Every founder, investor, and advisor faces the daunting question: “What is this startup actually worth?” The answer can influence funding rounds, partnerships, exits, and even the confidence of an entire team. With a decade of experience advising founders through the twists and turns of product launches, pivots, scaling, and negotiations, I’ve observed frequent waves of excitement, nerves, and sometimes confusion around valuation. Far from a fixed science, startup valuation is about artfully weaving together data, projections, psychology, and a dash of educated guesswork.

No single valuation method fits all; different business stages, industries, and capital needs call for flexible tactics. Let’s examine the proven approaches that experienced founders and investors turn to, highlighting their strengths, trade-offs, and when to deploy each in your playbook.

WHAT'S IN THE ARTICLE

Decoding the Complexities of Startup Valuation

Before diving into specific methods, it’s crucial to clear up a few misconceptions. First, valuation is rarely set in stone. It changes as a business achieves new milestones, uncovers market validation, or experiences setbacks. Second, early-stage startups, where uncertainty is high and hard data is scarce, often require methods very different from established companies.

What gives these approaches credibility is not how perfectly predictive they are, but how thoughtfully they balance logic, precedent, and vision. As your company grows, your toolset for valuation must adapt as well, aside from simply asking on how to value a startup.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

The Most Trusted Valuation Methods for Startups

Let’s break down each commonly used approach, explore when to rely on it, and discuss how to use it effectively.

Comparable Company Analysis (Comps)

This technique banks on the market’s existing wisdom. By analyzing how similar companies are valued, you create an implicit benchmark for your own business.

Key Steps:

- Identify peer startups — same industry, stage, growth rate, and location.

- Examine recent valuations, funding rounds, and exit multiples.

- Adjust for differences in growth potential, market size, or intellectual property.

When to Use: Comps provide clarity in sectors where acquisitions or funding activity is transparent, like SaaS platforms, e-commerce, or health tech. However, this method requires access to reliable data.

Strengths: There is never any guarantee when introducing a new product or service. A POC will assist in reducing that risk by identifying any possible shortcomings or weaknesses prior to the full-scale development. It enables founders to validate their main assumptions, discover the technical issues, and perfect their craft all in a controlled, low-risk setting. Failure fast helps businesses to prevent costly oversights and enables them to adjust when needed.

Limitations: There is never any guarantee when introducing a new product or service. A POC will assist in reducing that risk by identifying any possible shortcomings or weaknesses prior to the full-scale development. It enables founders to validate their main assumptions, discover the technical issues, and perfect their craft all in a controlled, low-risk setting. Failure fast helps businesses to prevent costly oversights and enables them to adjust when needed.

Discounted Cash Flow (DCF) Analysis

DCF is about future money, today. It estimates how much the business’s projected cash flows are worth right now, with a “time value of money” adjustment. Think of it as reasoning backward from future profits to present value.

Key Steps:

- Build financial projections for 3-7 years.

- Estimate a terminal value, reflecting what the company could be worth at maturity or acquisition.

- Discount future cash flows to their present value with an appropriate discount rate (often 20–60% for startups, reflecting risk).

When to Use: Works best when future revenues are somewhat predictable — think B2B SaaS with stable contracts or subscription-based models.

Watch Out: Startups rarely hit projections exactly. Smart investors will scrutinize the assumptions behind your growth, margins, and costs.

The Venture Capital (VC) Method

Developed specifically for venture investing, this approach zeroes in on required returns for investors.

Key Steps:

- Estimate a likely exit value based on peer exits and acquisition multiples based on valuing startups they own.

- Decide what ownership stake an investor would need to hit their return target (e.g., 10x their investment).

- Back-calculate to your startup’s current value by dividing anticipated exit value by the expected ROI multiplier.

When to Use: Ideal for startups eyeing hypergrowth or potential acquisition in 5–7 years.

Scorecard Method

This method is practical for angel investors and pre-revenue startups. Here, the founder’s story, team credentials, and market attractiveness can outweigh early numbers.

Key Steps:

- Start with the average valuation for similar startups in your region and sector.

- Adjust the valuation by scoring the company on criteria like management team, technology, competition, product, and sales channels.

- Apply weightings to reflect relative importance.

Why It Works: It recognizes that people and execution matter as much as ideas, especially before there’s significant user or revenue traction.

The Berkus Method

Designed by seasoned investor Dave Berkus, this approach brings discipline to early-stage startup valuations without resorting to wild guessing. It assigns a set value to different aspects of the business, capping each component to promote realism.

Value Assignments:

- Sound idea: up to $500K

- Prototype: up to $500K

- Quality management team: up to $500K

- Strategic relationships: up to $500K

- Initial revenues or signs of traction: up to $500K

The maximum possible pre-money valuation using this framework is often $2 million to $2.5 million, though figures can flex by region or industry.

When to Use: Especially helpful for founders at the pre-seed and seed levels, providing a framework to communicate value clearly to investors with minimal data.

Risk Factor Summation

Risk is everywhere in startups. This model operates by evaluating and scoring a startup across 10-12 major risk categories, plus or minus set dollar amounts according to perceived seriousness. Factors typically include: Technology risk, Market/competition risk, Regulatory risk, Funding risk, Sales and marketing risk, and Exit potential.

Each risk factor moves the valuation up or down relative to an industry baseline.

Cost-to-Duplicate Method

This method calculates what it would cost to build a similar company from the ground up, including technology development, intellectual property, hiring, and customer acquisition.

While it’s more often used for hardware or deep tech startups (where initial capital outlays are large), it sets a “replacement floor” below which most founders would simply decline to sell.

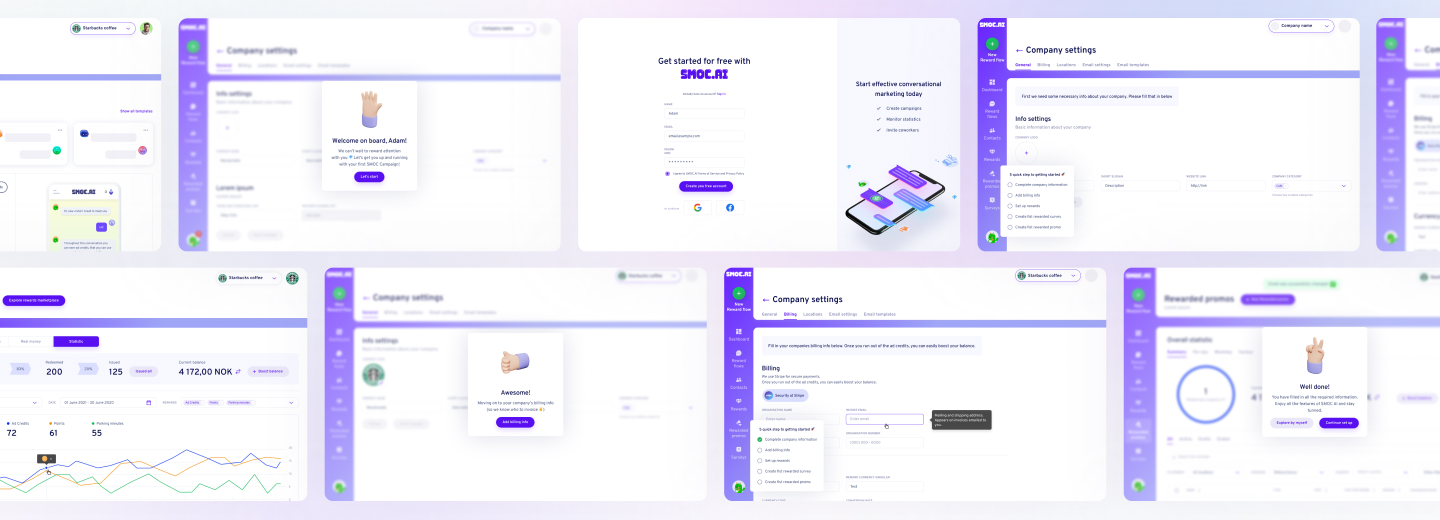

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Thinking Beyond the Numbers: Psychology and Negotiation

While data and projections have their place, startup valuation is rarely a solitary exercise. It is shaped by the emotional, strategic, and sometimes political interests of those at the table.

Several non-mathematical factors shape real-world outcomes:

- FOMO (Fear of Missing Out): Hot sectors or compelling visions can tip valuations upward.

- Market timing: Being in a trend’s “sweet spot” (AI, cleantech, etc.) attracts higher multiples.

- Investor perception: Confidence in the founders and the story can move negotiations more than spreadsheets.

Valuation discussions should always be paired with clear communication of your vision, momentum, and the unique risks and opportunities ahead.

Adapt Your Approach for Each Stage

Choosing the right valuation method often depends on where a company stands in its lifecycle. Strategies evolve and can change significantly as you pass key milestones:

Early-Stage Valuation

Early-stage startup valuation methods focus on early indicators and potential. Common approaches include the Berkus method, which assigns values based on key de-risking milestones, the Scorecard method, which compares the startup to similar funded companies, and the Cost-to-Duplicate method, which estimates the cost to rebuild the company from scratch.

Seed Stage Valuation

Valuation methods at this stage often include the Scorecard method for comparative analysis, the Risk Factor Summation method, which adjusts valuation based on various risk factors, and Comparables (Comps), for looking at the valuations of similar companies that have recently raised funding.

Growth Stage Valuation

Here, more traditional financial models become applicable. The Discounted Cash Flow (DCF) method is frequently used, projecting future cash flows and discounting them back to the present. Comparables (Comps) remain relevant for benchmarking against industry peers, and the VC method (Venture Capital method) is often used to determine pre-money valuation based on desired return on investment.

Scaling and Exit Preparation Valuation

Valuation methods become more sophisticated and data-driven. The Discounted Cash Flow (DCF) method provides a detailed financial projection. Comparables are used for assessing market value against similar acquisition targets or IPOs. The VC method can still be used, particularly from the perspective of an investor looking at their potential exit returns.

Early on, selling the vision, team, and problem-solving approach carries outsized weight. Closer to exit or late-stage rounds, concrete financial modelling becomes much more central.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Important Considerations for Founders and Investors

With so many methods and moving parts, it’s tempting to fixate on the highest possible startup valuation model. Several key points deserve attention:

Avoid Over-Valuation: Chasing the biggest number can create downstream complications if the company stumbles, struggles to meet up-round expectations, or faces tough questions from new investors.

Understand Dilution: The price you accept today can have major implications for founder equity, employee motivation, and future round dynamics.

Be Consistent: Use the same assumptions and benchmarks across rounds, and keep an audit trail of logic and data sources that guided each valuation.

Anticipate Questions: Experienced investors will poke at your assumptions. Be ready to defend your reasoning — not just your top-line number — with intellectual rigor and transparency.

How EVNE Developers Can Help

Early-stage startups thrive on innovation, but turning a brilliant idea into a viable product requires more than just vision. EVNE Developers empowers founders to evaluate their concepts before significant investment. We offer idea validation services, market demand analysis, potential challenges identification, and determination of the most effective technological pathways. This critical early assessment helps refine your concept, avoiding numerous pitfalls along the way.

Our approach goes beyond surface-level analysis. We are dedicated to performing market research, competitive analysis, and technical feasibility studies, helping you understand your target audience’s pain points and how your proposed solution can uniquely address them. Through rapid prototyping and proof-of-concept development, we can quickly bring your ideas to life in the most effective way. This allows for early user feedback, iterative refinement, and a clear understanding of your product’s potential based on startup company valuation methods selection.

By partnering with EVNE Developers, you gain a strategic technology partner dedicated to your success from day one.

Conclusion

Valuation of startups is a blend of logic, market context, reasoned optimism, and negotiation skill. Proven founders and investors adapt their process to each unique company, sector, and fundraising moment. The best valuations are those both sides walk away from energized to build, support, and outpace what came before.

We hope our advice helps you understand how to determine the valuation of a startup in the most effective way, and you are ready to bring this vision to life with your product.

Startups with no revenue are valued based on qualitative factors and future potential, often using methods like the Berkus Method, the Scorecard Method, or the Risk Factor Summation Method.

Investors typically expect a valuation that justifies a significant return on their investment (often 3x-10x over 5-10 years) given the inherent risks of early-stage startups. They look for a fair valuation that allows them to acquire a meaningful equity stake (e.g., 10-30% in early rounds) and doesn’t set unrealistic expectations for future rounds.

The most impactful factors on startup valuation include: Market Opportunity, Team Strength, Product/Technology Innovation, Traction/Milestones, and Competitive Landscape.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers