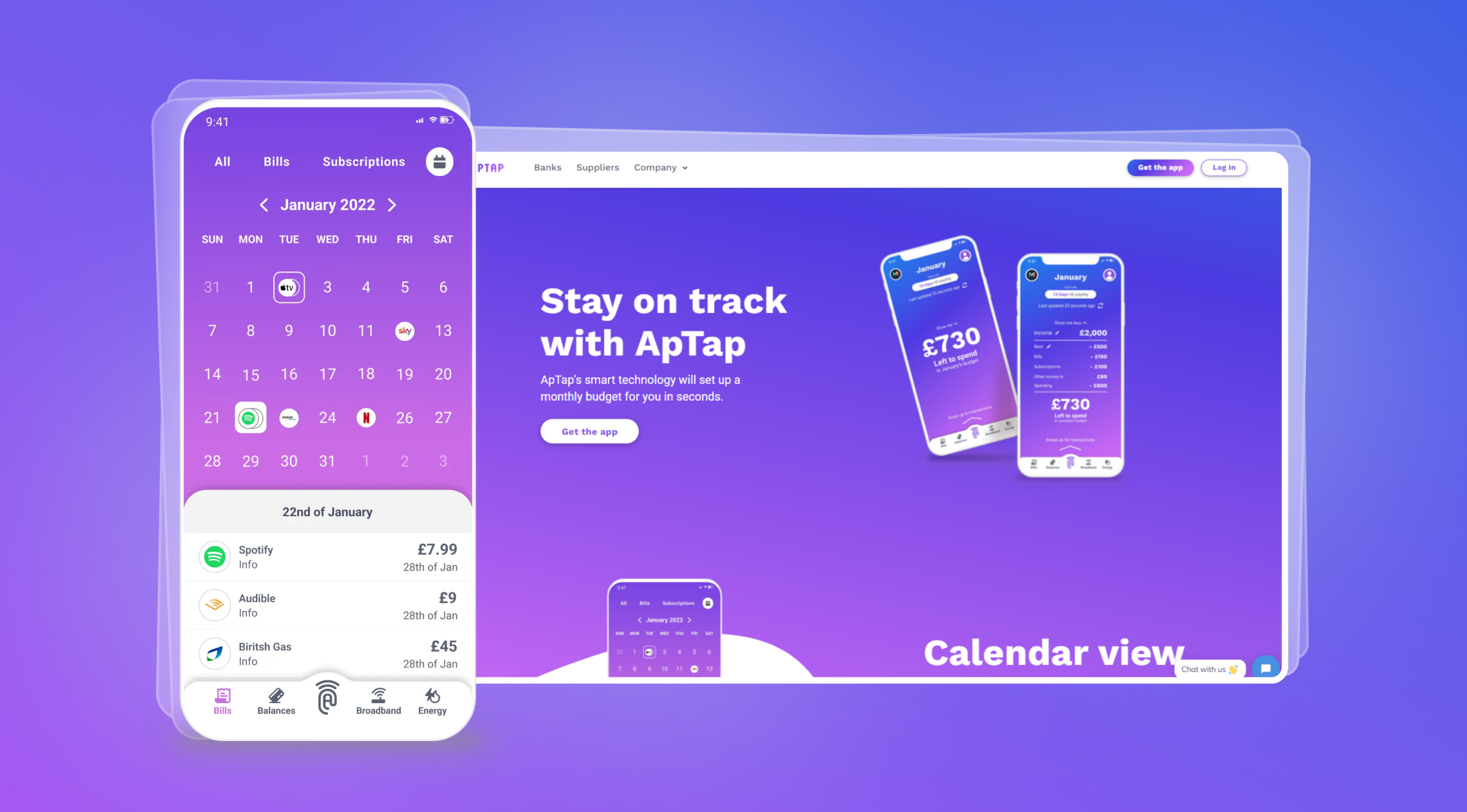

Search core for identification and recurrent payments in a click

Web platform allowing users to manage their personal subscription lists and make recurrent payments.

About

The client company initially had business in Finance domain and for entire operation wished to bring innovation to the industry and simpify the management of subscriptions. The company aimed to build a single engine allowing users to make identification and authorise recurrent payments in a single click within various financial institutions. That led to the creation of a unique solution in the market with outstanding reliability and security level.

Challenge

The business needed creation of a core engine for a user to be able to log-in or perform recurrent subscriptions with simple identification in one click. Additionally, the global system of subscriptions management was put into plan.

Solution

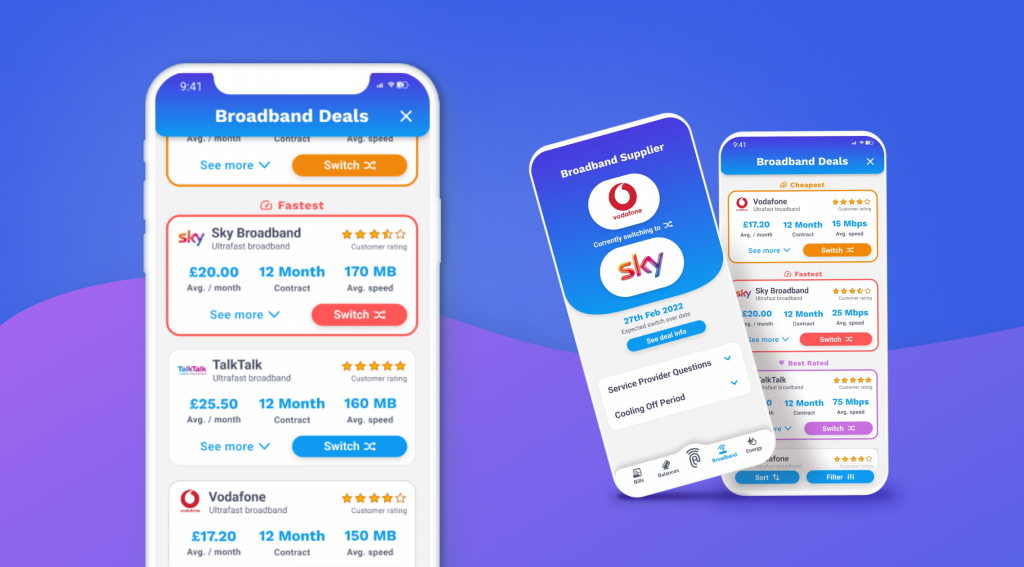

Creation of the unique and customisable web platform with market-changing features and strong identity.

5

Devs

Agile

Dev process

4+

Months

15

Countries

Pequarities of implementation

Performed brainstorming on the existing alternatives and possible ways to reach the goal

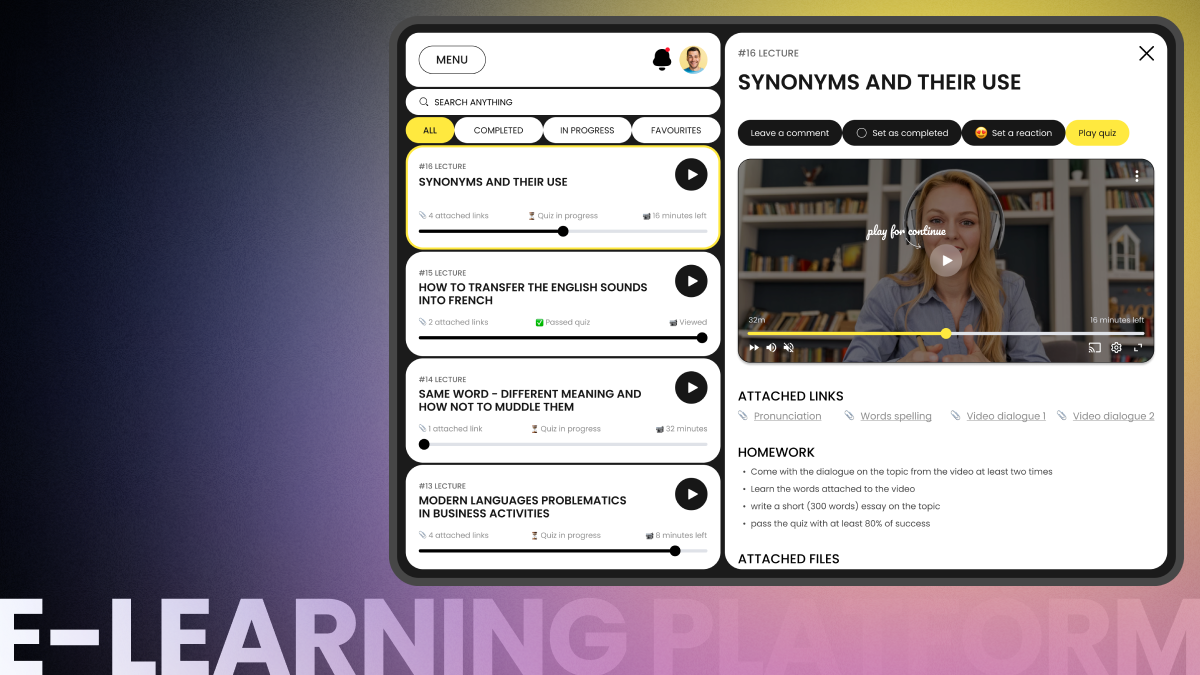

The scope of the first step included the analysis of the common bank searching algorithms and individual algorithms for special services. The outstanding task was to ensure that the end users are not blocked on authorisation by limiting the number of requests for a single user. Management and creation of special events list were one of the priorities as well, as the algorithm had to outline which of the events should be authorised and which are not. The results of the analysis were depicted in the special table and became the road points for future core developments and selection of particular adjustments of the system.

Built the logic of the basic algorithm

The core analysed the transactions and separated them by their type into several subcategories for faster analysis. In such a way it performed two functions at a time – analyzing and sorting to lessen the chance of mistakes and enhance the security of the data. The attributes of sorting were correlated by mathematical formulae with each having the special point. Based on the settings of the algorithm and point system, upon the completion of the analysis of users’ transactions, the user gets the results in a table with detected subscriptions grouped by their likelihood parameters.

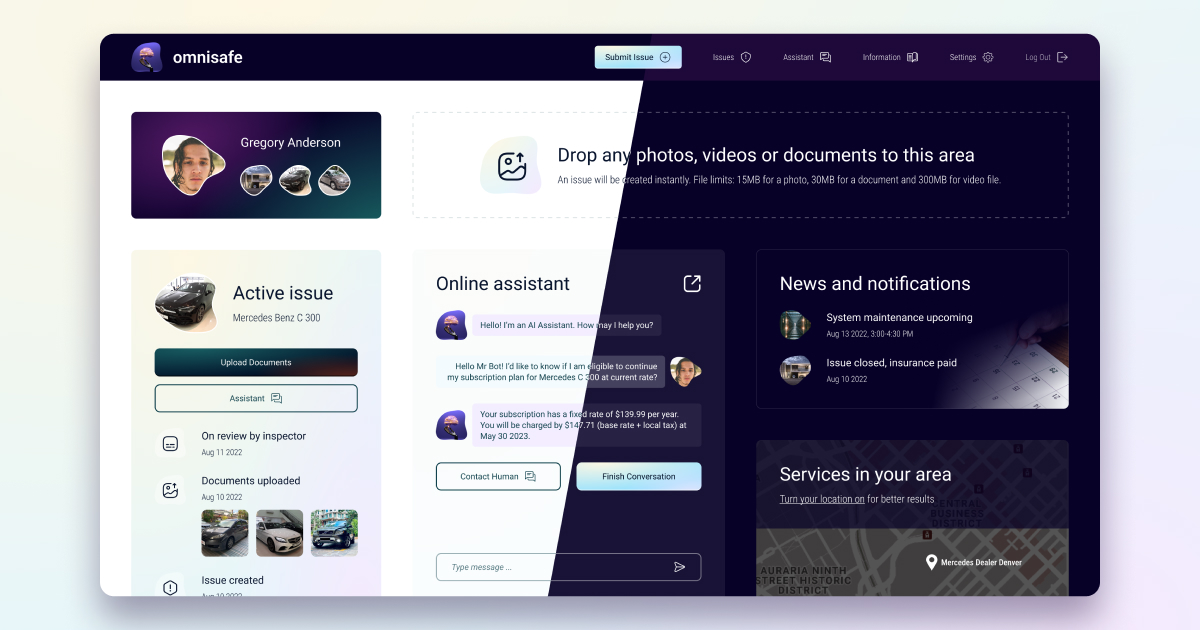

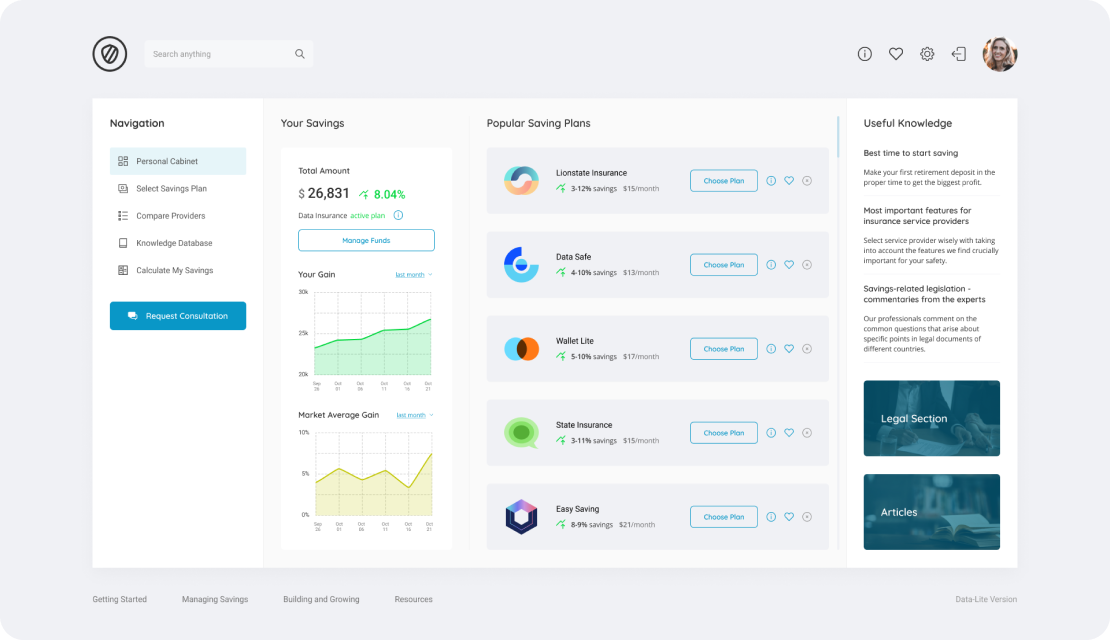

Developed the admin panel for bank representatives

To be able to make special adjustments to points and general algorithm, the bank representatives should have the admin panel for the solution. Moreover, the algorithm can be adjusted for common transactions and specified ones with their respective details and attributes. Bank representatives can calibrate the algorithms based on their goals and purposes. The second purpose of the admin panel was the introduction of separate functions for global settings: making limits for each end user, management of end users, management of the list of services for their detection by algorithm, the number and status of user’s requests, the list of detected subscriptions, their status. Such a table allows users to get the entire list of their financial data and check its security.

Results

The business received a unique solution in the form of a specialised search core that performs the analysis and separation functions according to specific algorithms. Unlike the app, the creation of the web-based solution allowed to make it worldwide available for various institutions and fastened the overall response time of the system. It requires 0,3 sec for 100 thousand transactions to be analysed with vivid results. As far as it is a fintech solution, the team paid special attention to the security of the data stored and transferred. Special encryption techniques were applied in the process. The scalability of the solution gives the opportunity to develop more modules to get wider market cover.

+100%

legal compliance

70%

optimised processes