Investors ask for it, founders debate it, and product teams quietly depend on it. Market sizing is more than a slide near the front of your deck. It sets the ceiling for strategy, helps pick segments, shapes pricing, and can keep your hiring plan honest. After a decade building products and advising early-stage founders, I’ve seen market math accelerate decisions when it’s done well. I’ve also seen confident teams trip over loose assumptions and inflated totals.

This guide keeps the focus on clarity and action. You’ll see how top-down and bottom-up estimates differ, where each shines, how to combine them, and how to turn a slide into a working plan. I’ll share examples, pitfalls, and a simple worksheet you can adapt today.

WHAT'S IN THE ARTICLE

- 01Why market sizing matters more than the slide suggests

- 02What a top-down estimate looks like in practice

- 03What a bottom-up estimate looks like when you’re building

- 04Comparing top down vs bottom up market sizing

- 05Startup tips to use

- 06Common traps and how to avoid them

- 07Signals that your model is investor ready

- 08A quick worksheet you can copy

- 09Conclusion

Why market sizing matters more than the slide suggests

- It calibrates ambition. A product with a small practical market can still be a solid business if you design for efficiency and pricing power. A giant market invites a different capital plan and partner strategy.

- It drives focus. Strong teams use market math to say no. The segment you skip is as important as the one you seed.

- It anchors pricing. ARPU and LTV shape your reachable revenue more than you think. Market size tied to price and adoption beats vague totals every time.

- It keeps promises realistic. Hiring, marketing spend, capacity, and support are real constraints. A good model respects them.

I encourage teams to publish their market math to their internal wiki. If your assumptions can’t survive daylight, they probably won’t survive ramp.

Three layers you need to name

TAM: the total revenue if you captured every buyer and every relevant use case. Think universe, not target.

SAM: the slice that fits your current product and regulatory or geographic reach.

SOM: the near-term capture with your actual sales motion and budget. This is what leadership should manage to.

TAM keeps you honest about ceiling. SAM and SOM keep you serious about the next 18 to 36 months.

What a top-down estimate looks like in practice

Top down market analysis starts from a large external number and narrows it with filters. Think analyst reports, census counts, and public comps. The market size top down approach is fast, useful for investor conversations, and a good way to set guardrails.

A simple path:

- Start with a credible total: an industry revenue number or a total buyer count.

- Apply relevance filters: regions, buyer types, regulatory scope, platform constraints.

- Apply product fit filters: segment needs, price bands you support, buying center.

- Apply reach filters: channels you can serve, languages, partner footprint.

- Apply an achievable penetration: what portion could reasonably buy in the time frame you model.

Top down market sizing example

Imagine a B2B scheduling SaaS for outpatient clinics.

- Total outpatient clinics in the U.S.: 230,000

- Clinics with 5 or more staff: 90,000

- Clinics using paid scheduling tools: 60 percent today

- Pricing model: 150 dollars per clinic per month

- Targetable regions and specialties this year: 40 percent of the 90,000 clinics

Top down approach market sizing:

- Step 1, SAM clinics: 90,000 x 40 percent = 36,000 clinics

- Step 2, reachable spend: 36,000 x 150 x 12 = 64.8 million dollars SAM revenue

- Step 3, SOM with 8 percent penetration over 3 years: 36,000 x 8 percent x 150 x 12 = 5.184 million dollars

This isn’t a promise. It’s a sanity check. Does 8 percent penetration require sales motions you do not have, or marketing budgets you cannot afford? If yes, revise the filters and keep iterating.

Strengths and gaps of top down market analysis

Pros

- Fast and easy to compare across segments

- Clean for investor conversations

- Great for setting outer bounds

Limitations

- Overstates reach if filters are weak

- Hides unit economics

- Ignores sales capacity and ramp time

- Vulnerable to double counting when segments overlap

Use top down market sizing as a compass, not as a contract.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

What a bottom-up estimate looks like when you’re building

Bottom up market analysis starts from what you can sell, to whom, at what price, through channels you actually use. It’s slower, grounded in unit economics, and tends to be more credible with operators.

A simple path:

- Define the sellable unit: per seat, per clinic, per transaction, per device.

- Identify the buyer segments you can reach now: ICP definitions, personas, regions.

- Estimate conversion per channel: outbound, inbound, partner, product-led.

- Tie price, discounting, and churn to each segment.

- Layer capacity: sales headcount, quota, win rate, implementation bandwidth.

- Build month-by-month adoption and revenue.

A bottom up market sizing example

Same scheduling SaaS, but now we model what we can actually sell.

- Sellable unit: clinic subscription at 150 dollars per month

- ICP: clinics with 5 to 20 staff in four regions, 36,000 target accounts from the top-down filters

- Channel mix: Outbound SDR + AE: 6 AEs with 700k dollars quota each, 20 percent win rate on 600 sourced opps per AE per year, average deal 1,800 dollars ARR. Inbound: 5,000 trials per year from content and ads, 6 percent conversion to paid, 1,800 dollars ARR. Partners: two EHR integrators referring 300 deals per year, 25 percent close, 1,800 dollars ARR

- Ramp: 50 percent quota in H1, 100 percent in H2

- Churn: 8 percent annual logo churn

Quick math:

- Outbound ARR at steady state: 6 x 700,000 = 4.2 million dollars ARR

- Inbound ARR: 5,000 x 6 percent x 1,800 = 540,000 dollars ARR

- Partner ARR: 300 x 25 percent x 1,800 = 135,000 dollars ARR

- Total steady-state new ARR per year: ~4.875 million dollars before churn

- Year one ramp at 75 percent average productivity: ~3.66 million dollars

Now test reach against the 36,000 ICP clinics. At ~2,700 paying clinics in three years, penetration is 7.5 percent. That aligns with the earlier top-down SOM at 8 percent. Alignment across methods earns trust.

Strengths and gaps of bottom up market sizing

Pros

- Anchored in price and conversion, which ties to CAC and LTV

- Reflects constraints like hiring, onboarding, and support

- Easier to operate against, since it maps to activities and resources

Limitations

- Sensitive to early conversion assumptions

- Can understate upside if virality or partner flywheels kick in

- Requires more data discipline

Bottom up approach market sizing is the right tool when you are planning quarters, hiring, and budgets.

Comparing top down vs bottom up market sizing

Both methods have a place. The smart move is to build both, then compare. Differences force better assumptions and productive debate.

Here is a quick comparison you can share with your team.

| Dimension | Top down market sizing | Bottom up market sizing |

| Starting point | Industry totals and buyer counts | Unit economics and channel performance |

| Speed to draft | Fast | Moderate |

| Use cases | Investor narratives, segment comparisons, ceiling checks | Operating plans, hiring, budget, pricing |

| Main risks | Overstated reach, double counting, weak filters | Overfitted to early data, underestimating network effects |

| Best validation | Penetration benchmarks, external comps | Cohort metrics, pipeline health, capacity models |

| Confidence grows with | Better segmentation and external sources | More closed-won data, stable conversion and churn |

Teams ask me which to trust. My answer: the one you can defend with data and behavior, not just a slide. Then triangulate.

A hybrid method that travels well

You do not need to pick a side. Use a hybrid model when stakes are high.

- Start with a top-down ceiling using two independent sources.

- Translate that into a SAM using filters you can explain in one minute.

- Build a bottom-up acquisition plan by channel and month.

- Reconcile the two: if bottom-up suggests 25 percent penetration in 18 months, raise a red flag and revisit either channel assumptions or your filters.

- Add a third angle: base rate adoption curves from similar software categories, census growth, or cohort data from public comps.

I keep a simple rule: no single-method market size goes into a board deck.

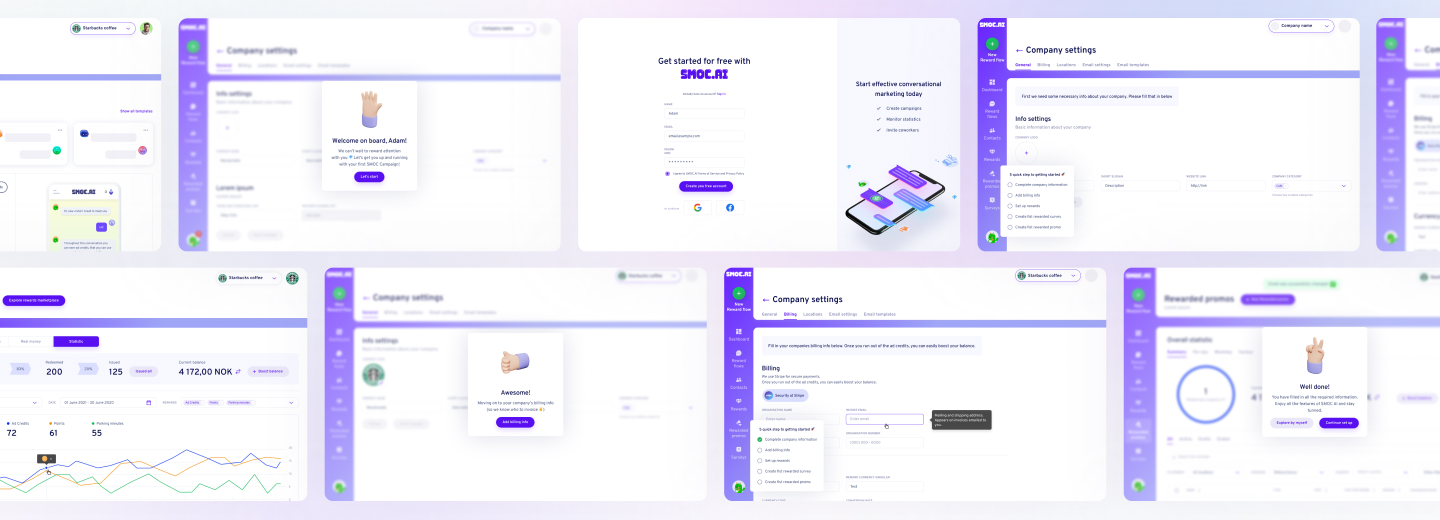

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Startup tips to use

The overall process may seem obvious, though there are plenty of approaches that can really add value and define success.

Pricing turns math into money

Market sizing without price is theater. Tie revenue to real pricing and discount policies, and you get somewhere useful.

- Define ARPU per segment, not a blended guess.

- Model discount ladders and packaging, since a lower entry tier changes adoption speed and LTV.

- Connect churn to value moments: if usage is tied to EHR integration, failing to integrate on time will distort early churn.

- Stress-test willingness to pay with 5 interviews per segment. Buyer language beats guesswork.

Bottom-up market analysis shines here. You can simulate how a price experiment lifts conversion, which lifts SOM in a way a top-down total never shows.

Use proper data sources

Use two or more independent sources for totals and for buyer counts. A few dependable options:

- U.S. Census, BLS, BEA, and SBA for firm counts, employment, and industry revenue

- CMS and AHRQ for healthcare provider counts and spend

- Eurostat and national statistics agencies for non-U.S. markets

- Gartner, IDC, Forrester for software categories

- PitchBook and Crunchbase for funding and company counts in verticals

- App Store, Google Play, data.ai for mobile categories

- G2 and Capterra for category traction and pricing bands

- LinkedIn Sales Navigator for firmographic filters and headcount tiers

- SEC filings and S-1s for public comps

- Regulatory registers for licensed professionals in niche markets

Document every source in the model with links and access dates. Your future self will thank you during diligence.

From a slide to an operating plan

Slides are for storytelling. Spreadsheets run the company. Here’s a structure I’ve used with dozens of teams.

- Sheet 1, Assumptions: price by segment, discount policy, churn, win rates, ramp, headcount plan, CAC by channel.

- Sheet 2, Accounts: total accounts by region and segment, with filters that define SAM and an addressable list count.

- Sheet 3, Capacity: hiring plan, quota, ramp curves, implementation capacity, support ratios.

- Sheet 4, Pipeline: leads by channel per month, conversion by stage, cycle length, win rates.

- Sheet 5, Revenue: monthly new ARR, churned ARR, net new ARR, ending ARR, cash collections.

- Sheet 6, Scenarios: a few toggles for price, win rates, and hiring dates.

- Sheet 7, Sources: links, timestamps, and notes on methodology.

Tie it together with named ranges and keep the math legible. If you can’t explain a formula to a new hire in two minutes, simplify it.

Practical filters that improve any model

Buyer count should match your ICP, not an industry. If your product only fits clinics with 5 to 20 staff, filter to that. Adoption rates should step up gradually. Start with low single digits in year one unless you have strong proof.

Price bands should reflect your current product. If the enterprise tier is a roadmap item, keep it out of today’s ARPU. Channel capacity should cap your wins. If your partner can only send 50 deals per quarter, don’t model 200. Expansion revenue should lag by cohorts. Land then expand beats instant upsell in most categories.

Write these filters in plain text above your spreadsheet. Make it readable.

Quick criteria for segment scoring

When picking where to start, score segments on a simple scale from 1 to 5.

- Pain acuity and budget

- Ease of access to decision makers

- Competitive intensity

- Regulatory friction

- Data integration complexity

- Referenceability and network effects

- Price sensitivity

Plot score vs reachable revenue from your bottom-up model. High score, high revenue segments deserve your attention first.

Telling a credible story with both methods

How you explain market math matters.

- Lead with the buyer. Show who pays, why now, and the specific pain you target. Investors buy the story of pain before they buy the math.

- Show both methods on one slide. Keep the same segments and time frames so the audience can compare.

- Highlight two to three critical assumptions by name. Price, win rate, or adoption curve. Invite scrutiny on those.

- Show how you’ll reduce uncertainty. Experiments, hires, partnerships, or product milestones that improve the inputs.

- Bring one external benchmark. A public comp’s penetration or an adoption rate from an adjacent category.

A calm, grounded story beats a giant number with fuzzy edges.

Special cases where methods need tweaks

Two-sided marketplaces. Size both sides. Usually the constraining side controls ramp. Start bottom-up on that side with supply acquisition costs, then map demand elasticity.

Hardware with software attach. Split revenue streams and margins. The TAM for devices is not the same as the SAM for your software attach rate.

Deep tech with long pilots. Adoption curves look different. Build longer sales cycles, pilot-to-paid conversion steps, and staged revenue recognition.

Regulated markets. Licensing, reimbursement codes, and formularies can shrink SAM dramatically. Speak with at least five people who run procurement or compliance before you trust the filters.

International expansion. Start with one region and hold the rest as upside. Currency, tax, and localization time fight with ramp.

Common traps and how to avoid them

- Double counting overlapping segments. If clinics are inside health systems, pick a buying center and avoid counting both.

- Inflated adoption rates. Keep early penetration under 10 percent unless you have category-level precedent.

- Static pricing. Intro pricing changes ARPU in year one. Reflect the ramp to list price or you will overstate revenue.

- Ignoring channel capacity. If an AE needs 12 implementations per quarter to hit quota and your onboarding team can only deliver 20 per quarter, your model breaks on Friday afternoon.

- Copying analyst totals without segmentation. Industry-wide revenue includes products and buyer types you do not serve.

- Failing to add time. Markets grow and churn. A flat model is a fantasy.

A good antidote is to write your assumptions as sentences above the model. If the sentence looks silly, the formula probably is too.

Signals that your model is investor ready

- Sources are listed and recent. Two independent sources for each critical input.

- Filters are explicit. Regions, segments, and buyer sizes named and counted.

- Price is tied to value. ACV and discount ladders explain early ARPU.

- Penetration is grounded. Adoption rates compare to similar categories.

- Capacity is represented. Sales, marketing, onboarding, and support constraints are visible.

- Scenarios exist. A base case, a push case, and a down case are one click away.

- The top down vs bottom up market sizing views converge within a believable band.

If you check these boxes, your market math stands up.

When each method leads the conversation

- Early idea stage: start with top down market analysis to avoid building for tiny niches by accident. Then sketch a minimal bottom-up plan to show you know how revenue happens.

- Post-MVP with a handful of customers: lead with bottom-up market analysis tied to actual conversion, price, and churn. Keep a top-down number in the appendix for context.

- Growth rounds: run both in detail. Use the hybrid approach to justify the hiring plan and channel bets.

Moving between the two isn’t a sign of weakness. It’s a sign you care about reality.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

A quick worksheet you can copy

Pick one product and one primary segment. Then write these few lines into a sheet and plug numbers you can defend.

- Total target accounts this year: A

- Expected outreach reach rate across all channels: B percent

- MQL to opportunity conversion: C percent

- Win rate: D percent

- Average contract value per year: ACV

- Sales cycle length in months: S

- Ramp time to full productivity in months: R

- Annual logo churn: Ch percent

- Sales headcount: H, quota per rep: Q

Outputs:

- Opportunities per month = A x B percent x C percent ÷ 12

- New customers per month = Opportunities per month x D percent

- New ARR per month = New customers per month x ACV x seasonality factor

- ARR at month t = Sum of new ARR up to t minus churned ARR up to t

- AE capacity check = H x Q vs New ARR per year

Then add a top-down check:

- Industry revenue for category = I

- Your SAM share by filters = F percent

- Reasonable 3-year penetration = P percent

- 3-year revenue envelope = I x F percent x P percent

If the bottom-up line crosses the envelope, recheck assumptions. If it falls far short, you may be underinvesting in reach or pricing.

Conclusion

If you want a second set of eyes on your top down market sizing or need help building a crisp bottom up approach market sizing model that your team can use to run the business, I can help. I’ve spent the last ten years shipping software, writing business analysis that holds up in diligence, and coaching founders through investor meetings where market size questions decide the outcome.

Bring your draft model, your price sheet, and a short description of your ideal customer. You’ll leave with a clear top down vs bottom up market sizing view, a list of sources for your segment, and a plan to turn the slide into an operating model that leadership can manage to.

Reach out with a short note and a link to your deck. Let’s get your market math working for you.

Market sizing is the process of estimating the potential size of a market by calculating the total number of potential customers or the total revenue potential for a specific product or service within a given timeframe and geographic area.

Top-down processes start with high-level plans and break them into smaller parts, flowing from leadership down through the hierarchy. In contrast, bottom-up processes begin with detailed components or ideas and build them into a larger whole, originating from lower levels and moving upward.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers