector’s earliest days, I’ve seen strategies succeed, dreams crash, and, occasionally, visionary ideas pull in vast resources almost overnight.

Yet, raising funds for a Web3 startup goes far beyond closing a few rounds or launching a token. It’s about structuring your company, positioning it in a market seeing exponential change, and earning the trust of top Web3 investors and decentralized communities alike. As a team with experience in technical analysis and product launches, we aim to guide you through the multifaceted landscape of Web3 fundraising options, while sharing the investor expectations that can help exceptional projects break out from the crowd.

WHAT'S IN THE ARTICLE

Ways Web3 Startups Can Secure Funding

Modern Web3 startups enjoy access to an expanded menu of funding channels, some deeply technical, others old-school relational, each with its own criteria and cons. Let’s break down these primary options.

Equity Funding from VCs and Angel Investors

For all the experiments with tokens and DAOs, traditional fundraising tools haven’t faded from the startup playbook. Meeting with venture capital firms and angel investors remains a powerful way to land your initial runway, especially for projects with long research and development cycles. Here’s what sets Web3 VC funding apart:

- Deep Diligence: Top Web3 investors ask questions beyond conventional SaaS metrics. They’ll analyze your token logic, community engagement, and the defensibility of your protocol or business model against forks.

- Network Effects: Reputation travels fast. Strong connections in the space open doors to further rounds, talent, and ecosystem partnerships.

- Multi-Stage Support: Many leading firms provide networks for grants or technical assistance, not just cash.

The right VC brings not just capital, but a vote of confidence that still inspires co-investors and strategic hires.

Accelerators and Incubators

Accelerators and incubators focused on blockchain and decentralized projects serve as force-multipliers. These organizations deliver more than funds, they provide mentorship, technical resources, visibility, and often introductions to Web3 investors.

Participating in an accelerator offers:

- Access to curated investor networks

- Guidance with tokenomics and compliance

- Sharp feedback to pressure-test your value proposition

- Community events, pitch days, and demo opportunities

Choosing the right program hinges on whether their network, values, and specializations fit your Web3 startup’s needs, for example, whether they’ve helped projects in DeFi, NFTs, infrastructure, or social protocols.

Grants & Ecosystem Funds

A distinctive opportunity in Web3 startup funding lies in blockchain ecosystem grants. Many major protocols support growth through non-dilutive grants. These awards let you iterate on a proof-of-concept, recruit developers, or build infrastructure complementary to the blockchain in question.

Consider:

- Ethereum Foundation Grants

- Solana Foundation Grants

- Polygon, Avalanche, and NEAR Ecosystem Funds

- Web3 grant programs from digital wallets, oracles, L2s

To succeed, anchor your application in the value your contribution adds to the ecosystem. Most web3 grants emphasize open-source impact and align with the core protocol’s vision.

ICOs, IDOs, STOs, and Launchpads

Token launches transformed startup capital formation. While the speculative swings of 2017’s ICO mania have cooled, well-structured token offerings, ICOs (Initial Coin Offerings), IDOs (Initial DEX Offerings), STOs (Security Token Offerings), remain a viable model. Launchpad platforms like Polkastarter, CoinList, or TrustSwap enable vetted projects to tap into global retail and crypto-native liquidity.

Critical success factors here include:

- Smart contract audits and robust tokenomics

- Transparency and legal compliance

- Engaged community management before and after the offering

Technical and regulatory hurdles run high, but for projects seeking mass adoption and liquidity from global supporters, these methods can be catalytic.

DAOs and Community Funding

The rise of Decentralized Autonomous Organizations (DAOs) has transformed the funding dynamic. Early projects can secure backing via DAO proposals, create community treasuries, and incentivize contributors through governance tokens.

DAOs offer:

- Immediate alignment with platform users

- Participatory fundraising models (e.g., quadratic funding)

- Smart contract enforced transparency

If your project has genuine utility and fosters active discussion, DAO-led funding can create long-term loyalty that outlasts transactional cap tables.

Public Crowdfunding Campaigns

Beyond Web3-native models, crowdfunding platforms still play a prominent role, especially for projects with broad consumer appeal. Sites like Kickstarter, Indiegogo, or newer crypto-native equivalents, empower founders to validate demand and secure pre-seed funds.

Consider this model if:

- You’re building for end-users (games, creative tools, DAOs, NFT platforms)

- You can build hype with compelling demos or narratives

- Your ideal supporters aren’t just crypto whales but see benefit in early access

Mixing crowdfunding with other sources helps diversify your risk and expand your support base.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Comparing Web3 Funding Paths

Here’s a quick summary contrasting main funding routes for Web3 startups:

| Funding Method | Type | Dilutive | Best For |

| VC/Angel Investors | Equity, SAFE, SAFT | Yes | Protocols, core infra, B2B, complex R&D |

| Accelerators/Incubators | Grants/Equity | Varies | Early-stage, teams seeking mentorship |

| Grant/Ecosystem Fund | Non-Dilutive | No | Infra, integrations, open-source tools |

| ICO/IDO/STO/Launchpad | Token Sales | Yes/No* | Community-driven, network effect-sensitive |

| DAO/Community Fund | Token/DAO Funding | Varies | Strong communities, public goods |

| Crowdfunding | Rewards/Token Sales | No/Yes* | Consumer apps, games, NFT-focused ideas |

*Token sales may be considered dilutive in Web3 depending on project structure and future token allocation.

What Investors Look for in Web3 Startups

Before any wire transfer or DAO proposal gets green-lit, experienced Web3 fund decision-makers scrutinize several core dimensions. Based on candid conversations and due diligence sessions I’ve had with both VCs and ecosystem panels, here’s what typically lands on their radar.

Founding Team and Expertise

Your team’s background, technical skill, and tenacity mean as much as your whitepaper. Investors look for:

- Well-rounded expertise: blockchain, cryptography, product, and business

- Prior exits or significant open-source contributions

- Passion and resilience when roadblocks emerge

A technical co-founder signals deep conviction. Seasoned advisors with Web3 credibility inspire further trust.

Product–Market Fit

Proven demand is gold. Show traction:

- Early user numbers or mainnet activity

- Clear pain points addressed by your tech or token

- Real beta feedback before seeking Web3 startup fundraising

VCs especially want evidence you can scale beyond crypto-native circles.

Business Model and Revenue Potential

Does your project have a viable path to monetization or does value accrue elsewhere (e.g., token price, protocol usage)? Typical models include:

- Transaction fees

- Premium features for enterprises

- Token value capture through staking or burn mechanisms

Сlear thinking here sets you apart from idealistic but unsustainable DAOs.

Regulatory and Security Compliance

Given global uncertainty, investors don’t want surprises. Demonstrate:

- Credible legal counsel for token offerings

- Consideration of cross-jurisdictional rules (US, EU, Asia)

- Proactive security audits

Transparent updates on compliance earn confidence and future capital.

Tokenomics

Sophisticated backers demand nuanced tokenomics. This means:

- Clear utility and value accrual for your token

- Governance rights vs. speculative value

- Vesting, emissions, and anti-sybil protection

A token just for fundraising signals inexperience. Careful supply management, lock-ups, and real-world alignment matter.

Technical Architecture & Security Audits

Battle-tested code and independent audits are increasingly non-negotiable. Investors usually require:

- Open sourced smart contracts

- Reports from top audit firms (e.g., Trail of Bits, OpenZeppelin)

- Ongoing bug bounty programs

Skimping here exposes both you and your investors to reputational risk.

Governance & Decentralization

Many funds only back projects with credible pathways toward true decentralization. This encompasses:

- On-chain or hybrid governance (Aragon, Snapshot, Tally, etc.)

- Fighting back against plutocracy and whale domination in governance processes

- Off-chain sync: ensuring the DAO reflects the community’s best interests

Early decentralization, or a clear roadmap toward it, often unlocks broader web3 fund access.

Network Effects & Partnerships

Protocols take off when compounded by ecosystem hooks. Investors want to see:

- Strong developer engagement (hackathons, documentation, open APIs)

- Partnerships with established platforms, oracles, or stablecoins

- Realistic plans to grow composability and integrations

Each tie-in is a multiplier on future user growth and defensibility.

Adaptability & Resilience

A bear market wipes out weak hands quickly. Standout teams adapt:

- Rapid pivots on product direction based on new tech or regulations

- Ability to cut burn or extend runway

- Openness to feedback from the community and stakeholders

Stories of teams that survived “crypto winter” carry vastly more weight at the negotiating table.

Transparency & Investor Communication

Honest, frequent updates are now baseline expectations. Investors appreciate:

- Dashboards with on-chain usage stats

- Monthly or quarterly treasury and dev updates

- Candid reporting on blockers, not just victories

Projects with demonstrably transparent operations build far more loyal communities.

Market Potential & Scalability

No one wants to fund the next PFP NFT rug. Articulate:

- The total addressable market unlocked by your protocol/tool/game/DAO

- How your solution could ride expanding trends (e.g., L2s, DePIN, RWA, DeFi)

- Roadmap for scaling on mainnet and to new verticals or chains

Grounding your ambitions in research and tested assumptions turns optimism into trust.

Web3 Experience & Advisors

A powerful advisory board can be a tipping point. The deeper the crypto-native expertise and network, the greater your credibility. Where possible, connect with:

- Protocol builders and core developers

- Founders of complementary projects

- Legal, compliance, and community-building experts

The best advisors not only add wisdom, they bring early users and signal to web3 investors that you’re serious.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

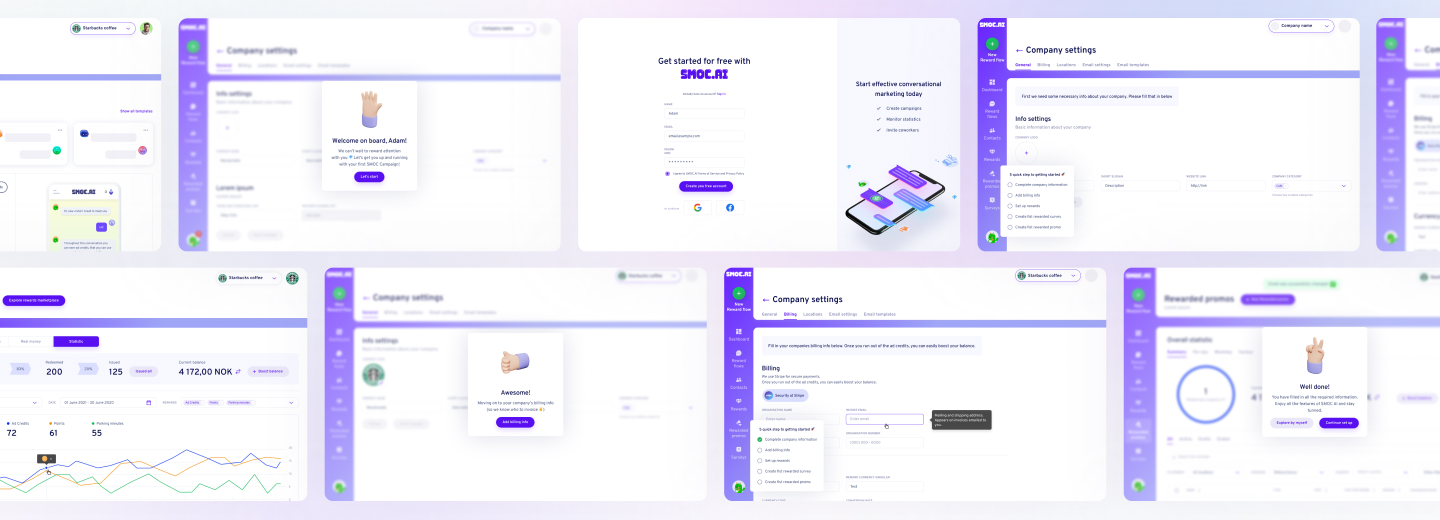

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

The Process of Investment Receipt for Web3 Startups

Securing investment is a pivotal milestone for any startup, regardless web3 or not. But the business journey doesn’t end with a handshake or a signed term sheet. Founders who understand the process of securing first investments can ensure a smooth growth and scaling process based on capital deployment. Here’s a step-by-step breakdown of what typically happens after you’ve secured a funding commitment:

1. Due Diligence

Once an investor is interested in a particular startup and expresses intent to invest, they initiate a thorough due diligence process. During it, they discover the peculiarities of your startup, especially legal, financial, and technical documentation. For web3 startups, this often includes:

- Reviewing smart contract code and security audits

- Assessing tokenomics and governance models

- Validating compliance with regulatory requirements

- Examining the cap table and previous funding rounds

2. Term Sheet Negotiation

After successful due diligence, investors present a term sheet. There, they outline the key terms and conditions on which any funding can be provided. Negotiating the term sheet is a critical step; ensure you understand every clause and seek legal counsel if needed. This document covers:

- Valuation and amount of investment

- Equity or token allocation

- Board seats or governance rights

- Vesting schedules and lock-up periods

- Rights of first refusal, anti-dilution, and exit provisions

3. Legal Documentation

Once the term sheet is agreed upon, both parties move to drafting and signing definitive legal agreements. These may include:

- Shareholders’ Agreement or Token Purchase Agreement

- Subscription Agreements

- Updated Articles of Incorporation or DAO governance documents

4. KYC/AML Compliance

This is a standard procedure to ensure compliance and lessen risk occurrence. Investors, especially institutional ones, will require your startup and its founders to undergo Know Your Customer (KYC) and Anti-Money Laundering (AML) checks.

5. Capital Transfer

With all documents signed and compliance checks completed, the investor transfers funds to your designated account or wallet. For equity deals, this is typically a fiat transfer. For token sales or web3 fund participation, it may involve stablecoins or cryptocurrencies.

- Ensure your wallets are secure and multi-signature protected

- Confirm receipt and provide investors with transaction confirmations

6. Post-Investment Onboarding

After the funds are received, maintain proactive communication with your investors. This includes:

- Issuing share certificates or distributing tokens as per agreement

- Providing regular updates on milestones and progress

- Inviting investors to governance forums or DAO discussions

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

You need to understand and master the investment receipt process to ensure steady growth with enough money. In addition to mentioned above, you build trust and credibility with your web3 investors and gain the possibility to rise your own community.

If you’re seeking assistance, feedback, or a tailored funding strategy for your next blockchain venture, let’s connect. We can help you with the design and development as well in addition to consulting. Years in this space have taught us the value of open, expert conversations, whether you’re an emerging founder, a technical lead, or a partner looking for standout projects. Leave your contact below and let’s build the future, together.

An Initial DEX Offering (IDO) is a method for crypto projects to raise capital by issuing tokens through a decentralized exchange.

User acquisition in Web3 is multifaceted. Leverage community-building in Discord, or Farcaster, which offer early user rewards, and nurture partnerships with existing Web3 ecosystems. Incentivize developers and early adopters through airdrops or governance rights, then amplify results using community-driven marketing.

Sometimes, fundraising roadblocks stem from timing, market trends, or shifting investor appetite. If you’ve iterated on feedback, refined your pitch, shown user traction (or even pivoted), and still can’t attract backers after several months and dozens of conversations, consider bootstrapping further or pausing to revisit core assumptions.

Absolutely. Many successful Web3 startups utilize a blend of token launches, VC involvement, crowdfunding, and early customer revenue. Ecosystem grants can provide a valuable boost, but are not a necessity.

Each route carries distinct benefits. Venture capital brings network access and strategic guidance, often best for technically ambitious or B2B-focused startups. Community-driven funding (through DAOs or launchpads) works for projects with consumer appeal, emphasizing grassroots buy-in and user loyalty. Many top ventures pursue a hybrid approach, first gaining community traction, then inviting institutional investment to scale.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers