I have spent a decade building products, reading messy dashboards at 2 a.m., and sitting across from founders who are one change away from momentum. Funding tends to be that change. When a young company secures its first outside capital, everything speeds up. Meetings get easier. Hiring makes sense. Experiments run faster. The question is not whether to raise. The question is how to raise in a way that multiplies your odds, protects your control, and sends a clear signal to the market that you are going somewhere important.

Below is the approach I use when guiding founders through their first round. It blends product rigor, business analysis, and a candid view of investor psychology. Treat it like a field manual, not a script.

WHAT'S IN THE ARTICLE

- 01Start with the only funding rule that matters

- 02What investors actually look for at the first check

- 03Design your milestone and build backward

- 04Traction you can generate before funding

- 05The early capital market in one table

- 06How to run a tight fundraising process

- 07Product and technical signals that increase confidence

- 08Common mistakes and how to fix them fast

- 09How to turn meetings into offers

- 10A short checklist you can use today

- 11Conclusion

Start with the only funding rule that matters

Money is a tool for retiring risk. Investors buy risk that is about to be resolved, not risk that is piling up. Your first check arrives when at least one major risk looks smaller than it did 60 days ago. That is the line you must cross.

- Team risk shrinks when your core team has shipped together or carries proof of execution worth betting on.

- Market risk shrinks when a narrow segment bites hard and pays something, even if small.

- Product risk shrinks when users keep coming back without you begging them.

- Distribution risk shrinks when a repeatable motion shows up in the data, not in a slide.

I plan the round around a milestone that objectively reduces one or two of those risks. Then I align everything else to that milestone: the story, the proof, the round size, the investor list, and the meeting choreography.

What investors actually look for at the first check

Investors keep pattern libraries in their heads. They will not always admit it. I will. There are five signals that cut through noise:

A crisp wedge into a specific problem. Narrow beats broad. A specific buyer persona, a clear workflow, and a sharp reason they will switch.

Evidence of pull, not push. Waitlists with verified identities, pre-orders, letters of intent with pricing, paid pilots, or users who return without prompt.

A go-to-market motion that is boring on purpose. One channel that shows steady unit economics. One sales motion that closes at a predictable rate. One content stream that creates SQLs.

A model that fits on a whiteboard. Few moving parts. Gross margin above 60 percent if software. Payback under 12 months if B2B. Repeatable pricing.

A team that looks inevitable for this space. Prior domain work, technical depth where it counts, and a bias for speed that is obvious in the product and in the calendar.

I teach founders to build these signals into their deck and their data room. When the signals are present, negotiations feel like choosing a partner. When they are missing, even a good pitch feels like pushing a rock uphill.

Design your milestone and build backward

Do not set a round size until you decide the milestone that will unlock the next round or financial self-sufficiency. Choose one milestone that your team can hit in 9 to 15 months with 20 to 30 percent buffer.

- Consumer app example: reach 50 thousand WAU, 25 percent 8-week retention, and a referral rate above 20 percent.

- B2B SaaS example: 20 paying customers in one ICP with net revenue retention above 100 percent and payback under 9 months.

- Marketplace example: 3 balanced city pairs with independent supply and demand acquisition channels and a take rate tested at scale.

Once you lock the milestone, translate it to a budget. Add hiring, infrastructure, experiments, and a 3-month cash reserve. Now you have a round size that sounds like engineering, not wishful thinking.

Aside from building the product, you should know how to show it and sell it in the best way. Here is the pre-seed and seed data room that wins trust, where every file should answer a question. Every chart should tie to the chosen milestone.

Core items

- One-page company memo with problem, wedge, ICP, pricing, progress, and next milestone

- 10 to 12 slide deck tied to the memo

- Product demo video that is less than 5 minutes

- Metrics pack with clear definitions and cohort views

- Go-to-market plan with weekly activity targets and funnel math

- Team bios with responsibilities now and planned hires

- Legal folder with incorporation, cap table, SAFE templates, IP assignments, and key contracts

- Security and reliability note, including data handling and vendor list

- Customer proof folder with emails, LOIs, or pilot SOWs and pricing

- Financial model that can be read on one screen and ties to the ask

Optional items when relevant

- Architecture overview with key tradeoffs and scalability plan

- Compliance plan with a timeline if operating in regulated categories

- Competitive tear-downs focused on customer segments rather than feature tables

Now answer the question that scares investors the most: why you, why now, why this narrow starting point.

Do not forget to respect the time and brain of your readers who are going to examine your data. Pitch decks drown in fluff. I like 10 to 12 slides with numbers in big fonts and visuals that explain themselves. If a slide cannot be tied to a risk being reduced, delete it.

- Opening claim: one sentence where you state the outcome customers get, not a feature list

- Problem in the wild: screenshots, quotes, or a step-by-step of a broken workflow

- ICP and wedge: who buys first, how they buy, and what you are not doing

- Product snapshot: three frames maximum, each tied to a measurable outcome

- Results so far: retention, speed to value, revenue or commitments, and unit signals

- Go-to-market: one channel, one motion, weekly activity required, and spend plan

- Business model: pricing, margins, payback math in plain sight

- Competitive lens: segment map showing where you win and why switching happens

- Team: role clarity and proof that you can ship this product for this buyer

- Milestone and use of funds: what you will prove by when and how the dollars map to it

- The ask: round size, instrument, lead needs, and timing.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Traction you can generate before funding

Plenty of first checks show up only after scrappy traction. That is healthy. Here are fast paths that usually work.

- Paid pilots with clear success criteria and a short SOW

- Pre-orders or deposits with refund terms that feel fair

- Letters of intent that include pricing and decision makers

- Design partner programs with weekly sessions and data access

- No-code or low-code prototypes that deliver the core value

- Concierge versions where the team manually performs the workflow to learn

- Waitlists that gate real usage and measure referral rates

- Content that attracts your ICP and converts to a call without gimmicks

- Channel partners who will include your offer in at least three sales cycles

- Pricing tests with real credit cards on a landing page

The metric that moves hearts is not total users. It is a tight loop that produces value fast. Time to value under one day in B2B is a superpower. A consumer loop that delivers a visible dopamine hit in under 30 seconds is even better.

The early capital market in one table

Different money fits different proof levels. Choose the match that respects your milestone and your timeline.

| Source | Typical check size | Speed to close | Dilution | Proof investors ask for | Founder time cost | Key risks |

| Friends and family | 25k to 250k | Fast | Medium to high | Team quality and personal trust | Low | Relationship strain if goals slip |

| Angel syndicates | 100k to 500k | Medium | Medium | Clear wedge, early traction, strong deck | Medium | Herd dynamics and slow wire timing |

| Solo angels | 25k to 250k | Fast | Medium | Founder quality and narrative clarity | Medium | Limited follow-on support |

| Pre-seed funds | 250k to 1.5M | Medium | Medium | Early pull, team fit, plan to seed | High | Deeper diligence and partner timing |

| Accelerators | 100k to 500k plus program | Set cohort dates | Medium | Potential and growth rate during program | High | Time away from customers |

| Venture studios | 500k to 2M plus shared ops | Medium | High | Studio thesis fit and team chemistry | High | Shared equity and governance limits |

| Corporate VC | 250k to 2M | Slow | Medium | Strategic fit, security posture, pilots | High | Process drag and conflicting incentives |

| Grants | 50k to 1M | Slow | None | Research or public impact, compliance | Medium | Non-recurring and rigid scope |

| Revenue-based financing | 50k to 500k | Fast | None | Revenue consistency and margin quality | Low | Cash flow pressure if growth stalls |

| Crowdfunding | 100k to 1M | Medium | Medium | Engaging story, community, compliance | High | Ongoing updates to a large base |

Pick one or two paths and commit. Trying four at once exhausts the team and confuses your story.

How to run a tight fundraising process

I like to treat fundraising like sales. Build a list, run a cadence, maintain a clean pipeline.

- Target list: 80 to 150 names with a reason for each based on stage, check size, thesis, and past deals

- Segments: must-have, strong-fit, and test-fit

- Warm paths: identify connectors who can send tailored intros within 7 days

- Assets: memo, deck, 5-minute demo video, and a metrics pack with a clear definition sheet

- CRM: a simple board with columns for intro, first call, partner meeting, diligence, verbal yes, and closed

Cadence

- Week 1 to 2: 20 to 30 intro emails, 10 meetings booked

- Week 3 to 4: partner meetings and follow-up data sent within 24 hours

- Week 5: nudge silent threads and promote momentum if a term sheet appears

- Week 6 to 8: negotiate, reference check for fit, and close

Do not drip outreach over 4 months. Momentum lives on a clock.

Cold email that gets opened

Subject: Fast overview, [space you serve], showing [result metric]

Hi [Name],

I am building [company], a [simple category] for [ICP] that shortens [pain] from [baseline] to [new result]. We have [traction signal], growing [metric] by [percentage] month over month.

I am raising [round amount] to reach [clear milestone] in [timeline]. If you are interested in [space or thesis link], would you like a quick look? I can send a 5-minute demo video and the memo.

Best,

[Your name]

[One line bio with a proof point]

[Link to 5-minute video]

[Link to short deck or Calendly]

Personalize the second sentence with an authentic tie to their thesis or a deal you both know.

The pitch meeting flow

- Minute 0 to 3: why this problem, why this wedge, why it is moving now

- Minute 4 to 7: product demo tied to outcomes, not features

- Minute 8 to 12: traction signals and unit economics that show repeatability

- Minute 13 to 15: go-to-market math and a week-by-week plan

- Minute 16 to 18: team and hiring plan that hits the milestone

- Minute 19 to 20: the ask and timing

Offer to screen share the metrics pack only if the investor asks. Keep the first call simple and strong.

Tough questions you should be ready for

- What breaks if demand triples next month?

- Which metric, if flat for 2 months, forces you to pivot?

- Where do you make money in year two, not just year one?

- Who fails if you win?

- What is the cheapest way to get your next 50 customers?

Short, direct answers win respect. If you do not know, say so and commit to an experiment with a date.

Focus most of your attention on the model every investor wants to see. You do not need a fragile 20-tab spreadsheet. You need a 12-row view that ties to reality.

Core rows

- New customers per month with a channel split

- Price and expected discount

- Gross margin

- Churn or retention by cohort

- CAC by channel, including labor

- Sales cycle length

- Payback period

- R&D, GTM, and G&A headcount and cost

- Infrastructure and tooling cost

- Cash balance and runway by month

- Use of funds tied to the milestone

- Sensitivity cases for price, acquisition, and churn

Short example

- B2B SaaS at 200 dollars MRR, 80 percent gross margin

- 30 new customers a month from outbound at 800 dollars CAC and 45-day cycle

- Net revenue retention at 110 percent by month 12 through expansion

- Gross payback at 6 months and contribution payback at 8 months

- Target seed milestone at 100 customers and 10 thousand MRR with small team

If your math shows a payback longer than 12 months with thin margin, explain why the market still produces a big outcome. Some markets are worth that trade. Many are not.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

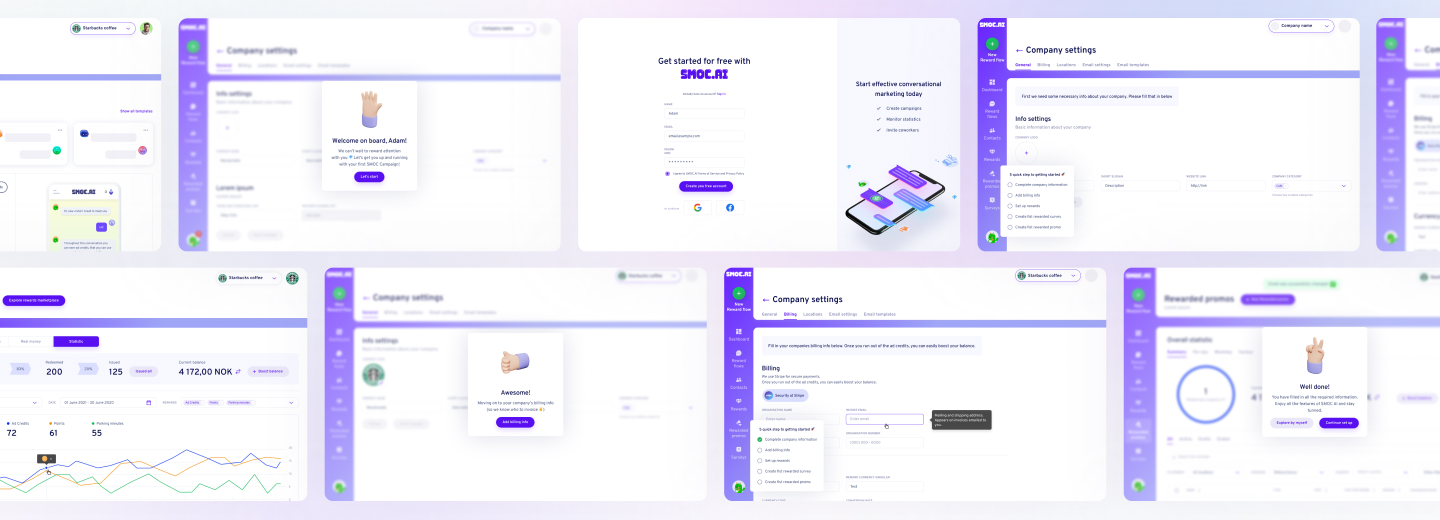

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Product and technical signals that increase confidence

As a dev and product lead, I care how the engine is built. Investors care when it affects speed, quality, and risk. Call out what you do not build, it is important to show the global goal and solution, not the tiniest technical details of it.

- Clear architecture diagram with choices justified by customer needs, not buzzwords

- A staging environment and CI pipeline that cuts release time below one day

- Observability with logs, tracing, and alerts that feed into a weekly ops review

- PII and secrets handled by policy and code, not by email and hope

- Feature flags and kill switches to roll back fast

- Metric instrumentation on activation, habit formation, and value moments

- A backlog where priorities tie to impact, not internal politics

- Design research sessions with videos and notes that show what changed

Make special attention to your first term sheet. Focus on what compounds. Do not spend energy on things that do not change your life.

- Instrument: SAFE with a valuation cap or equity with a clean 1x non-participating preference

- Valuation cap: set it to reflect the milestone you will hit next, not the last headline you saw

- Discount: fair level for very early believers if a cap is not present

- Pro rata rights: keep them for your angels who will support you

- Board: keep it simple at pre-seed, add structure at seed when helpful

- Information rights: fine, as long as reporting cadence is feasible

- ESOP size: allocate at closing so the plan fits your next 12 months of hires

- Founder vesting: reset for new rounds if needed with sensible cliffs

Ask investors how they behave when a plan slips. Call two founders they backed who had a rough patch. Patterns show up fast when you ask the right questions.

Common mistakes and how to fix them fast

Story drift: changing the wedge every week confuses buyers and investors. Choose a lane and give it 90 days.

- Vanity traction: top-line user numbers with no depth. Track depth metrics that map to value, like actions per user and week 8 retention.

- Messy CRM: forgetting who is where in the process. Treat it like sales and update daily.

- Round mismatch: raising too much for the proof you have. Reduce the round or increase traction before pushing for a high cap.

- Overengineering: building infrastructure for year three. Ship the smallest version that proves the value loop.

- Pricing fear: setting a price below pain relief. Charge something meaningful early and adjust with data.

- Hiring too early: adding sales before repeatability. Founders should own the first 10 to 20 deals.

Correct course in weeks, not months. Most early mistakes are reversible with focus.

Pay special attention to any legal issues as they can easily shut down your operations. A simple folder with these items saves weeks. It also signals that you execute. Good companies get stuck on small paperwork. Fix that early.

- Incorporation in a standard jurisdiction with preferred startup terms

- Clean cap table, founder vesting in place, and 83(b) filed on time

- IP assignment agreements signed by every contributor

- Contractor and advisor agreements that match reality

- Standard SAFEs or term sheet templates ready for quick edits

- Data processing addendums for key vendors if touching PII

- Basic financials with a monthly close checklist

How to turn meetings into offers

Operational habits increase closing rates, even when the market is tight. Investors invest when the deal feels like it is getting better every week. Give them a reason to believe that.

- Send a crisp summary email after every meeting within 12 hours

- Share one new datapoint each week that moves the milestone forward

- Ask for the next step in the room instead of waiting for email

- Offer customer references only when interest is real

- Keep a running FAQ that grows with every question you meet twice

If you are technical, show discipline in product scope. Investors respect founders who can say no. Your backlog should reflect three types of work only:

- Proving the core value loop

- Removing friction from activation and first value

- Tightening one go-to-market motion

Everything else is future roadmap. Use feature flags, kill scope aggressively, and ship small releases that reduce one metric at a time.

What a weekly operating rhythm looks like during a raise

- Monday: review the milestone scoreboard and the two numbers that matter most

- Tuesday: five customer calls or demos, log learnings by 6 p.m.

- Wednesday: product release or experiment roll-out, measure by EOD Thursday

- Thursday: investor updates and follow-ups

- Friday: debrief, backlog cut, celebrate one small win

Send a short weekly update to investors you want on your cap table. Three bullets, one chart, one ask.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

A short checklist you can use today

- Does our deck prove that milestone is reachable with data or credible proxies?

- Do we show one channel and one motion that are already working at a small scale?

- Is our model readable on one screen with payback and margin up front?

- Are our legal and finance basics clean and in one place?

- Do we know exactly who we are emailing this week and why they fit?

- Are we sending weekly updates that show real movement?

- Do we have a single milestone that reduces risk and fits inside 9 to 15 months?

If you want a copy of the template deck, the data room structure, and the model I referenced, reach out and I will send it. We also run free 20-minute diagnostics to spot the two moves that would raise your odds the most this quarter.

Your first check is closer than it feels when your proof is organized and your ask is crisp. If you want a second set of eyes, send me a note with your memo and your chosen milestone. I will reply with direct, specific feedback and, if it aligns, introductions to the right investors for your stage.

Conclusion

My firm builds products and helps founders get to real proof faster. The difference is in the living details. We know where unit economics break and how to repair them. We know how to design a deck that answers questions before they are asked. We know what to cut from a sprint and what to double down on. That mix of code, analysis, and deal-making shortens the distance between a plan and a term sheet.

If you are raising your first round, I am happy to review your deck, your model, and your go-to-market plan. No fee for a first look. If you want tailored help, we work on clear scopes and timelines with founders who are serious about the milestone that counts.

Bootstrapping / Self-Funding, Friends, Family, and Fools (FFF), Grants and Competitions, Angel Investors, Incubators and Accelerators, Crowdfunding, Seed Venture Capital (VC) Firms.

The amount should be calculated based on your runway and milestones.

You should aim to raise enough capital to operate for 12 to 18 months and reach a significant milestone (e.g., hitting a specific revenue target or user count) that will make you attractive for your next round, typically a Series A.

Product-Market Fit (PMF) is the point at which you have created a product that satisfies a large, addressable market.

For early-stage startups, demonstrating strong early indicators of PMF is the single most critical factor VCs look for before investing in a Series A round. It proves that customers not only use your product but are willing to pay for it, indicating a scalable business model.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers