If you have been in startup trenches for long enough, the word pivot stops sounding dramatic and starts sounding like a disciplined recalibration. As a founder turned CEO of a development and consulting firm, I have worked inside more than a hundred product teams over the last decade. Some got it right on the first strike. Most did not. The ones that thrived built a repeatable pivoting approach, measured it with rigour, and treated it as a leadership skill rather than a last-ditch manoeuvre.

What follows is a practical field guide. It is not about panic. It is about precision, timing, and execution.

WHAT'S IN THE ARTICLE

What people actually mean when they say pivot

Let’s clean up the vocabulary first because fuzzy language creates fuzzy decisions.

Pivot strategy meaning: a structured change to a core element of your business in order to unlock growth or viability.

Pivot definition business: a targeted shift in product, market, channel, or model that keeps the mission but rewires the path to it.

Pivoting meaning in business: replacing a major assumption with a better one based on new evidence, usually within the same competency and team.

What is pivoting in business: it is not a reset of values; it is a reset of bets.

A pivot can be bold without being chaotic. It can be fast without being reckless. The key is that a pivot is not a bundle of small tweaks. It is a clear new choice about who you serve, what you build, how you sell, or how you make money.

I call this the pivoting approach: decide the smallest set of changes that can change the trajectory, then test them like a scientist and execute like an operator.

When to pivot and when to persevere

Teams usually ask for a clean rule. There isn’t one. There are patterns.

Watch these signals across a three to four month window:

- Flat or declining retention despite feature velocity

- High engagement from a narrow niche while the broader target ignores you

- LTV to CAC below 2.5 for more than two paid cohorts

- Sales cycle elongating while win rate falls

- A channel dries up, and replacements do not produce repeatable results

- Unit economics worsen when you scale beyond a narrow pilot

- Prospects love the demo but stall at procurement or integrate and never activate

If you have two or more of these and your best experiments do not move the curves, you likely have a business model or market fit issue, not a product quality issue. That is a pivot startup moment.

When not to pivot:

- You have strong cohort retention and net revenue expansion, but growth feels slow. That is usually a marketing and ops problem.

- You have feature bloat. Cutting scope is not a pivot. It is discipline.

- You are six weeks into a launch with no budget and expect miracles. You need a proper test plan, not a new strategy.

Pay attention to numbers

Founders often bring optimism that outruns data. Keep the optimism, install guardrails. Numbers create clarity. They also reduce internal politics and show the real situation with your processes. Below are some of the most common signs that you are at risk of pivoting:

- Retention curves: Roll cohorts weekly for the last six months. If your curve flattens above a survival threshold you respect, you have something. If it keeps sloping down past 90 days, you need a new bet.

- Payback: If CAC payback exceeds 18 months in SMB or 30 months in mid-market, the model struggles unless your gross margins and expansion rates are exceptional.

- Contribution margin: Count support, hosting, refunds, and payment processing. If the margin per marginal account is weak, scaling makes you fragile.

- TAM sanity check: Top-down slides do not save you. Bottom-up model a reachable number of targets, realistic pricing, and a likely win rate. If this yields a ceiling that does not excite you, consider a market or problem pivot.

- Concentration: If 50 percent of revenue sits with 10 customers, a segment or channel pivot can de-risk the book.

A practical taxonomy of pivots

Most moves fall into a handful of categories. Labelling the move helps you pick the right tests, metrics, and risks to monitor. The table below is a shortcut. It gives you a pivot business strategy menu and a way to attach experiments to it. The goal is to pick one primary move and one supportive move. Two is the limit. Three breaks teams.

| Pivot type | Pivot definition business | Typical triggers | Key risks | First experiments | Primary metric |

| Customer segment pivot | Serve a different buyer within the same product category | High activation in a sub-segment, weak fit elsewhere | Org gets stuck selling to both segments | ICP rewrite, outbound to new persona, landing page for new segment | Conversion to a sales-accepted opportunity and 4-week activation |

| Problem pivot | Reposition the core job your product solves | Users hack your tool for a different job than intended | Team keeps shipping for the old job out of habit | New messaging, onboarding redesign, price-page copy test | Feature-level retention tied to the new job |

| Product pivot | Redesign core workflow or form factor | High interest but frequent drop-off at a key step | Tech debt hides the true cost of change | Clickable prototypes, concierge workflow, limited-scope build | Task completion rate and time-to-value |

| Channel pivot | Switch primary acquisition or distribution channel | Paid CAC inflates, organic plateaus | Brand and sales motion fragment | Partner pilots, marketplace listings, and new affiliate tests | CAC payback within the target window |

| Monetization pivot | Change pricing, packaging, or billing model | High usage, low revenue per account | Price shock increases churn | Usage-based variant, value metric test, annual contract offers | ARPA lift and gross revenue retention |

| Tech platform pivot | Move to a new core platform or architecture | Scale issues, platform dependency risk | Long build gaps hurt momentum | Dual-run subsystems, feature flags, migration cohorts | Reliability SLOs and margin improvement |

| Growth model pivot | Shift from sales-led to product-led or vice versa | Sales cycle too long or self-serve stalls | Cultural whiplash across teams | Trial design, freemium boundary, sales assist playbooks | PQL rate or SQL rate with stable win percentage |

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

A 30-day pivot studio you can run with a small team

Pivot process

I run this format for seed through Series B companies. It is lightweight and disciplined.

Week 0: Pre-work, 3 days

- Assemble a pivot memo. One page. Current thesis, target customer, big assumptions, last six months of results, runway, and ask.

- Create a metrics glossary. One source of truth for key definitions. No vague terms.

- Set kill criteria for the pivot experiment before you start. This avoids romanticising sunk cost.

Week 1: Field intelligence

- Ten recorded customer calls across three segments. Ask explicit upgrade, purchase, and referral questions.

- Shadow five onboarding sessions or user sessions. Note failure points.

- Price sensitivity survey for 50 prospects or a Van Westendorp lightweight pass. Do not overfit, but look for ranges.

Week 2: Prototype the move

- Write a narrative for the new bet. One page. Problem, who, solution sketch, why now, why us.

- Build a prototype or a concierge version within two to three days.

- Rewrite the landing page. New headline, subhead, three reasons to believe, social proof. Keep it simple.

Week 3: Market contact

- Run a targeted outbound campaign for the new ICP, 200 high-signal accounts, personalised first message, clear ask.

- Spin up a paid test with guardrails, two creative variants, three audiences, and tight budgets.

- Offer three calls with the founders to qualified leads. Speed creates insight.

Week 4: Decision and plan

- Review against pre-set kill criteria. Green, yellow, or red.

- Green means double down. Yellow means another two-week sprint with a tighter scope. Red means stop, not pause.

This is a pivoting approach that respects time and cash. You validate the pivot in the smallest window that still produces a signal, then you move.

How to pick the right pivot in business

The fastest way to get lost is to pick a move that fights your strengths. A pivot in business works when it compounds what you do well.

- Keep your core competency intact. If your edge is data ingestion, do not pivot into a company that depends on brand-driven sales without a product wedge.

- Choose a customer with high urgency. Will they reallocate budget this quarter, or are they window shopping?

- Prefer markets where you can ship a meaningful outcome inside 30 days, not a year.

- Look for pull evidenced by users bending your product to a new job.

- Validate the go-to-market path with real contacts, not hypotheticals.

This is where the pivot business strategy becomes a talent strategy. You can change direction. You cannot swap the DNA of the team overnight.

Communicating a pivot to your team and investors

Inside the company, clarity beats hype. Outside the company, confidence beats apology.

- With the team: Share the memo, the kill criteria, and the new bet. Define decision owners. Put calendered checkpoints. Invite scepticism inside the room, then commit after the decision.

- With investors: Frame the pivot strategy as risk reduction. Show the data that invalidated the old bet, the evidence for the new one, and the runway math. Ask for help in one or two lanes only.

- With customers: Avoid vague statements. If this pivot changes a promise, own it early, offer clear migration plans, and honour contracts.

Tooling to support the pivot, not slow it

You do not need a wall of new software. You need a crisp data spine and a clean communication loop.

- Analytics: A single product analytics tool with event names that map to the new job. Keep a lightweight event taxonomy doc.

- CRM and outbound: Keep sequences short, value-focused, and targeted. Trash any bloated workflows that slow the tests.

- Billing: If you test pricing or packaging, set up a parallel plan and clean proration. Finance should track revenue recognition impacts before you roll wide.

- Experiment notebook: A shared doc that lists each test, hypothesis, owner, start and end dates, and result. Close the loop.

The people side that keeps pivots on track

A startup pivot is a test of culture as much as it is a test of tactics. A pivot is not a referendum on the team’s past work. It is a rational response to new information.

- Decision rights: Assign a single DRI for the pivot. Many contributors, one owner.

- Psychological safety: Ask teams to make sharp calls, then protect them when a test fails. This speeds learning.

- Rituals: Weekly pivot review with data, not opinions. Clear next actions. No meetings that go nowhere.

- Language: Retire the old story publicly once the pivot is chosen. Mixed messages slow adoption.

To make the process easier, prepare a special memo with all necessary information included into it. Keep it short. One page, two if you must, and keep it living and changing to your business requests.

- Objective: Name the pivot type and the change you seek.

- Evidence: Current metrics and customer insights that invalidate the prior bet.

- New thesis: Who we serve, what job we solve, how we win.

- Tests: Three experiments, owners, start and end dates, and kill criteria.

- Metrics: The one or two numbers that decide.

- Risks and mitigations: The top three risks with specific countermeasures.

- Resourcing and runway: Budget, people, and time.

Pricing and packaging during a pivot

Monetisation pivots are powerful and risky. Move carefully. The best pricing changes feel fair to both sides. If customers feel trapped, churn will surface later.

You can pick one value metric that you can measure easily and that customers understand. That will allow you to test packaging with real offers to real buyers. Will they pay now, or do they stall?

Apply model proration, refunds, and annual prepay options before launch. Finance should confirm revenue recognition and cash impact before any major investment addition to the project. And don’t forget about your early adopters – grandfather early users with a clear path to the new model. Respect and trust compound.

Legal, data, and platform work you cannot ignore

A pivot can touch contracts, data flows, and partner obligations.

- Contracts: Check MFNs, exclusivity clauses, and termination windows. A channel pivot can trigger surprise clauses.

- Data: If you change the user base or geography, verify compliance. Privacy promises must match the new reality.

- Platform: If you move away from a dependency, plan migration cohorts and platform partner communications early.

These steps are less glamorous than prototypes and ads, but they prevent bigger problems.

The investor lens on a startup pivot

Investors tend to categorise pivots as either a controlled bet or a random event. Your job is to make it look like the former. Show pattern-matched signals, not vague hope. Demonstrate you can run tests quickly, interpret results honestly, and stop when needed. Highlight the asset base you carry forward. Code, data, brand, distribution relationships, or a unique team skill.

If you need capital to fuel the new bet, ask with a precise plan. Investors back a pivot when they believe the team can turn validated insight into repeatable motion.

Making space for originality inside a pivot

A pivot is not a template. It is a choice to focus your originality where it can win.

- Find one contrarian insight backed by your user data. Killer pivots often hinge on a small but powerful truth others missed.

- Build a signature workflow that competitors cannot copy without rewiring their product.

- Design small customer rituals that create habit and advocacy, from onboarding to renewal.

- Measure your company’s calories. Spend them on a few actions that move the model.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

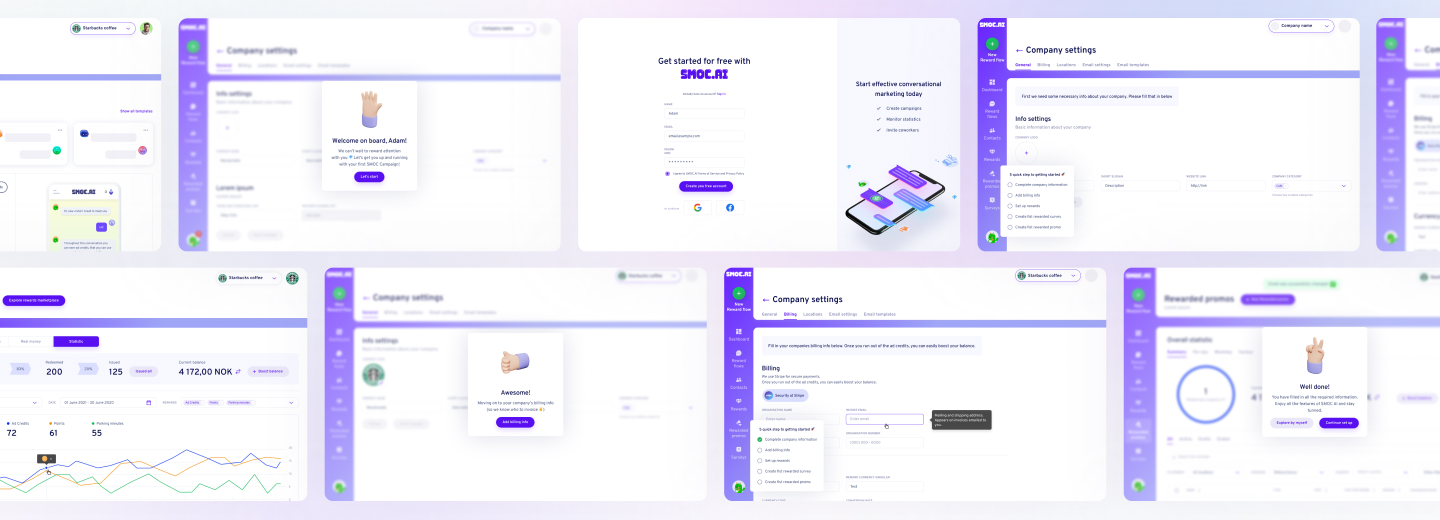

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Avoiding common traps in pivoting

I have seen these mistakes repeat across teams and stages.

- Multi-pivot confusion: Changing product, market, and channel at the same time makes attribution impossible.

- Half-measures: Keeping the old roadmap alive while you try the new bet dilutes momentum. Park it, or kill it.

- Vanity metrics: Focusing on views, clicks, or signups without activation and revenue motion. Do not kid yourself.

- Over-indexing on anecdotes: A single loud customer can fool you. Build a sample size that gives a real signal.

- Emotional timeline: Extending tests beyond pre-set dates because you “feel close.” Keep your word to yourself.

A 90-day playbook for executing a pivot

This is the operating system I share with founders who commit to the new bet.

Days 1 to 7

- One-page memo finished, event tracking updated, first prototypes built.

- Outreach and paid tests live. Team briefed with roles and check-ins set.

Days 8 to 21

- Two more prototype iterations based on user sessions.

- Three founder-led sales calls per day. Notes captured, patterns labelled.

- First pricing test live with the annual option.

Days 22 to 45

- Kill or keep decisions on experiments. No zombies.

- Content and messaging revised to the new job and ICP. Sales materials updated.

- Playbooks are published for success, support, and sales assistance.

Days 46 to 70

- If green, expand tests. If yellow, refine narrowly. If red, stop.

- Double down on a single channel that shows repeatability. Push volume by 2x within the same CAC guardrails.

- Reliability and scale work begin if product usage climbs.

Days 71 to 90

- Formal post-mortem on tests and decisions. Hire plan adjusted to the new motion.

- Budget shifts from exploration to scale investments.

- Metrics are rolling weekly, board update is prepared.

What changes when you bring in a crew like ours is not just speed; it is the reduction of waste. You do fewer things and they matter more. This is how you convert a pivot into a machine.

- Diagnostic: 10 to 14 days of customer interviews, metrics review, and market scans, ending with a clear call on what to test.

- Prototype: Build the minimal version that proves the new job, then reshape onboarding so value shows up quickly.

- GTM engine: Write the playbooks, stand up the outbound and paid tests, and train your team on the new motion.

- Pricing lab: Pick a value metric, run offers, and model margin and payback. Finance and ops are involved from day one.

- Execution drumbeat: Weekly reviews, decision logs, and clean roll-ups for the board.

If you are wrestling with what is pivoting in business for your company right now, if you need a crisp pivoting approach to pick the right move, or if your board wants clarity on pivot strategy meaning, let’s talk. My team will run a no-cost, 45-minute pivot audit where we review your data, your pipeline, and your options. We will give you a short plan, not a deck. If it resonates, we can execute side by side.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Conclusion

Pivoting can be daunting and challenging if you pass through it for the first time in your career. Nevertheless, you can start with smaller steps to try this approach. Draft the one-page pivot memo with your team. Put a date on the decision and any meaningful criteria you can test right now. Book ten customer calls and five user sessions over the next ten days and make an analysis based on them. That will help to rewrite your homepage headline to match the new job, and test it within a day.

As a consulting and development partner, my company lives where strategy meets code. Years of product and business analysis across dozens of industries taught us a repeatable pattern.

If you’re looking for support that combines product craft with business math, you can always send a note. Tell us your target customer, the current metric that hurts the most, and where you think the pivot lives. We gladly help your startup rise and gain recognition.

No. A pivot is evidence that you are listening. Failure is running out of cash while defending a bad bet.

Long enough to reach a real decision with pre-set criteria. Many teams can get to a green or red in 30 to 45 days if they act with focus.

Rarely. Many pivots revolve around a new job, new packaging, and a new motion to market. The codebase often carries over.

You can, but do not change more than two major elements at once. The second pivot should be a refinement, not a reversal.

A clear plan, fewer priorities, and visible wins restore energy. Burnout often comes from confusion, not work rate.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers