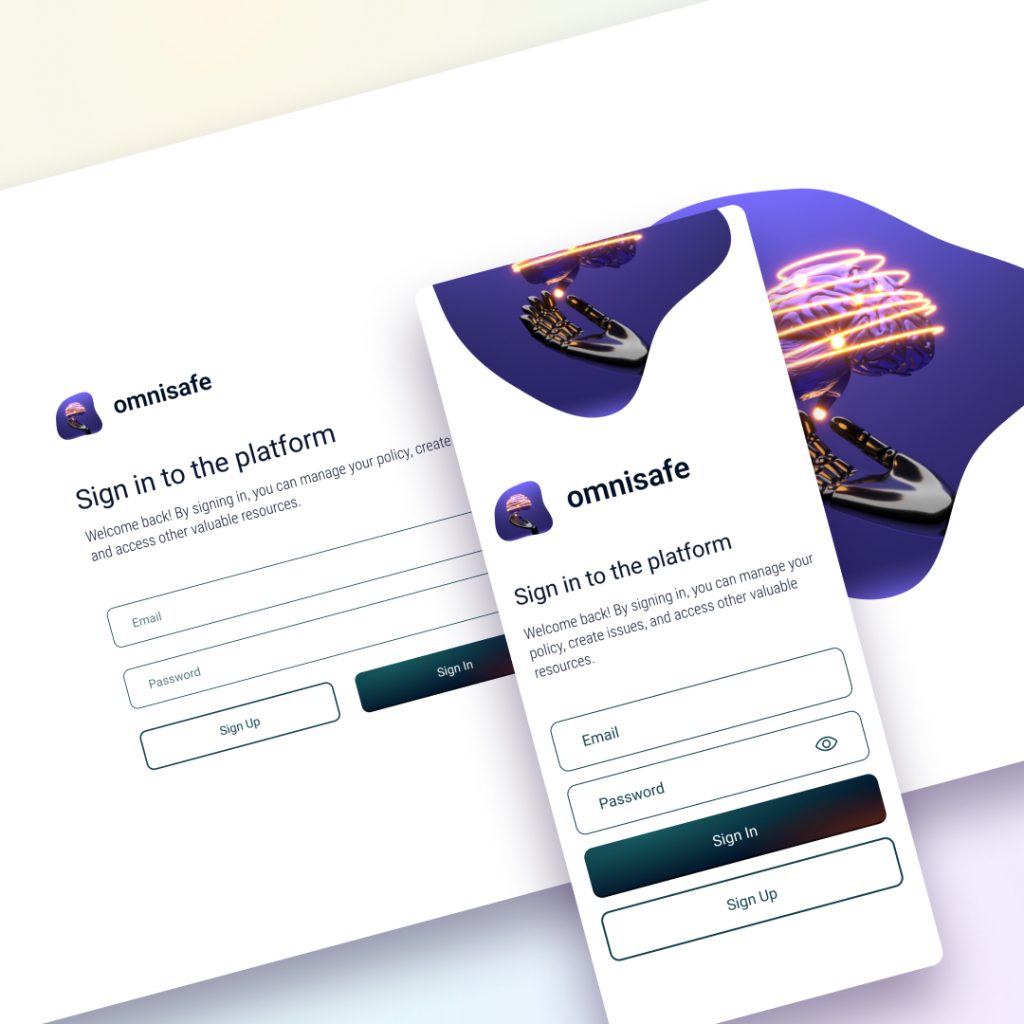

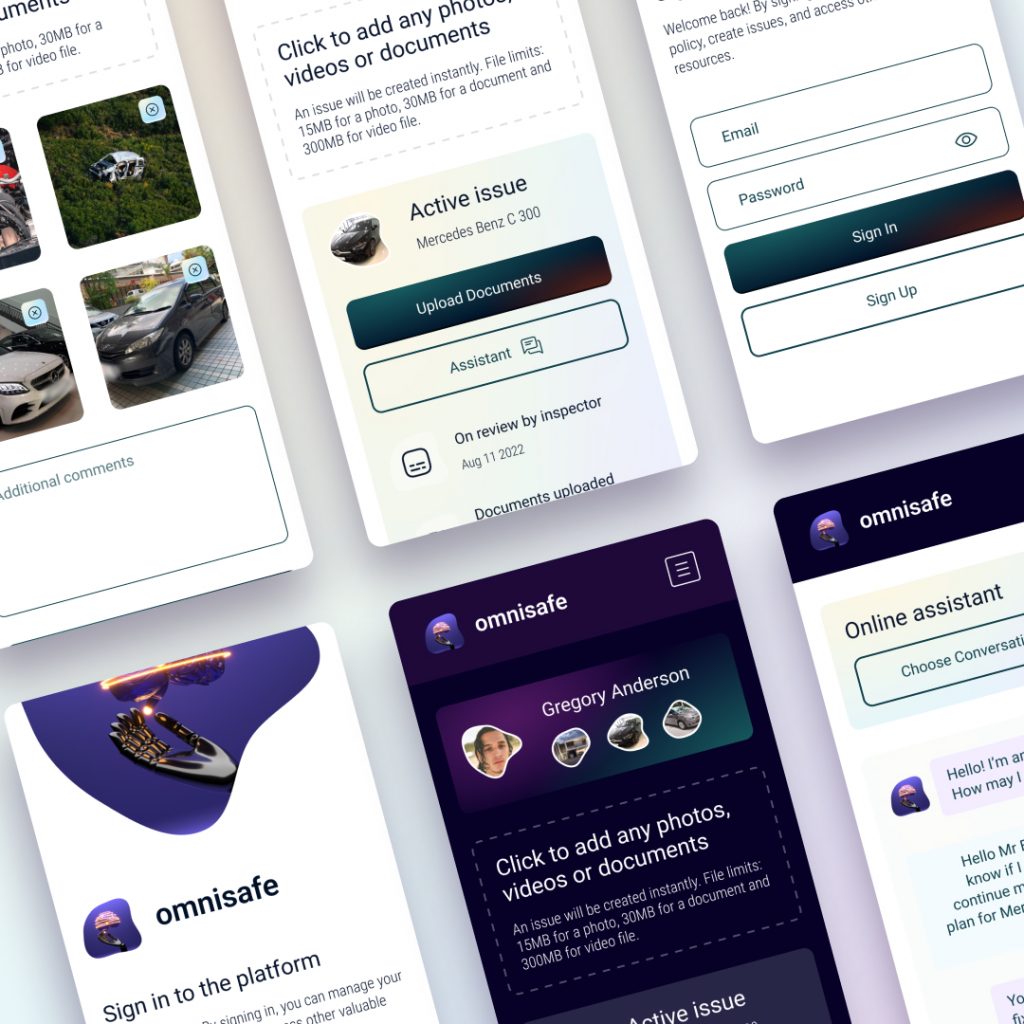

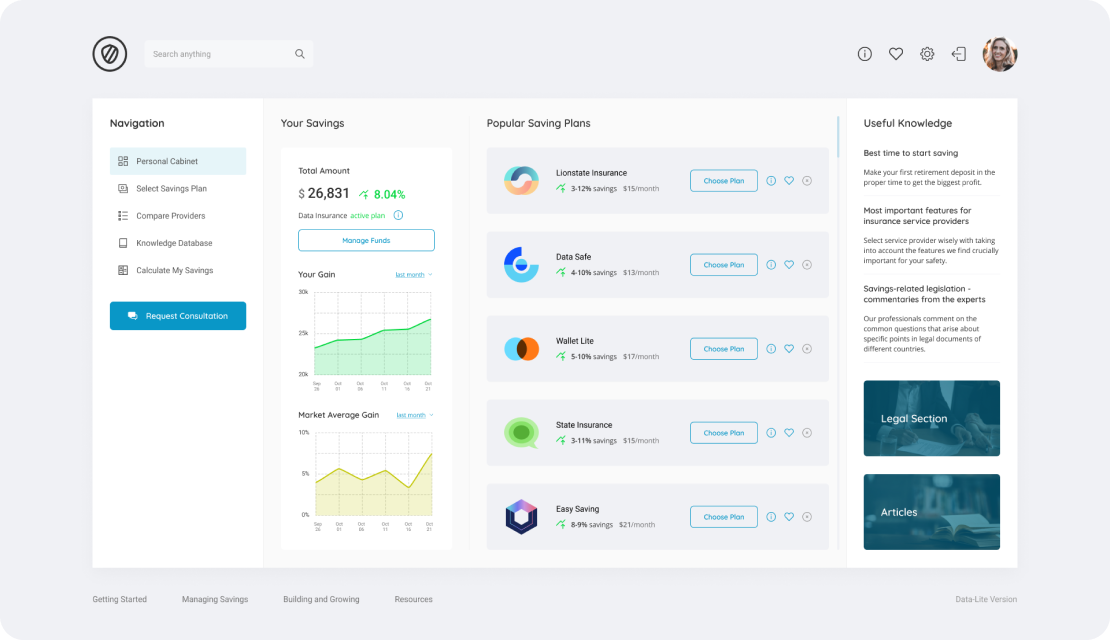

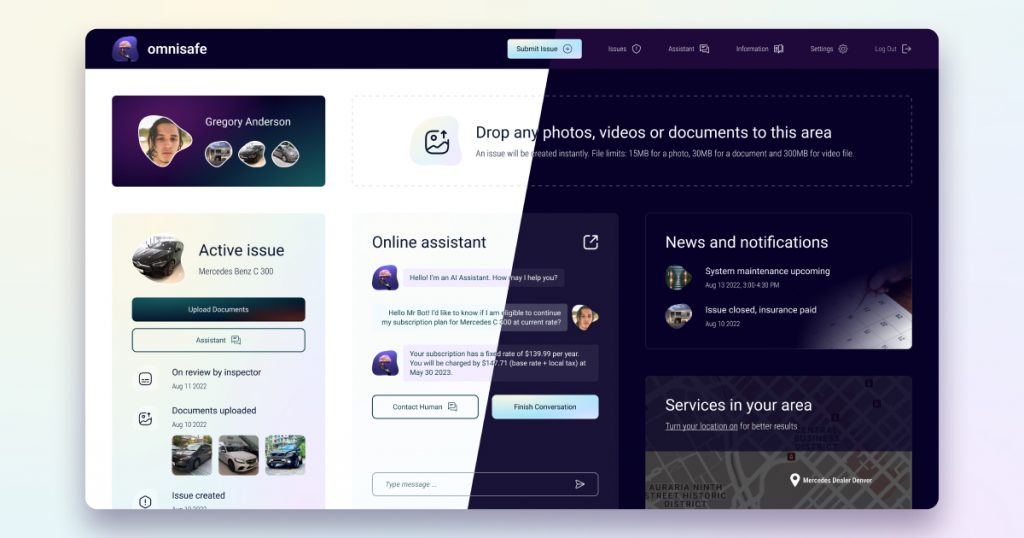

Web platform for insurance company

The team dealt with the web development of a specialised platform for claims and maintenance issues settlement in the automotive industry.

About

As far as the market of vehicles grows, especially talking about electric cars, the customer decided to start their business with in-vehicle services and products, including insurance. The designed system should be oriented primarily on the owners of electric cars which allows the possibility of direct incorporation of vehicle status reports into insurance claims. Automatisation has been placed the priority which led to 20% fewer manual processes and the number of interactions between the user and the insurer with a 60% decrease in related human factor mistakes appearance.

Challenge

Today’s claims journeys are fragmented, complex, and manual. Processing claims requires significant input from customers, insurers, repair-shop networks, and rental providers, and it often relies on incomplete data from involved parties. This was experienced and greatly disliked by the customer so they wished to change this approach with their customised system.

Solution

Creation of the differentiated customer experience required deep analysis and discovery of the market and the users using electric vehicles with data-driven business analysis.

8

Engineers

Agile

Dev process

11+

Months

USA

Market

Pecularities of implementation

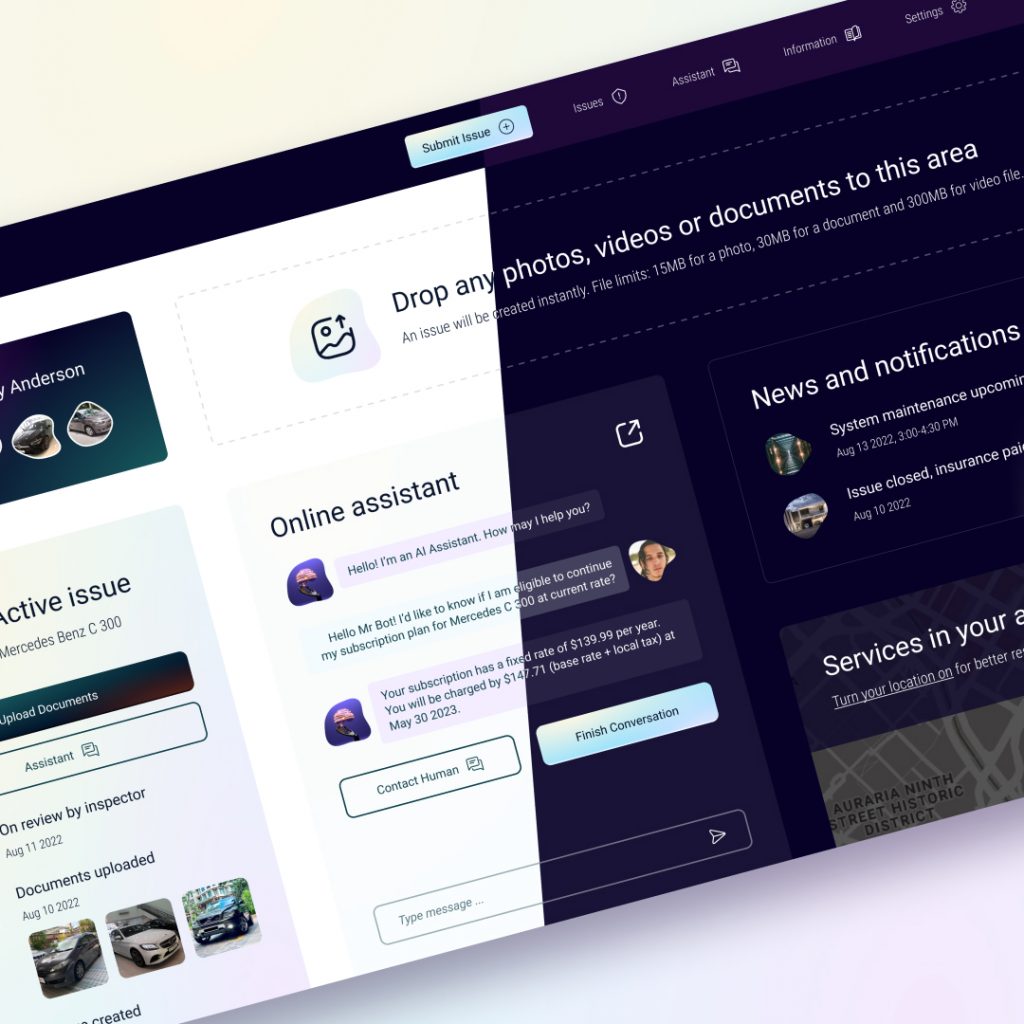

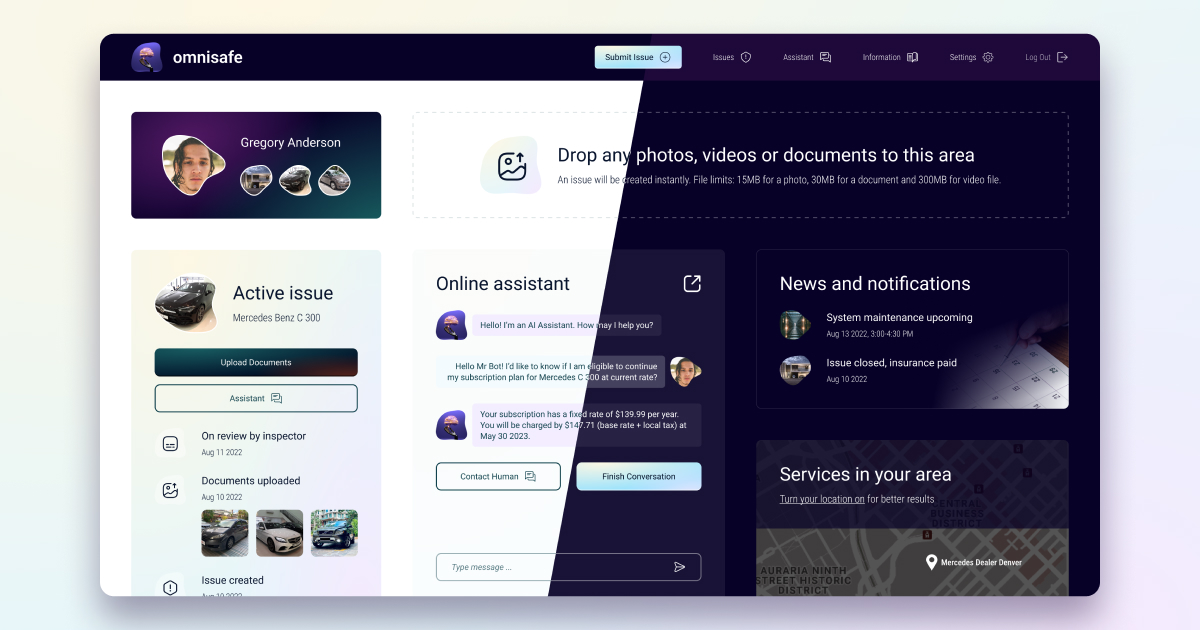

Dividing the UX into 4 interconnected though separate flows

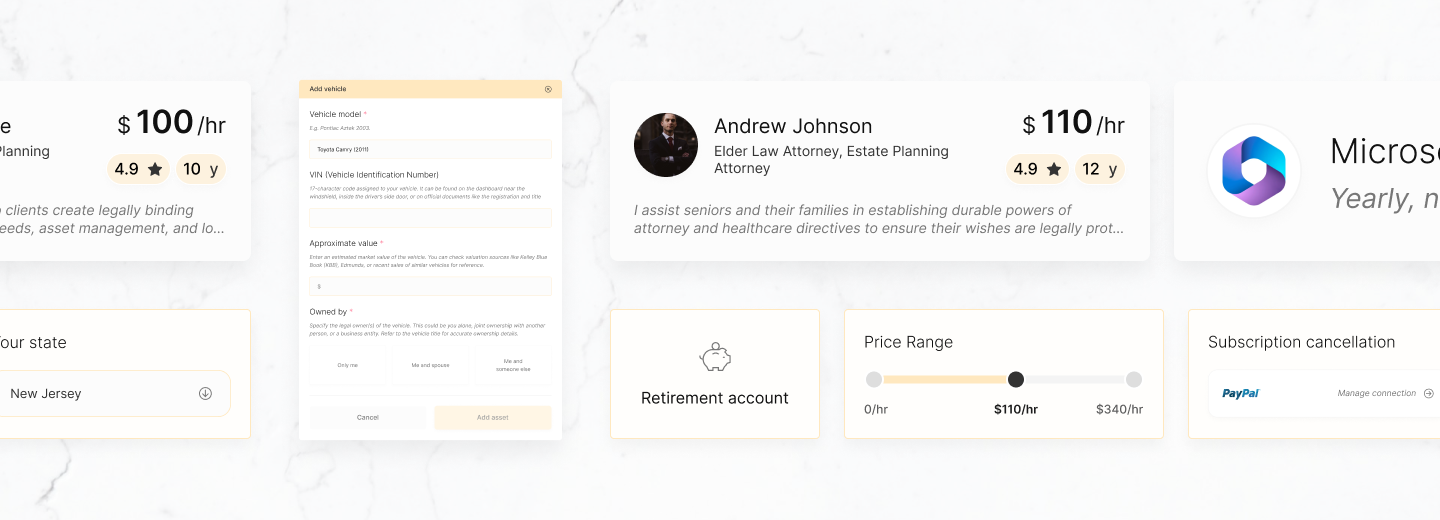

Based on the analysis the system had to divide general user experience into several streams, including the following: car insurance companies, car owners, experts dealing with companies and owners, and repair station owners. The part of the system for car insurance companies’ representatives allows them to enter accident-related details received from car owners into a table and process them. The car owners upload photos or videos of their damaged vehicles and then map the inflicted damage and create special assisted reports. They can also deal with the bot that will assist them while driving and in case of an accident to make things right and complete the claim and report properly. The experts collect text data from the car insurance companies and photos from the car owners respectively to estimate the claimed damage and make their decision. Shop owners can use the system to promote their services and provide owners with fast solutions to the raised problems with their vehicles. Such an approach to UX allowed clear combining and creation of all interconnections between these profiles within the system.

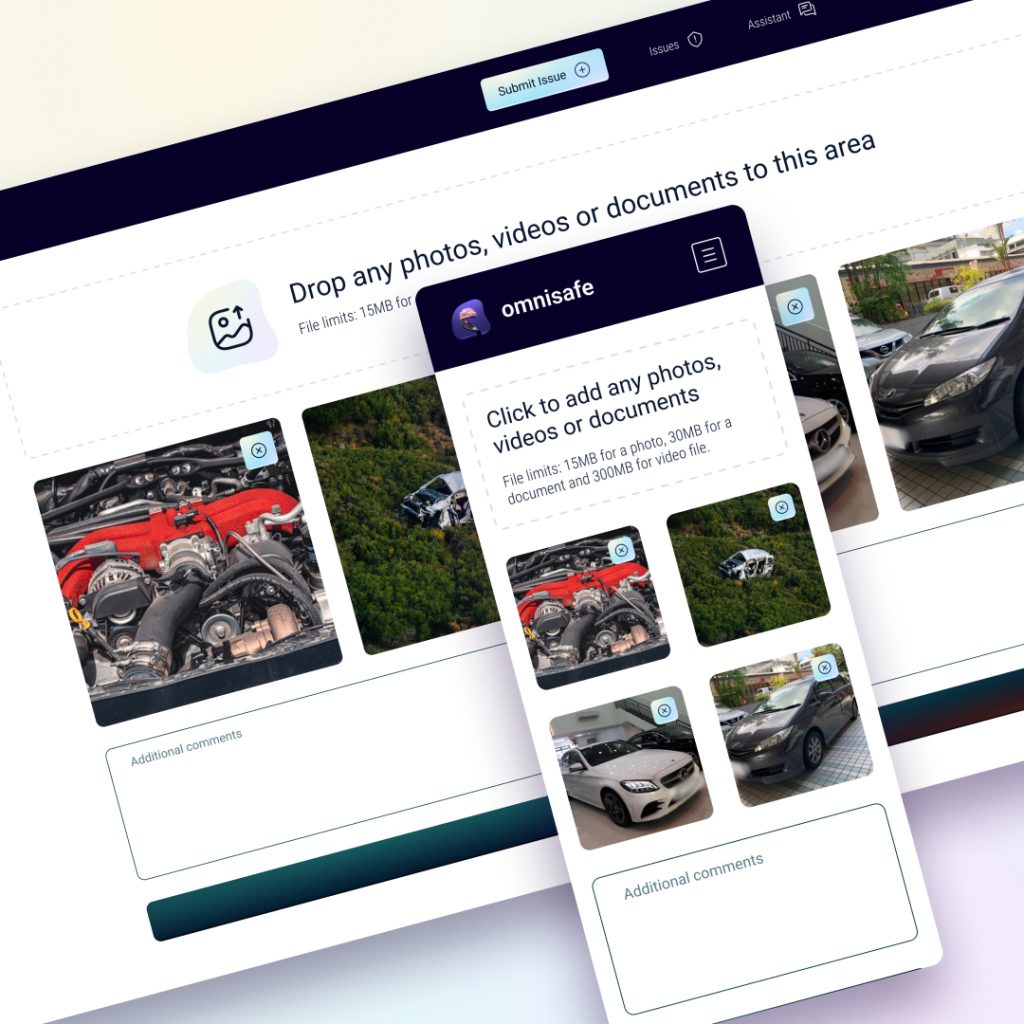

Automated reporting with assistance and visuals collection

Another module dealt with proto or video fixation of the damage with its further receipt and evaluation by the AI-based algorithms prior to the insurance experts. This function requires access to a smartphone camera which implied an additional level of privacy and security considerations. As far as privacy requirements define the absence of distinctive private data of other nonparticipants of the accident, the AI-based module anonymises all vehicle registration plates and people’s faces which are in the frame and do not belong to the issue. Photo and video are available in several resolutions for different users as not all of them require the scarce and deep discovery of the harm imbued to the vehicle. Based on GPS tracking in real-time, the user can collect and provide information about vehicle location to the report without additional interactions. Besides that helps in emergencies of any sort and as a chat-based assistant. The system also provides the essential ability in building the route in advance and track vehicle movement and stay secure.

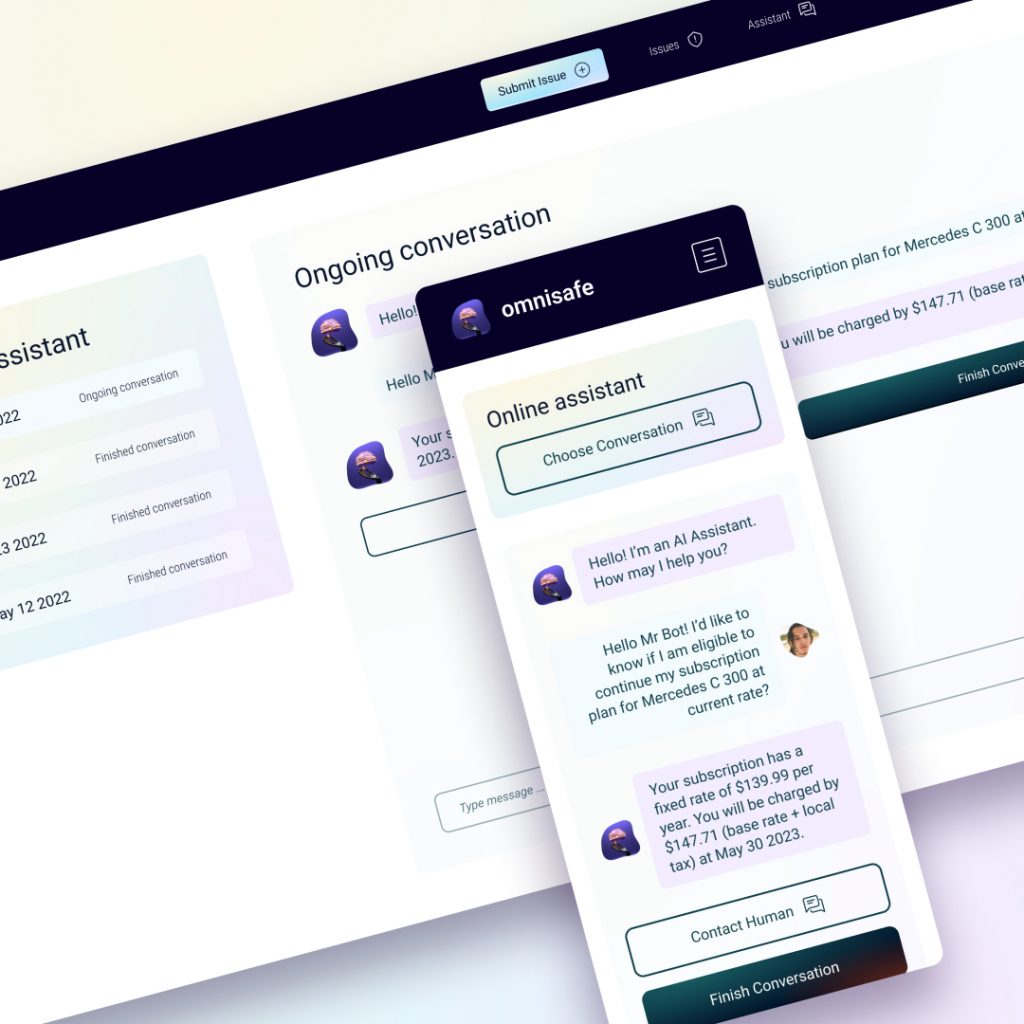

Chat assistant and direct interaction with insurance company representative

For providing a risk-embued approach, the system has a specialised function for preventing accidents as well. That can be achieved with the specialised AI-based chatbot offering assistance for car drivers on legislation and driving. The chat can provide assistance in case of an accident as well and help the user to provide the correct and required information for the company for faster issue resolving. To get simple and secure access to external resources and public data which can assist with resolving issues, such as legal documentation the team used several APIs which were incorporated into the report evaluation module as well. For example, it allows checking the vehicle status to eliminate extensive paperwork and get all the data about a particular car: year of manufacture, model, license plates, etc. Such info is necessary for accident registration and claims, and APIs simplify its collection significantly. That allowed us to offer users the best experience, lessen development costs and brought some space to test ideations in disruptive business models for the customer’s companies.

Results

The customer received the fully functional system for car insurance claim estimation and management. After a complex evaluation of the existing solutions within the market, the team moved to a data-driven risk-preventive approach to the development process requiring application of the AI-based algorithms and bots and the integration of APIs. Automated processing of filing standard reporting or any other documents to the insurance company or regulatory authorities allowed for reducing human factor errors rate and brought a higher level of security. NAIC Registry and similar APIs help the system to retrieve and store data on online systems for misconduct identification and other purposes and bring faster interaction and security.

60%

less human-factor related issues

20%

fewer manual processes

30%

faster issue resolution