Ten years of shipping products in regulated categories taught me that the most stubborn markets flip all at once, then move fast. Deathcare in the United States has reached that inflexion. Families now expect digital options when a loved one dies, employers are adding bereavement services next to fertility and mental health benefits, and regulators are slowly updating rules that were written for paper files and phone calls. The result is a rare window for founders who can combine empathy, dependable engineering, and a repeatable go-to-market motion.

This is not a niche. It is a set of intertwined needs that start years before death and continue for months after. It touches finance, identity, legal affairs, content, logistics, and mental health. That breadth rewards thoughtful product strategy and punishes shortcuts.

I have built and scaled platforms in finance, health, and legal tech. The same playbook can work here, with careful tuning to the lived reality of grief and the real-world constraints of funeral homes and courts. The prize is significant and durable.

WHAT'S IN THE ARTICLE

Why death is finally getting product innovation

Cremation has overtaken burial in the United States, which changed the economics of the industry and made consumers more price aware. Remote families and blended households need coordination tools more than they need a showroom. The average consumer now maintains dozens of digital accounts, from banking to cloud storage, which creates a long tail of post‑mortem work for survivors. Add to that the rise of at-home medical care and the need to close out benefits and policies across multiple systems, and you have a backlog of manual tasks waiting for automation.

Market structure matters too. Large consolidators own many funeral homes, but tech adoption inside those businesses varies widely. Independent homes want better CRM, case management, and e‑commerce. Hospitals, hospices, and faith communities are searching for vetted partners to refer families. Employers want to retain staff through hard moments, and insurers want claims to close faster. Each of those channels is hungry for reliable digital products that reduce friction without losing the human touch.

The pandemic forced a trial run for virtual memorials, remote notarization in some states, and digital intake for cremation. Consumers adopted new behaviours, and some of those behaviours became permanent. When a market learns new habits, avenues for acquisition open.

Economics that endure

SaaS for funeral homes and hospices can reach 75 to 85 percent gross margins with clear unit economics once churn stabilizes. Employer benefits typically sit near 60 to 70 percent gross margin depending on the share of human casework. Direct cremation and logistics are thinner, but they can work if acquisition costs are controlled and add‑ons are a meaningful share of revenue.

CAC is the silent killer in this space. Search advertising around death terms is expensive and emotionally charged. The teams that win keep paid search as a small slice of the mix and tap durable channels like referrals from employers, faith communities, social workers, and financial advisors. Content and local SEO work, but you need patience and clinical accuracy. The legal bar for probate information is high, and it pays to meet it.

Unit economics to aim for: CAC payback under nine months in consumer flows, under twelve months in employer deals, and net revenue retention above 115 percent where you have cross‑sell. Product leaders should track time to first resolution for key tasks, completion rates for document uploads, and the share of cases handled fully self‑serve versus assisted.

From taboo to product category

People talk about death differently now. They plan through apps, assign legacy contacts on their social accounts, and share memorial pages online. That social shift unlocked room for a product category that spans five phases:

- Preparation and education

- Asset and document organization

- Moment-of-need logistics

- Estate administration and claims

- Remembrance and ongoing care

Each phase can stand alone as a product, but the most valuable companies link them without making users feel trapped in a bundle. The best teams respect that grief rearranges attention. They design for low cognitive load, clear language, strong defaults, and human escalation at any point.

A practical way to think about scope is to start with a narrow wedge, nail service quality, then expand across adjacent phases. A planning app can grow into employer benefits. A funeral home SaaS can add embedded financing and e‑commerce. A probate assistant can integrate with insurers and banks.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

The segments, the money, and who buys

Winning teams pick a high‑value wedge, build trust with graceful service, and attach to durable distribution. That applies across consumer and enterprise channels. If we were launching a product tomorrow, we would start with these moves, then compound.

- B2B2C partnerships: integrate with employers, life insurers, and credit unions; package your service as a benefit that improves retention and claim cycle time.

- Expert marketplaces: build a curated panel of attorneys, grief counselors, and notaries; route paid referrals with transparent pricing and quality scores.

- Embedded payments: handle memorial donations, financing, and disbursements; earn margin while reducing work for families and funeral homes.

- SEO with authority: publish high‑signal content written by licensed professionals; focus on state‑specific probate steps, forms, and timelines.

- High‑touch support: combine chat, phone, and human case managers; design escalation paths that protect your NPS when users are exhausted.

Pricing is not guesswork. In consumer flows, align price to the dollar value of time saved and the number of institutions handled. In B2B2C, tie fees to utilization and claims outcomes. In funeral home SaaS, enrich basic case management with payments and financing, then share in the upside.

Here is a snapshot of common segments, how they make money, and who is paying. This is not exhaustive, but it captures the center of gravity in the United States today.

| Segment | Primary Customer | Regulatory Hotspots | Core Revenue Model | Notable Examples (US) |

| End‑of‑life planning apps | Consumers, employers | E‑wills state rules, privacy laws | Subscriptions, B2B2C licensing | Cake, Everplans, Lantern |

| Estate and probate assistants | Executors, insurers | RUFADAA, court filings, KYC/AML | Per‑case fees, referrals | Empathy, Atticus |

| Funeral home software | Funeral directors | Funeral Rule updates, PCI, preneed | SaaS, payments, marketplace | Passare, Parting Pro, Gather, Tribute Tech |

| Direct cremation e‑commerce | Consumers | State funeral licensing, payments | Transaction margin, add‑ons | Tulip Cremation, Solace |

| Digital asset and memorial | Families, social users | RUFADAA, content rights, moderation | Freemium, upsells | GoodTrust, Keeper, GatheringUs |

| Estate planning and e‑notary | Consumers, advisors | E‑notary, e‑will acceptance by state | Document fees, subscriptions | Trust & Will, Notarize partners |

| Grief and caregiver benefits | Employers, payers | Telehealth licensing, PHI handling | PMPM, capitated fees | Empathy employer, Modern Health partners |

If you are building new product here, the buyer types split cleanly into three buckets: consumer, business buyer at a funeral home or hospice, and benefit buyer at an employer or insurer. Each buyer has a different sales cycle, different evidence bar, and different churn pattern. Map your roadmap to one of those paths and resist the urge to pitch all three on day one.

Who is already shaping the market

Empathy straddles consumer and employer channels, combining software with human guidance on estates and grief. Their bet is that employers want to keep workers stable after a loss, and insurers want faster claims. They price per employee per month and by case.

Everplans, Cake, and Lantern focus on planning, directives, and document organization. Their strength is education and a friendly tone that lowers the barrier to planning. Distribution runs through employers, advisors, and direct consumer subscriptions.

Trust & Will brought estate planning into a digital flow and built strong brand recognition. The integration path is natural: financial advisors, credit unions, and benefits platforms. This is a powerful on‑ramp to broader post‑death services when permitted.

Passare, Parting Pro, Gather, and Tribute Technology provide the software stack for funeral homes, from case management to websites and e‑commerce. Payments, memorial pages, and broadcast of services are built in. This vertical SaaS layer is gaining features quickly and is ripe for integration with consumer tools and employer benefits.

Tulip Cremation and Solace run tech‑enabled direct cremation models with transparent pricing and remote intake. The market rewards reliability in logistics and simple, clear communication. Upsells into memorial products and services can improve margins without pressure tactics.

GoodTrust, Keeper, and similar platforms handle digital assets and remembrance. The core challenge there is durable engagement. The opportunity is clear when products link planning to actual transfer and executor workflows under RUFADAA.

Facebook’s Legacy Contact and Apple’s Digital Legacy quietly set consumer expectations for account transfer and memorialization. Startups benefit when these big platforms make policies predictable and easy to act on, even if they remain walled gardens.

Obstacles that still choke growth

The roadblocks are real. They can be managed, but only with open eyes.

- Patchwork state rules

- High CAC in paid search

- Low purchase frequency

- Offline logistics that break SLAs

- Partner sales cycles that drag

- Data retention sensitivity

- Walled gardens for key accounts

- Emotional context that magnifies small UX flaws

Product teams that plan for these constraints from day one get further with less spend. That planning shows up in hiring profiles, QA discipline, content strategy, and legal budget.

Regulation without paralysis

Deathtech intersects with sensitive data and services that are often state regulated. The good news is that a clear compliance posture is now a growth asset. Partners, especially employers and carriers, will ask for it early.

Anchor points to design around:

- RUFADAA, adopted by most states, governs access to a deceased person’s digital assets. Your product should track consent and priority rules with audit trails.

- FTC Funeral Rule is under review. Price transparency online is the direction of travel, which supports e‑commerce and comparison tools.

- HIPAA may apply if your workflow touches protected health information. Treat PHI and non‑PHI data differently and standardize on least‑privilege access.

- CCPA and CPRA in California, plus state analogs, make user data rights and retention schedules table stakes.

- E‑wills and remote online notarization are expanding state by state. Design your doc workflows to toggle based on jurisdiction and maintain clear provenance of signatures.

- Preneed sales and trust accounts carry strict rules. If you touch preneed funds or installment plans, confirm whether you trigger money transmitter laws and embed KYC/AML.

- Memorial donations and pooled funds need clean money movement with fraud controls. Plan for refunds, chargebacks, and bereavement scams.

A compliance‑by‑design approach is measurable: data classification from day one, encryption at rest and in transit, role‑based access, explicit consent flows, and immutable logs for executor actions. That setup accelerates enterprise deals and reduces rework.

What investors misread

Many investors think the addressable market is too small or too morbid. They are missing two things. First, spending is already large and persistent. Funeral services, cremation, estate legal fees, memorial products, and travel add up to tens of billions of dollars a year. A modest shift to digital capture yields meaningful revenue for companies that earn trust.

Second, the most resilient revenue here does not rely on one‑time transactions alone. Subscriptions for planning and secure document storage, employer benefits with multi‑year agreements, software for operators with high switching costs, and payments that scale with volume all stack nicely. The mix creates defensibility.

We have seen this pattern in other regulated categories. The teams who build stable rails and become the default partner for a hard moment grow steadily even when the overall economy slows.

AI that actually helps

AI shines when it removes repetitive tasks and keeps humans in control. Probate and claims generate exactly that kind of work. The right uses look like this:

- Intake that converts a messy pile of PDFs into a structured task list.

- Entity resolution to match accounts and institutions to a deceased person across fragmented records.

- Draft letters and forms that match bank and insurer templates, with human review.

- Triage for support teams so the hardest cases land with the most experienced agents.

- Memory preservation that respects consent and context, not hype.

Guardrails matter. Collect explicit permissions from executors and next of kin, allow opt‑outs for memorialization features, and publish your model policies. Families remember when you treat their stories with care.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

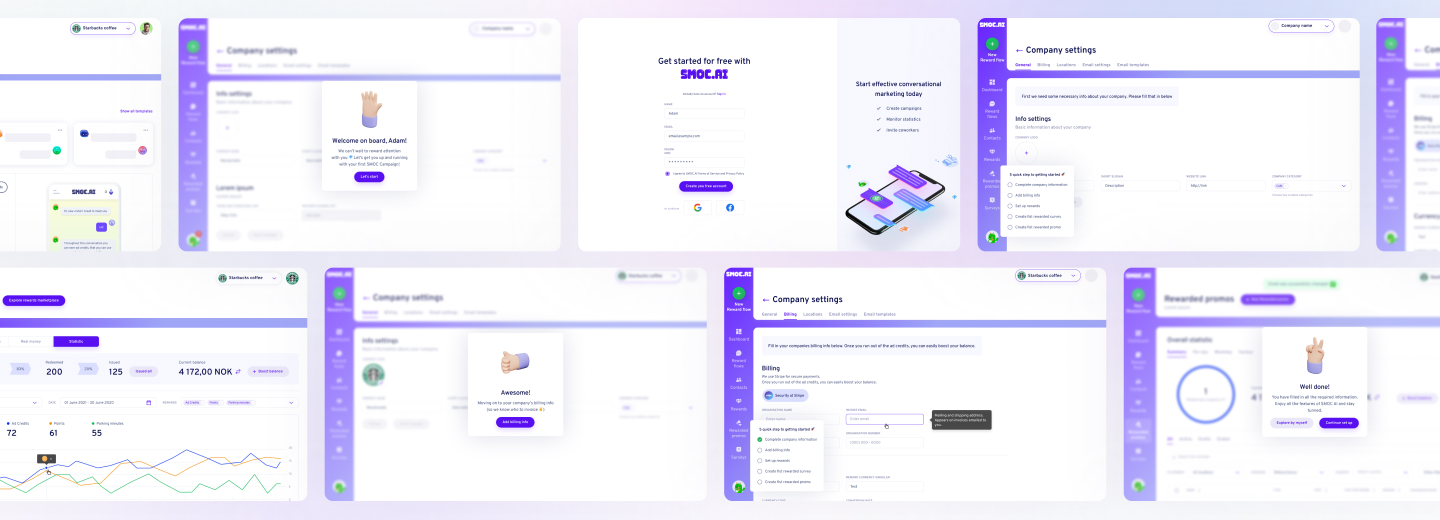

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Building with care: product and tech notes from the trenches

If you handle estates or memorials, you are in the business of trust. That is a product requirement and a brand requirement. It shows in response times, tone of voice, and the speed with which you fix mistakes.

From a build perspective, choose boring tech for the core. Use proven frameworks, invest in observability, and keep the attack surface small. Data isolation by client or region is wise if you sell into employers or hospitals. Treat every action by an executor or funeral director as a transaction that needs an audit trail. That audit trail is your safety net during disputes.

Integrations are your leverage point. Banks, insurers, credit bureaus, notaries, and identity providers all matter. Pick one or two to start and deliver depth, not breadth. Where APIs do not exist, build robust automation with clear fallback to human ops. Be honest about what is automated and what is handled by a trained case manager.

On the front end, write for exhausted people. Microcopy should be short and literal. Avoid growth hacks inside memorial flows or claim guidance. Use clear pricing on every screen that mentions a paid feature. Build a cancel button that works. Respect is the ultimate growth loop in this category, because references come from families, social workers, clergy, and attorneys.

A clear path for founders and partners

If I were advising your team today, I would keep you focused on a thin slice with outsized value, then widen the aperture as proof piles up. The first proof points should be about outcomes you can measure and repeat.

- Pick your wedge: start with one phase, for one buyer, with one clear outcome; for example, employer‑paid estate guidance that reduces average claim duration by 10 percent.

- Prove reliability: publish SLA attainment, first‑response time, and task completion rates; put a human name on every case.

- Land durable distribution: sign one benefit broker, one insurer pilot, and one multi‑location funeral partner; align incentives with shared savings or revenue share.

- Industrialize compliance: document data flows, narrow access, and automate retention; prepare for vendor risk questionnaires from day one.

- Price to value: tie fees to time saved, cases resolved, or verified outcomes; avoid rates that invite the wrong buyers.

If you are an employer, insurer, or large funeral operator, the opportunity is to standardize on a trusted platform rather than stitch together point solutions. APIs give you control, and co‑branding lets your families know you stand behind the service.

We spend our days designing, building, and scaling software that people rely on when everything feels heavy. If you are building in this space, or if you are responsible for serving families at scale, reach out. I will share the roadmaps, compliance templates, and hiring profiles that have worked for us, and we can shape a rollout that respects your brand and delights your stakeholders.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

As we stand at the intersection of technology and mortality, the rise of digital DeathTech startups in the USA signals a profound transformation in how society approaches the end of life. This sector, once shrouded in tradition and taboo, is now being reimagined by visionary entrepreneurs who blend empathy with innovation. The convergence of demographic shifts, digital literacy, and a growing demand for personalized, dignified end-of-life experiences is fueling unprecedented growth and opportunity.

Yet, the journey is not without its challenges. Regulatory complexities, cultural sensitivities, and the need for robust data security demand thoughtful navigation. The most successful players will be those who not only harness cutting-edge technology but also build trust through transparency, ethical stewardship, and genuine human connection.

Looking ahead, the future of digital DeathTech startups is bright and full of promise. As these companies continue to disrupt and redefine the industry, they will empower individuals and families to approach death with greater agency, clarity, and peace of mind. For founders, investors, and innovators, the time to engage with this transformative movement is now. The impact of your vision could resonate for generations, reshaping not just how we die, but how we live.

If you are ready to explore the future of DeathTech, collaborate on groundbreaking solutions, or seek expert guidance in navigating this evolving landscape, we invite you to connect with us. Let’s shape the future of digital DeathTech together.

The global DeathTech market is estimated to be worth several billion dollars, with projections indicating continued growth in the coming years. In the United States alone, the sector is valued at over $100 billion when considering the broader funeral and end-of-life services industry.

Key drivers include demographic shifts such as an aging population, increased digital literacy across all age groups, and a growing demand for personalized and dignified end-of-life experiences.

Restricting factors include regulatory complexities, varying state and federal laws, and cultural sensitivities surrounding death and dying. Data privacy and security concerns are paramount, as digital platforms handle sensitive personal information.

Common digital products in the DeathTech sector include online will and estate planning platforms, digital memorial services, virtual funeral streaming, grief support communities, end-of-life planning apps, and digital asset management tools. Some startups also offer AI-driven legacy creation, secure storage of important documents, and platforms for managing digital identities after death.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers