Every startup leader faces the moment when momentum needs money. You have a strong concept, early believers, maybe even a working prototype, but no sales yet. That gap between promise and proof is where many founders stall. It does not have to be like that.

Over the past decade building products and analyzing businesses for founders across industries, I have seen pre revenue startup funding come together again and again with a repeatable process. Pre revenue does not mean pre traction. It means investors will judge you by different signals. If you set those signals up with clarity and speed, capital starts to look less like a mystery and more like a plan.

Let’s build that plan together.

WHAT'S IN THE ARTICLE

- 01What pre revenue actually means

- 02The step-by-step approach I use with founders

- 03What investors look for before the first dollar of revenue

- 04A practical budget for a pre revenue raise

- 05Valuation logic when you are pre revenue

- 06Non-dilutive capital: grants, credits, and prizes

- 07Common pitfalls and how to avoid them

- 08Your first 30-day plan

- 09Conclusion

What pre revenue actually means

Founders hear the term everywhere, then realize no one defines it the same way. So let’s answer the basics.

What is pre-revenue? A company is considered pre revenue when it has not yet booked recognized revenue from customers. You may have a prototype, pilots, signups, or letters of intent, but no recorded income.

What does pre revenue mean for investors? They cannot analyze sales efficiency or retention yet, so they look for proof in other places: problem depth, market timing, team capability, early demand, technical progress, and a clear path to the first dollars.

Pre-revenue meaning in practice: The bar shifts from financial metrics to milestone-based risk removal. Every bit of evidence that reduces market, product, team, or technical risk is your currency at this stage.

Another way to phrase it: what is pre revenue? It is the stage where evidence replaces revenue, and story structure replaces cohorts and CAC.

If you see prerevenue as a distinct game with its own scorecard, you will prepare the right assets and approach the right investors.

The step-by-step approach I use with founders

Across hundreds of pitches and many rounds closed, I run a simple sequence. Each step builds proof that stacks neatly for the next investor conversation.

Step 1: Clarify the problem and who feels it the most

Pre revenue funding starts with an undeniable problem and a tight customer segment. General pain statements do not move checks. Precision does.

- Define the job your user is trying to get done in one sentence.

- Identify the top three triggers that make the problem acute.

- Write a single, concrete outcome your product enables within 30 days of adoption.

Run 15 to 30 short, structured interviews with target users. Record the words they use to describe the pain, the workarounds they rely on today, and the boundary conditions that block adoption. This language will power your pitch, landing page, and outreach. It also tells you exactly who to prioritize first.

My team builds a one-page narrative from those interviews that reads like a user story, not marketing copy. The tighter that one pager, the smaller your first attack wedge, the faster your early evidence will appear.

Step 2: Turn the idea into investable evidence

A pre revenue startup must replace sales metrics with evidence. Aim to produce three to five of the following within 4 to 8 weeks:

- Design partner letters or signed pilot commitments

- A waitlist with qualified leads segmented by role and company size

- Prototype or clickable demo that answers the three hardest product questions

- A small alpha or beta cohort with defined success criteria

- Technical de-risking notes that prove the hardest capability is feasible

- A basic unit economics model grounded in today’s alternatives

- Market demand signals like inbound requests, RFP invites, or integration asks

The best signal is active use. Second best is clear, verifiable intent from credible customers. I prefer design partner agreements with dates, deliverables, and success metrics. They push your team to ship and give investors something tangible to reference.

Step 3: Choose the funding path that fits your stage

Not all capital is the same. Pre revenue startup funding can come from several sources, each with different expectations.

| Funding path | Typical check size | What investors expect upfront | Timing to close | Notes |

| Friends and family | 10k to 150k | Trust in you, simple story, basic plan | 1 to 6 weeks | Keep terms clean, document everything |

| Angel investors | 25k to 250k | Team, market insight, early evidence | 3 to 10 weeks | Prioritize angels with domain fit |

| Super angels | 100k to 500k | Clear wedge, path to seed, signal | 4 to 12 weeks | Often lead early syndicates |

| Pre-seed funds | 250k to 1.5M | Strong team, prototype, pilots | 6 to 14 weeks | Expect formal diligence |

| Accelerators | 100k to 500k | Coachability, early traction signals | 4 to 12 weeks | Trade equity for network and speed |

| Venture studios | Team plus resources | Team plus problem depth | 4 to 8 weeks | Shared cofounding model |

| Strategic investors | 250k to 2M | Strategic fit, pilot potential | 8 to 20 weeks | Longer cycles, can open doors |

| Grants and competitions | 50k to 2M | Research, clear impact, technical plan | 8 to 24 weeks | Non-dilutive but time heavy |

Pick one or two lanes to pursue first. A common pairing: angels plus a pre-seed fund, or accelerator plus angels. Grants can be layered in parallel if you have the right technical profile and patience for paperwork.

Step 4: Select the right instrument and terms

At prerevenue, I favor simple instruments that reduce friction:

- SAFE with a valuation cap and discount

- Convertible note with a cap, discount, and interest

- Priced equity rounds are possible but slower and heavier on legal work

- Grants when available

- Venture debt is rare at this stage

Key points to align:

- Valuation cap that matches your milestone profile

- Discount that rewards early checks

- Pro rata rights for meaningful investors

- Clear target raise size and runway

- No exotic clauses that complicate later rounds

Keep it clean. A messy cap table or unusual term can scare off future leads. I often advise founders to set one standard SAFE with a fair cap and move quickly rather than over-optimizing. Momentum beats perfection.

Step 5: Build a lightweight data room that answers the real questions

Investors do not need a novel, they need confidence. Package a lean folder with:

- Ten slide deck and a 1-page summary

- 12 to 18 month operating plan and budget

- Product roadmap and milestones tied to the next round

- Market thesis, segmentation, and initial ICP

- Early evidence: pilots, letters, usage, waitlist data

- Founding team bios and references

- Cap table, founder vesting, IP assignment docs

- Legal entity and any prior agreements

- Basic risk log with your mitigation plan

If you have a demo, record a 3 to 5 minute walkthrough showing the key workflow. Keep file names clean and short. Keep a version log so you can reference what changed after new insight arrives.

Step 6: Build a targeted outreach engine

Random meetings lead to random outcomes. Replace wishful thinking with a clear process.

- Create an investor list of 60 to 120 targets ranked by fit: sector, stage, check size, and historic interest in your category

- Track in a simple CRM or even a spreadsheet with status and next steps

- Get warm introductions first, then run thoughtful cold outreach in sprints

- Send short monthly updates to people on the fence

Cold email template that gets replies:

Subject: 2-min intro – tackling [specific problem] for [specific user]

Hi [First Name],

We are building [product in one line] to eliminate [pain] for [ICP]. Early signals:

- [Pilot or design partner detail]

- [Prototype or technical milestone]

- [Waitlist or quant signal]

Raising [amount] on a [SAFE or note] to hit [three milestones] over [runway months]. Worth a quick call?

Best,

[Your Name] [Link to deck] [Link to demo] [One-liner]

Keep it focused, specific, and verifiable.

Step 7: Structure a pitch that converts meetings into diligence

A strong deck for pre revenue looks like this:

- One-line problem and outcome

- Who feels the pain most and why now

- Your product and what is unique

- Early evidence that proves demand or feasibility

- Go-to-market wedge and how you win the first 100 customers

- Business model with unit logic

- Competition and your durable edge

- Team and why you can make this real

- 12 to 18 month milestones tied to use of funds

- The raise: amount, instrument, cap, and who is in

Rules I live by:

- Lead with the problem and who screams the loudest about it

- Show rather than tell with a short demo or product visuals

- Quantify your wedge. Vague land grabs stall investor imagination

- Address the biggest risk before they bring it up

- Know your numbers, even with no revenue: market size, implied ACV, adoption rates, CAC guesswork based on today’s channels, and funnel math

Step 8: Run diligence and closing like a professional

Pre revenue rounds can still collapse if closing is sloppy. Treat closing as a project with owners and dates.

- Share a short calendar with all target close dates and milestones

- Use standard docs and a single link to the latest version

- Set expectations for weekly updates during closing

- Keep a FAQ with crisp answers to repeating questions

- Bring in counsel for final terms and cap table checks

After a soft circle of 60 to 70 percent, push for a hard close date. Social proof matters. Name committed investors with permission, and share when you hit material milestones during the raise.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

What investors look for before the first dollar of revenue

I often hear, “No revenue yet. Is anyone going to fund this?” Yes, if you show the right mix of signals.

- Team signals: founder-market fit, speed of execution, clarity of decisions

- Market signals: a narrow wedge with convincing expansion paths

- Product signals: solving something non-trivial with a real workflow

- Demand signals: pilots, letters of intent, usage, or qualified waitlist

- Timing signals: change in regulation, cost curve, tooling, or behavior

- Capital efficiency: lean plan to reach a clear proof point

Treat each as a mini score. Keep a simple scoreboard and update it weekly. It becomes your operating system during the raise.

Sometimes it is better to emphasise the other side of the process. When numbers are thin, story structure matters. That does not mean hype. It means sequence.

- Start with the job to be done in plain language

- Show the cost of inaction today

- Reveal the new capability your product enables

- Prove people care with evidence

- Explain why now, and why you

- Map 12 to 18 months of progress into 3 to 5 named milestones

- State the raise with terms and who is already in

A clean arc keeps investors with you. It lowers cognitive load and leaves less room for misinterpretation.

A practical budget for a pre revenue raise

There are numerous signals that it is time to get funding. I watch for a few tells that separate founders who close from those who stall:

- Short cycle times between conversations and product changes

- Crisp math on go-to-market even before a dollar comes in

- Willingness to confront the hardest risk first

- Clear boundaries on what the company will not do in the next 12 months

- Respect for capital that shows up in the budget and hiring plan

These signals compound. Investors talk. Your reputation for speed and clarity moves across calls. Set a budget that lets you hit milestones that unlock the next round. Keep it specific and lean.

| Category | 12-month target | Notes |

| Core team | 350k to 600k | 2-4 engineers, 1 design, 1 founder salary calibrated |

| Cloud and tools | 30k to 80k | Keep infra lean, use credits |

| Design and research | 25k to 60k | Usability, customer interviews |

| GTM motion | 60k to 150k | Founder-led sales plus targeted experiments |

| Legal and admin | 15k to 35k | Formation, IP, contracts, payroll |

| Contingency | 10 percent of spend | Protect runway |

Tie each spend category to a milestone and a date. When investors see money mapped to proof, confidence increases.

What investors want most at this stage is disciplined execution. You can show that discipline in the way you plan, prioritize, and communicate. Pre revenue meaning shifts from theoretical to practical the moment you show that every week produces new proof. It turns your raise into a series of small yes votes that stack into checks.

- Share a monthly update with goals, evidence, product progress, and asks

- Tie each spend to a close milestone

- Track key leading indicators even before revenue: pipeline quality, time to pilot, onboarding friction, user activation on early builds

- Keep meetings short, follow with written recaps, and always note what you will measure next

Valuation logic when you are pre revenue

No one can value a dream with precision, so investors use pattern matching and risk discounting. That can feel arbitrary. Bring structure to the conversation.

- Cap anchored to milestones: pick a cap that reflects what you have proven and what you will prove in the next 12 to 18 months

- Comparable rounds: review recent caps for similar teams in your sector

- Supply and demand: unique angle and speed can justify the upper end

A simple guide I share with founders:

| Evidence profile | Typical cap range in US markets | What to improve to move up |

| Team plus sharp thesis, no product | 4M to 7M | Prototype, LOIs, alpha design partners |

| Prototype plus 2 to 4 design partners | 6M to 12M | Live usage, repeatable pilot workflow |

| Live pilots with measurable outcomes | 10M to 18M | Early revenue or strong pipeline quality |

| Regulated or deep tech with grants | 8M to 20M | Technical proof against key risks |

Do not overshoot to feel good on paper. Overpricing creates pain in the next round when numbers must match a steeper slope. Choose a cap that lets early supporters win and gives you space to grow. Not every raise should continue without change. Consider three clear decision points:

- After 20 to 30 investor meetings with no second calls: your wedge or narrative is off. Pause for a week to tighten ICP and demo.

- After strong interest but soft declines on cap: reassess valuation against your evidence. Small adjustments can unlock a lead.

- After weeks of mixed signals and limited proof: reallocate time to pilots and demand instead of more meetings.

You control the tempo. Switching from pitch mode to proof mode for two weeks often resets the dynamic in your favor.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

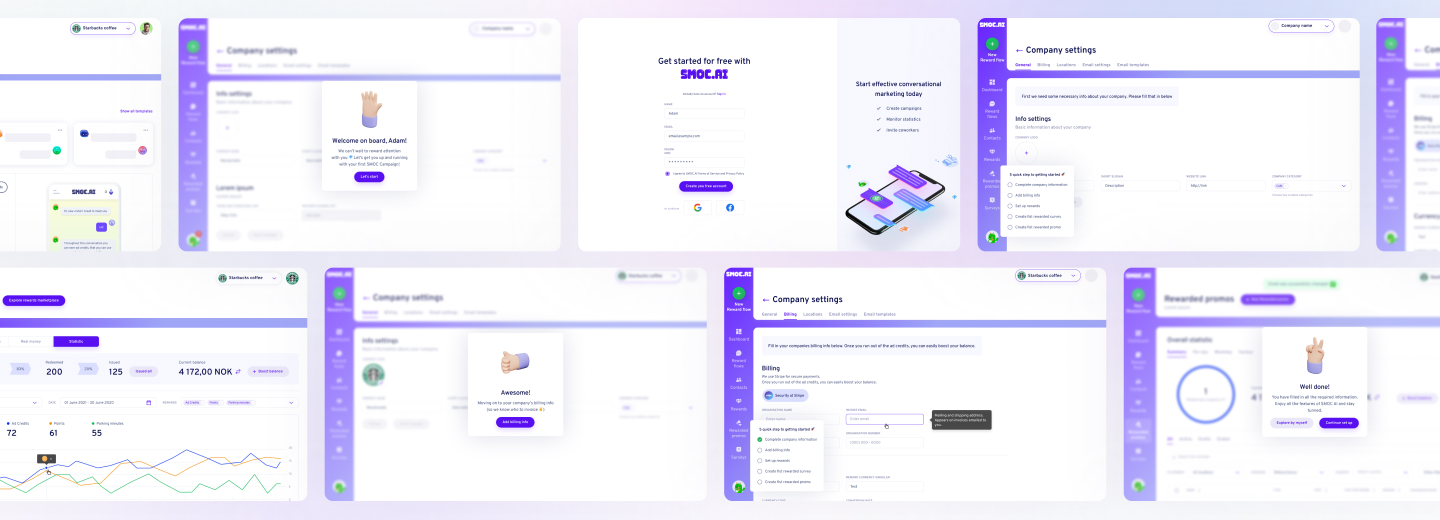

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Non-dilutive capital: grants, credits, and prizes

Some categories pair well with grants. If your product has research depth or public impact, you may qualify.

- SBIR and STTR in the United States for deep tech and research-heavy products

- NSF and NIH programs for science-driven innovation

- State innovation funds and matching grants

- R&D tax credits where applicable

- University-linked programs and corporate challenges

Grants require time, detailed plans, and patience. Use them in parallel with other funding, and never let the application cycle slow down customer evidence.

Common pitfalls and how to avoid them

Patterns repeat. Here are the most common mistakes and how I coach founders through them.

- Vague customer segment: Tighten your ICP until you can name 50 target logos and 3 buyer titles. Narrow first, then widen.

- Deck bloat: Keep it to ten slides. Extra detail goes in the appendix or data room.

- Hand-wavy traction: Replace vanity metrics with tangible evidence. LOIs with dates and outcomes beat social likes.

- Weak outreach: Do not blast. Send 15 to 25 precision emails a week, track replies, and iterate your message based on what moves.

- Overcomplicated terms: Run one instrument. Say no to side deals that create inequality and confusion.

- Hiring too early: Keep the team small and senior until you reach the next proof point. Contractors can fill gaps.

- Ignoring compliance: Assign IP to the company, set up founder vesting, and log data access. Sloppy basics kill deals late.

Your first 30-day plan

If I were parachuting in as your acting CEO for a month, this is the sprint I would run.

Week 1

- Confirm target segment and write the one-page problem narrative

- Build the investor list and gather warm intro paths

- Outline ten-slide deck and initial data room structure

Week 2

- Ship a clickable demo or prototype that answers the three hardest questions

- Run five to ten customer conversations and translate insight into product scope

- Draft standard SAFE and term summary with counsel

Week 3

- Lock two to three design partner commitments with success metrics

- Launch a focused waitlist page and capture qualified signups

- Start investor outreach with 20 precision emails and 5 warm intro requests

Week 4

- Record a crisp 3-minute demo video

- Host five investor calls, log objections, refine deck and narrative

- Send a clear update to interested parties with new evidence and next steps

By the end of the month, you should have a small stack of proof, a living pipeline, and a set of investors leaning in. Momentum is a choice.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

Pre revenue is a label, not a limit. The right question is not “who will fund me without revenue,” but “what proof can I create this month that makes funding the logical next step.”

If you want an experienced partner to turn that sentence into action, reach out. My team helps founders compress the time from idea to evidence to invested. Share a short note with your problem, your wedge, and where you are today, and we will respond with a crisp plan and a timeline you can believe in.

Time-bound product trial with defined goals and success criteria.

Pre revenue: No recognized revenue yet, but may have pilots or usage. Cap: The valuation ceiling used to calculate conversion of a SAFE or note. Discount: Percentage reduction applied to the next round valuation at conversion

Simple Agreement for Future Equity that converts into shares in a future priced round

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers