The way financial firms operate and interact with customers is steadily changing due to Artificial Intelligence (AI) advancements. In fact, chatbots for banks and financial services have become the new normal in financial industry, removing the need for long queues and office visits. Thanks to the conversational AI and multi-channel features of chatbots, customers now have easy access to services that were once limited to apps.

Erica, the chatbot introduced by Bank of America, has been gaining popularity for its ability to send customer notifications, offer balance information, suggest cost-saving options, provide credit support updates, facilitate bill payments, and assist customers with basic transactions. Within a span of just three months, the chatbot has managed to attract a user base of one million customers.

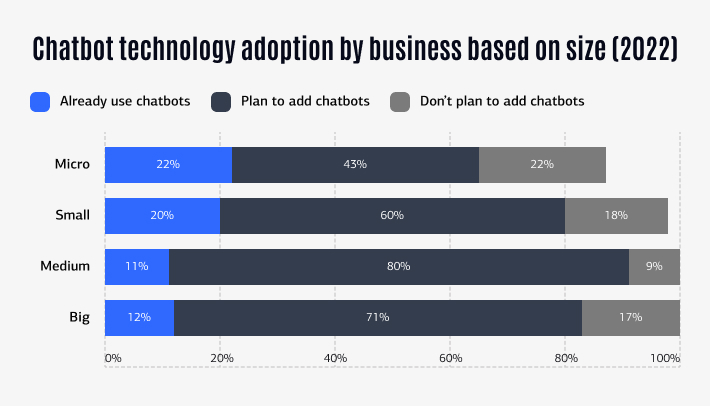

As the distinction between human and machine support continues to blur, the finance industry must embrace chatbots to provide exceptional customer experiences and keep up with the demand of the digital age. Thus, the BFSI sector explores or at least plans to explore the ways to integrate financial service chatbots into their processes to achieve a new level of customer service.

Benefits of AI-Based Chatbots in the Financial Service Industry

Artificial Intelligence (AI) has transformed various industries, and the financial service industry is no exception. AI-based chatbots in the financial service industry have become increasingly popular due to their ability to streamline processes, provide efficient customer service, and reduce operational costs. According to JPMorgan Chase, by utilizing its COIN chatbot to rapidly analyze intricate back-end contracts, JP Morgan was able to save over 360,000 hours of work.

Here are some of the key benefits of AI-based chatbots in the financial service industry:

Enhanced Customer Experience

AI-based chatbots can respond instantly to customer inquiries, enhancing the overall customer experience. The bots can handle multiple requests simultaneously and respond accurately to customer queries, providing customers with immediate assistance. This not only increases customer satisfaction but also helps build brand loyalty.

Ease of Use

Chatbots are more user-friendly and intuitive compared to traditional banking apps. They do not require downloading, and machine learning enables chatbots to personalize the experience over time.

Task Automation

AI-based chatbots can automate repetitive and mundane tasks like balance inquiries, transaction history requests, and account opening processes. This helps financial institutions to reduce operational costs and allows their employees to focus on more complex tasks. This also speeds up the processing of customer requests, resulting in faster turnaround times.

Onboarding

Chatbots can streamline the onboarding process for new customers. The chatbots can collect information from customers and complete the necessary paperwork, eliminating the need for human intervention. This results in a faster and more efficient onboarding process, reducing the time it takes to get customers up and running.

New Account Generation

Chatbots can help generate new accounts by greeting prospects, answering their questions, and directing them to relevant information. This personalized engagement increases the likelihood of a prospect opening a new account.

Reduction in Support Cost

By automating customer service, financial institutions can reduce the cost of hiring and training customer service representatives. Chatbots can handle most customer inquiries, and when necessary, they can escalate the issue to a human representative. This reduces the need for human support, ultimately leading to cost savings.

Increase in Revenue

AI-based chatbots can provide personalized product and service recommendations based on a customer’s transaction history and preferences. This can result in cross-selling and upselling opportunities, leading to an increase in revenue for financial institutions. Chatbots can also identify potential fraud and security issues, reducing the risk of financial losses.

Trends for Chatbots Financial Services

Use of AI and NLP technologies

As chatbots become more sophisticated, financial institutions are leveraging artificial intelligence (AI) and natural language processing (NLP) technologies to improve the accuracy and responsiveness of chatbots. This trend is likely to continue in 2023 as AI and NLP technologies continue to evolve.

Integration with voice assistants

In addition to chatbots, voice assistants such as Amazon’s Alexa and Google Home are also becoming more prevalent in financial services. In 2023, we can expect to see more financial institutions integrating their chatbots with these voice assistants to provide a seamless and personalized customer experience. As AI makes searches even easier, the percentage of searches done by voice can rise to 50% or more within three years.

Enhanced security features

With the rise of cyber threats, security is a major concern for financial institutions. We can expect to see more chatbots incorporating enhanced security features such as two-factor authentication and biometric identification to ensure the safety of customer information.

Increased personalization

Chatbots are becoming more intelligent and are able to provide more personalized recommendations and advice to customers. We can see more financial institutions leveraging this capability to provide tailored financial advice and services to their customers.

Chatbot integrations with blockchain technology

According to Techjury, the worldwide market for blockchain technology is projected to generate $20 billion in revenue by 2024. By integrating blockchain technology with chatbots, it is possible to create a back-end function that allows users to view the number of transactions completed by the chatbot and also the company’s reputation score on the blockchain network.

How Chatbots Are Being Used In Financial

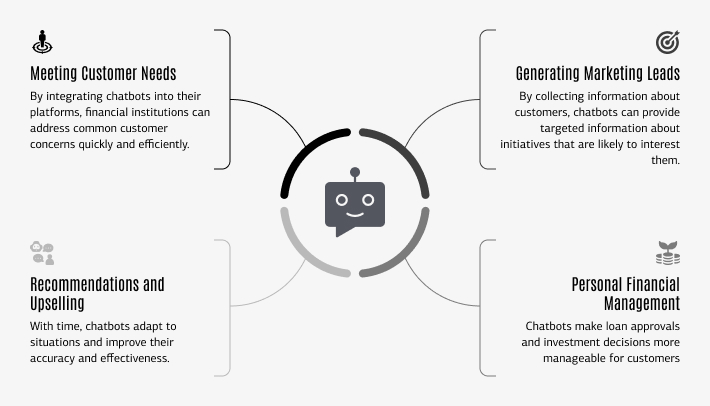

Meeting Customer Needs

While banking personnel have limited availability, digital tools such as websites and mobile apps equipped with chatbots are accessible 24/7. By integrating chatbots into their platforms, financial institutions can address common customer concerns quickly and efficiently. Previously, tasks such as reporting hacking attempts or locking accounts required customers to log in, search for options, and take action. However, chatbots can now provide solutions within seconds, and with the convenience of being on a mobile phone, verifying user credentials is easy.

Generating Marketing Leads

Incorporating Artificial Intelligence-backed chatbots into marketing strategies is an effective way for financial institutions to attract and retain customers. By collecting information about customers, chatbots can provide targeted information about initiatives that are likely to interest them. This helps identify potential customers and expands the customer base, keeping existing customers engaged with the convenience of 24/7 support.

Recommendations and Upselling

As financial services become more diverse, it’s important to inform the right customers about relevant policies and initiatives. Intelligent chatbots can more accurately identify interested customers, maintain customer profiles, and provide feedback on existing products and services. With time, these chatbots adapt to situations and improve their accuracy and effectiveness, making it easier to upsell and recommend products.

Personal Financial Management

AI based chatbot service for financial industry can act as personal financial assistants, providing users with spending tracking, payment reminders, and automated payment options to avoid late fees. They help customers avoid overspending and provide regular reports of expenses, which can be used to profile customers based on their financial needs, status, and expenses. This makes loan approvals and investment decisions more manageable for customers.

Should You Develop Your Own Chatbot Or Use Service Providers?

In today’s digital age, chatbots are used in finance for businesses looking to enhance their customer experience. However, many companies struggle with the decision of whether to develop their chatbots or use service providers. While integrating ready-made bots may seem like a quick and easy solution, developing your chatbot can offer significant benefits.

One of the most significant advantages of developing your chatbot is the level of customization and personalization it provides. A customized chatbot can be tailored to your business needs, specific customer requirements, and industry niche. Moreover, you can choose the language, tone, and style that fits your brand voice, which enhances the customer experience and strengthens brand loyalty.

In addition to customization, developing your chatbot provides better control and flexibility in terms of updates and maintenance. When you develop your chatbot, you have access to the source code, making it easier to modify or add new features as per the changing customer demands or business requirements. On the other hand, using a third-party chatbot limits your control over its functionality, design, and updates, and you are often dependent on the service provider to make changes to your chatbot.

Furthermore, developing your chatbot allows for the chatbot integrations of cutting-edge AI technologies that can significantly enhance the bot’s capabilities. With the involvement of AI integration, the AI based chatbot for financial advice can understand natural language, provide intelligent responses, and even predict customer behavior based on their preferences and interactions. This, in turn, enables better engagement, higher satisfaction levels, and ultimately, increased revenue and customer loyalty. EY predicts that by 2030, chatbots will be so deeply integrated into banking operations that customers will not be able to distinguish between interacting with a bot or a human.

EVNE Developers can provide AI based chatbot service for financial industry and develop your chatbot or bot elements, with the involvement of AI integration from ChatGPT. We can help create a personalized, intelligent, and efficient chatbot that meets your business needs and provides a seamless customer experience.

EVNE Developers Experience with AI Chatbot Integration

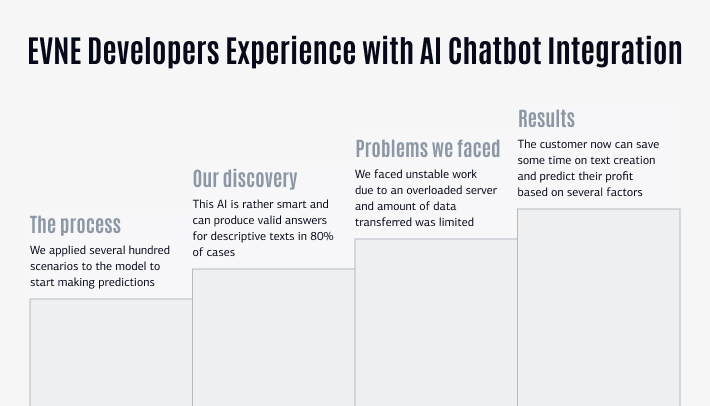

We can share with you one of our cases. We had two major tasks at hand: firstly, creating descriptions for Airbnb apartments based solely on keywords, and secondly, developing a model that can predict service availability during specific periods.

The process:

We applied several hundred scenarios to the model to start making predictions. As for the precision of those predictions, it took some time to verify them. As for content creation, the basic functions suited the customer with the services offered.

Our discovery:

This AI is rather smart and can produce valid answers for descriptive texts in 80% of cases. Different types of AI-based chats offer different outcome data even when applying similar income data. The things on which they learned matter a lot.

Problems we faced:

Under some conditions, we faced unstable work due to an overloaded server. Also, the amount of data which can be transferred to the bot is rather limited and varies from 2k to 4k tokens, we required 40k, so this limitation required the separation of the content into blocks to achieve the results. Nevertheless, after making several packages of the data, the AI started to make reliable calculations and assumptions for the entire scope.

Results:

The customer now can save some time on text creation as they are automatically generated with suitable quality and can be easily changed with the use of other keywords. As for the second task, after model education, the customer can predict their profit based on the season and several other factors.

How to Integrate Chatbots For Financial Services

AI based chatbot for financial advice are usually found on the company website, in addition to social networks, such as Facebook or Twitter. When used on the website, the chatbot must be visible. Otherwise, the implementation of the virtual assistant is pointless. Fortunately, there are suitable tools to increase the conversion rates of chatbots and motivate users to interact with the assistant.

Pop-ups

Pop-ups are a popular method to draw website visitors’ attention to a newsletter or a special offer. Meanwhile, they are also becoming more and more established in the chatbot context. As the name suggests, the chatbot pops up centrally on the page. This draws the visitor’s attention to the chatbot and encourages them to interact.

Top Bar

A less intrusive variant is the so-called Top Bar. Here, a window appears at the top of the screen, allowing strategic placement. This variant is also available at the bottom of the screen. In terms of chatbots, this alternative is certainly one of the most popular. Just think how often you have visited a website with a chat window in the bottom right corner of the screen, where you can communicate with the chatbot.

Scroll pop-ups

Scroll pop-ups are specially designed for users who stay on a website for a longer period of time. They appear like a pop-up on the screen only after a visitor has scrolled to a certain point. The user’s attention is thus specifically directed to the chatbot.

Ideally, combine the chatbot with a pop-up or bar that puts the chatbot in the visitor’s field of vision. This gives users an easy way to ask questions without having to look up another page. In the long run, this can increase conversion rates and improve customer experience.

Conclusion

Chatbots are used in finance for improving customer engagement, streamlining operations, and enhancing customer experience. Effective chatbot integration with website or app require a deep understanding of customer needs, a strategic approach to design and development, and an emphasis on data security and privacy.

By partnering with us, you can develop chatbot financial services that align with your business goals and meet the evolving needs of your customers. With AI integration from ChatGPT, the chatbots developed by EVNE Developers can provide valuable insights, enhance personalization, and improve the overall efficiency of your operations.

Feel free to contact us for more details and further discussion.