Saving and investment mobile app for teenagers

The platform ensures a secure way of managing personal funds and selecting a specific investment with the deliberate user experience achieving a retention rate of 80% in the first quarter.

About

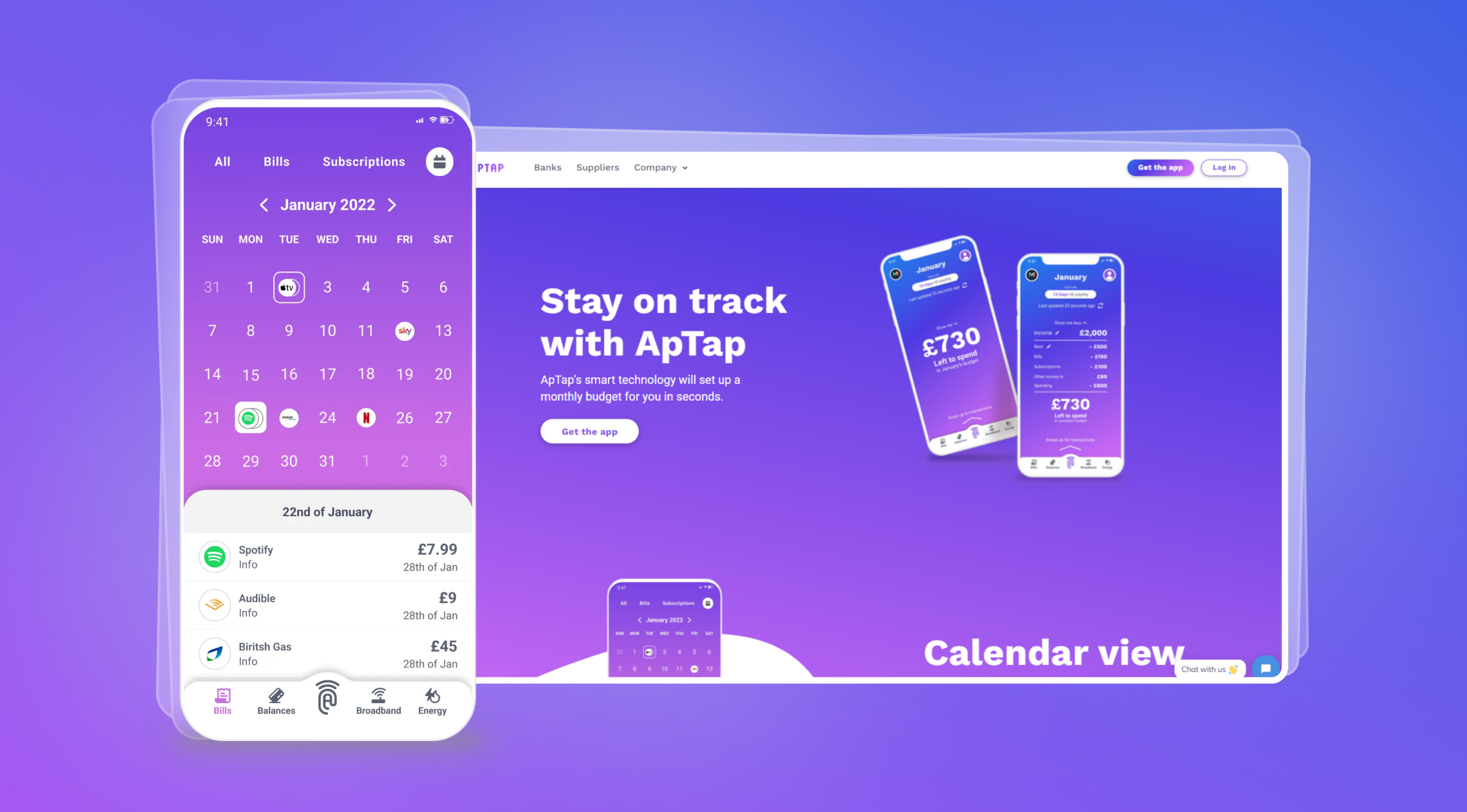

The client company is a commercial firm offering personal finance management services for broad audiences. With the need to scale the digital presence, they decided to create an application for a new group of users. Aside from this, their goal was to promote financial literacy among the young audience and satisfy enterprise social responsibilities.

Challenge

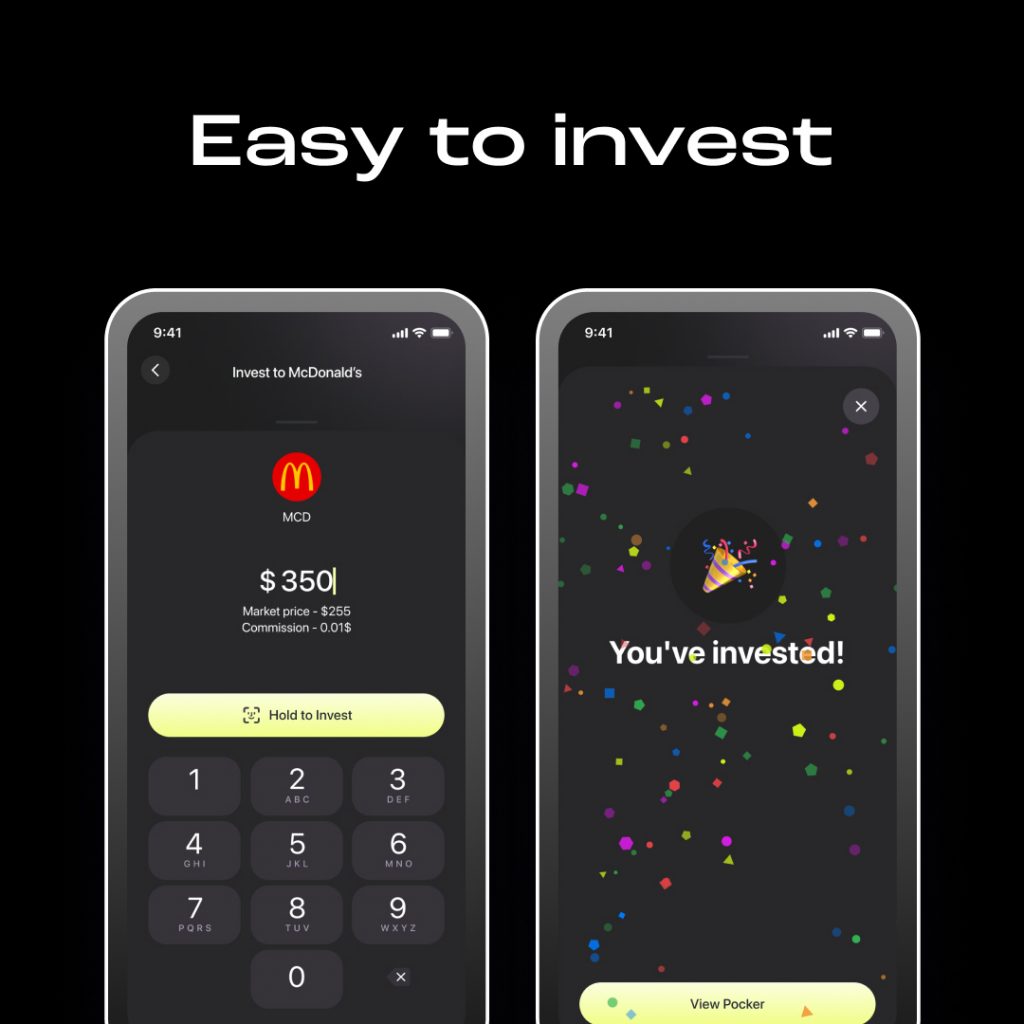

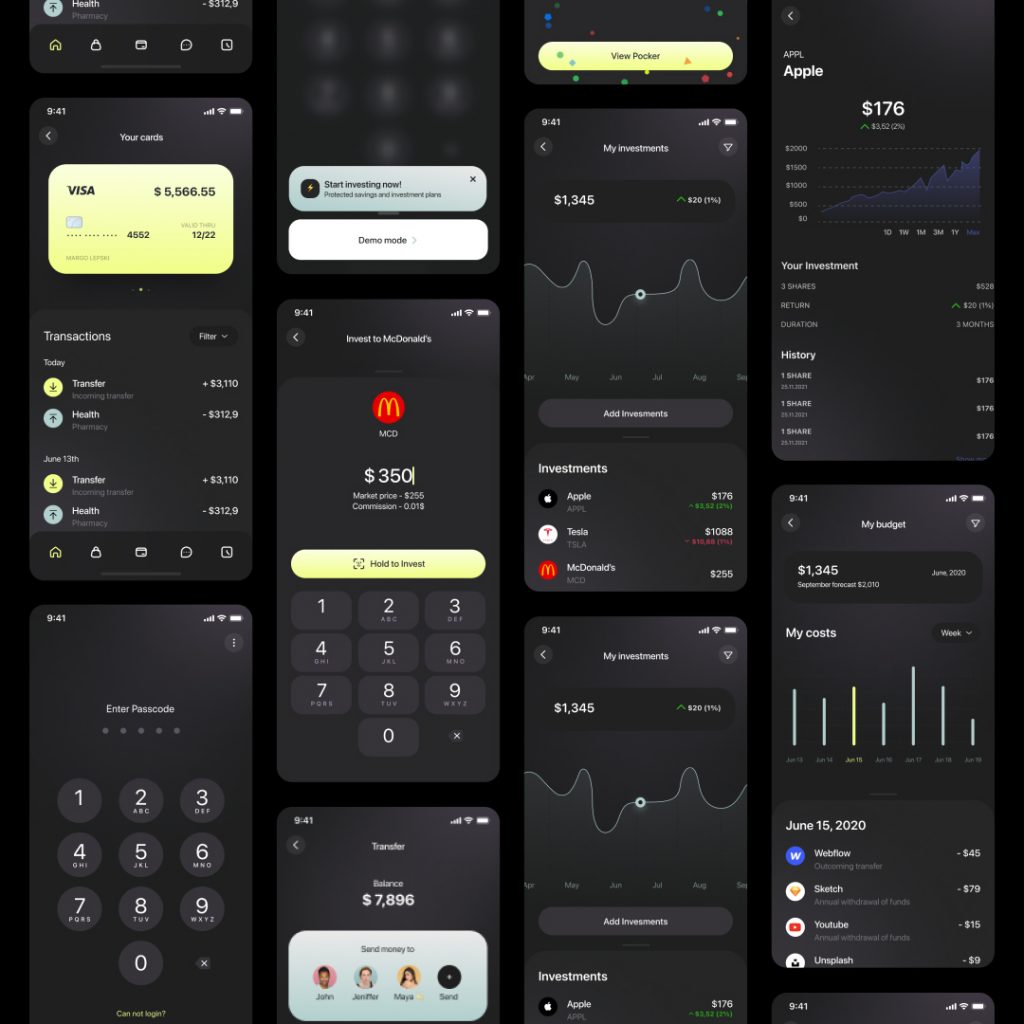

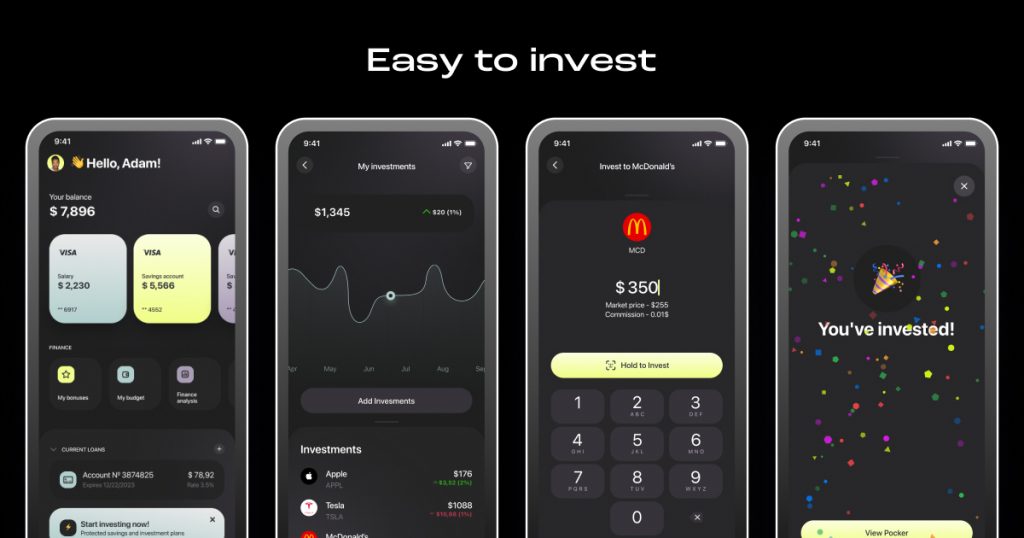

The team aimed to develop an interactive but easy-to-use mobile savings management investments app to empower financial literacy and open stock market investing for teenagers. That is why the team applied the complex approach of UX designing while representing complicated things in simple charts, dashboards, pop-ups, and assistance notes. Data security was an additional concern as well.

Solution

We build the application with a scalable architecture that can handle high data loads, ensuring high performance and perfect data security based on the market research and ideation of the target audience we received from the customer with specific UX and vivid UI.

7

Engineers

Agile

Dev process

10+

Months

UK

as target market

Pecuarities of implementation

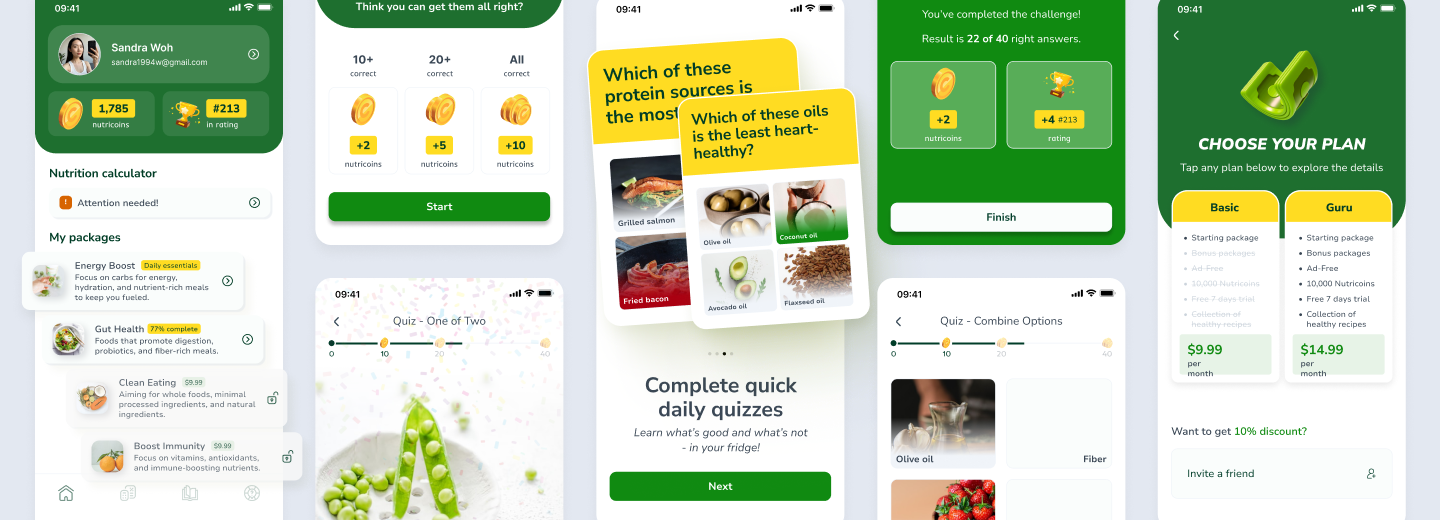

Design for a specific audience

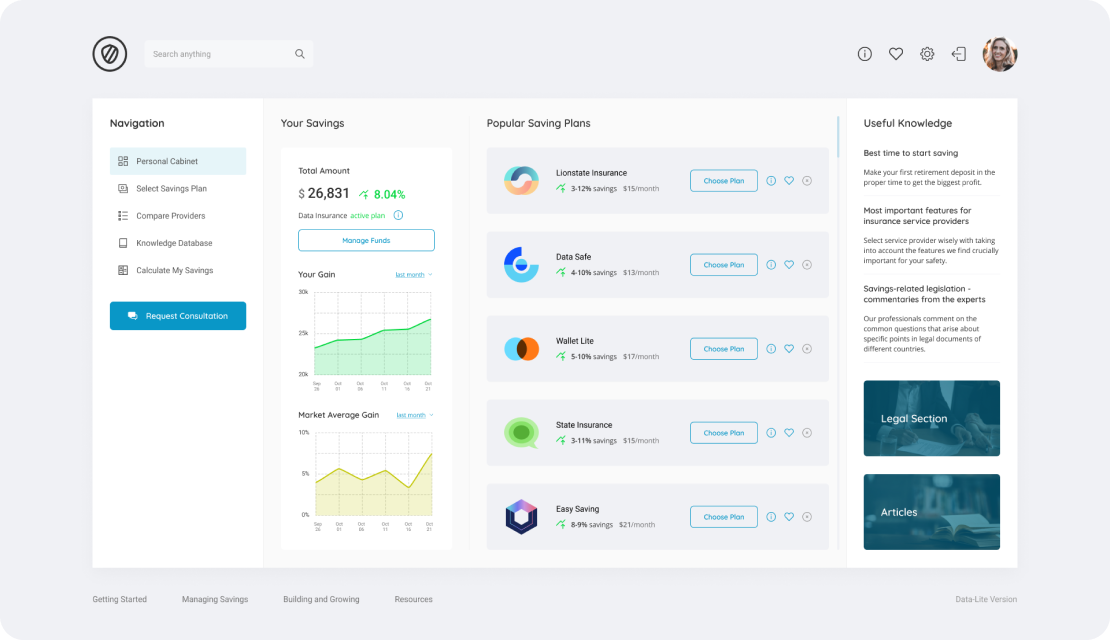

On the basis of market behaviour analysis, the team discovered that young people frequently look for the best approach to managing their money. Therefore, the designers needed to provide the target users with robust dashboards, assistants, and specialised tools with vibrant visuals, assisting them on their way to the wise management of their money, savings and credits, even aside from investment moments. Among other examples, we can name interactive bars, pie charts, infographics, pop-ups, and chat assistants which are planned to get an AI module. The information delivered is insightful and visually appealing throughout to find the proper feelings of the target audience. To suit the general goal of increasing financial literacy, the app delivers daily, monthly, and quarterly reports to give users a consistent impression of their financial and investing activity. That all is done with the help of gamification techniques, such as achievements, leaders’ dashboards and others.

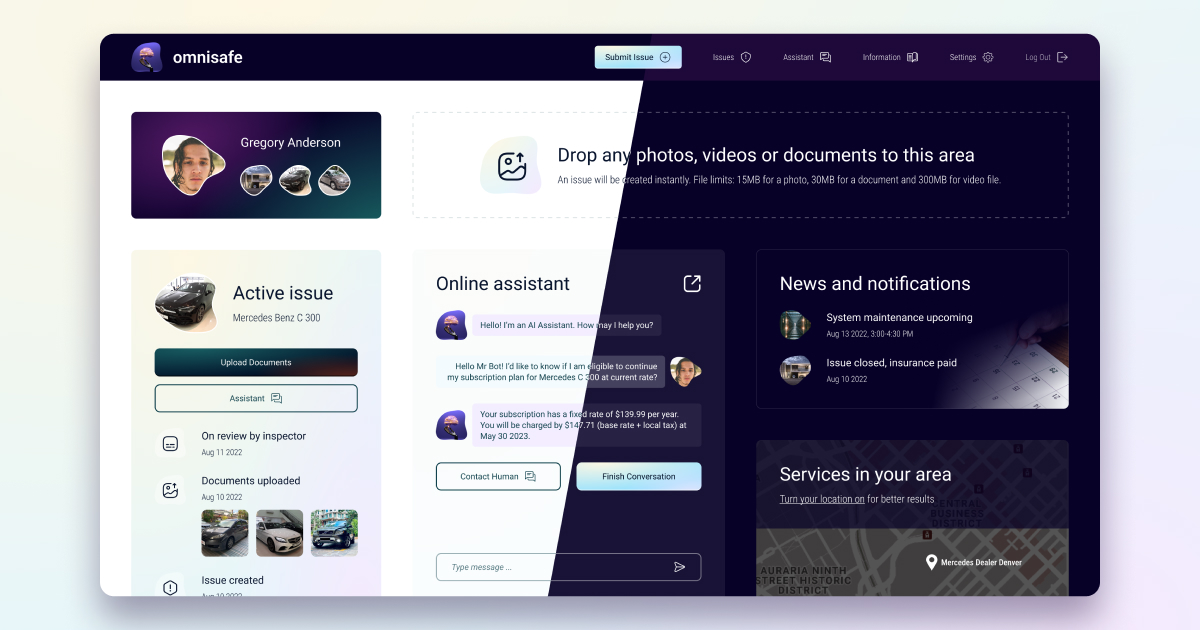

Investor portfolios & money management tools

From the home screen, they can visit the module for managing their funds and tracking their expenses. The data is separated into different titles and allows wide adjustments to suit the needs of any user. Saving and investing can be performed in multiple currencies and can be adjusted as well. The investing module of the app allows users to manage, edit, and change their portfolios. It provides intuitive tools for transactions and the investment of funds. These include search and sorting features and stop-loss price options to sell a stock automatically when it reaches a specified price. Also, users have a dashboard to review their assets, see stats on each asset, and diversify their portfolios. Push notifications, personalized reminders, and real-time alerts are used to inform users about specific asset price rises/falls, buy/sell order completion, return on investments, special offers, promotions, suspicious account activity, and more. The application got cryptocurrency support to make it more useful for a younger audience. Donations and charitable gift options are added as a supplementary module for more experienced users and allow making a limited number of transactions to support someone without charging the commission.

Security concerns

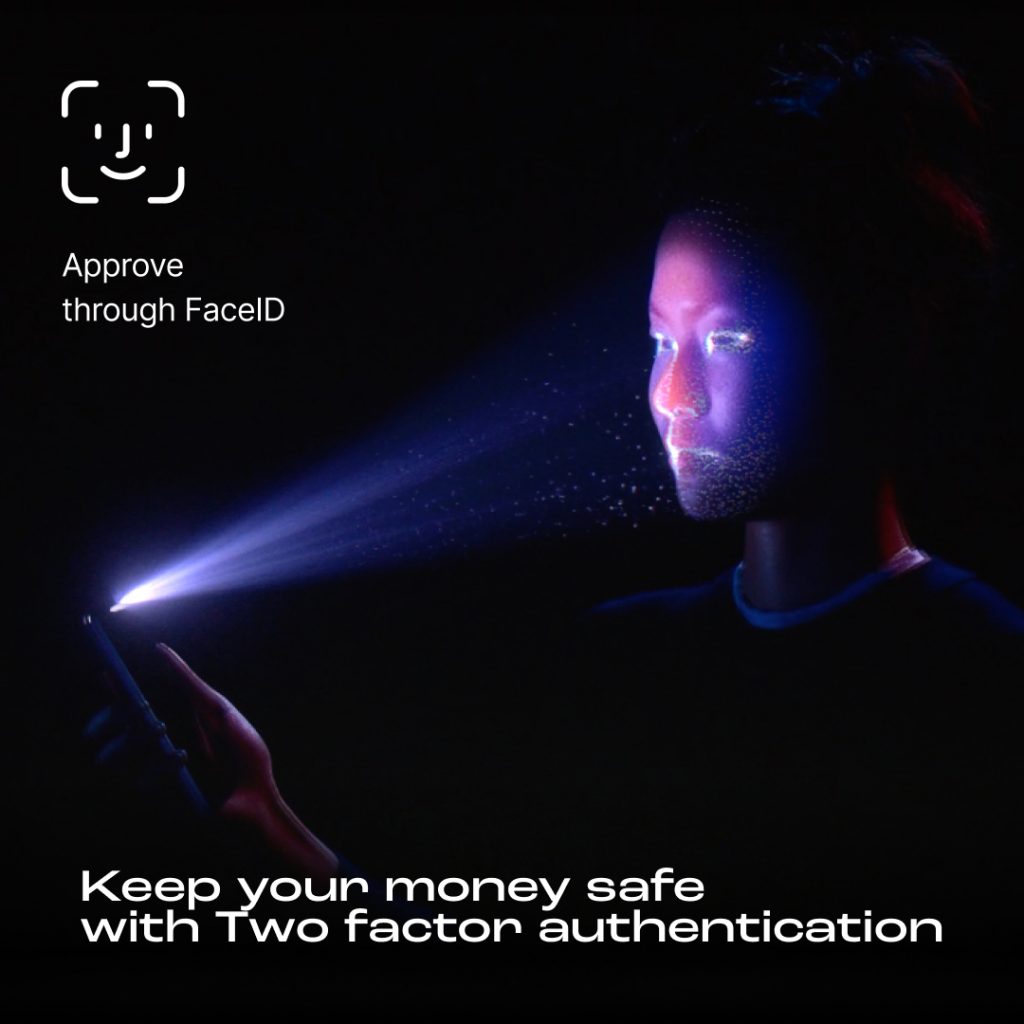

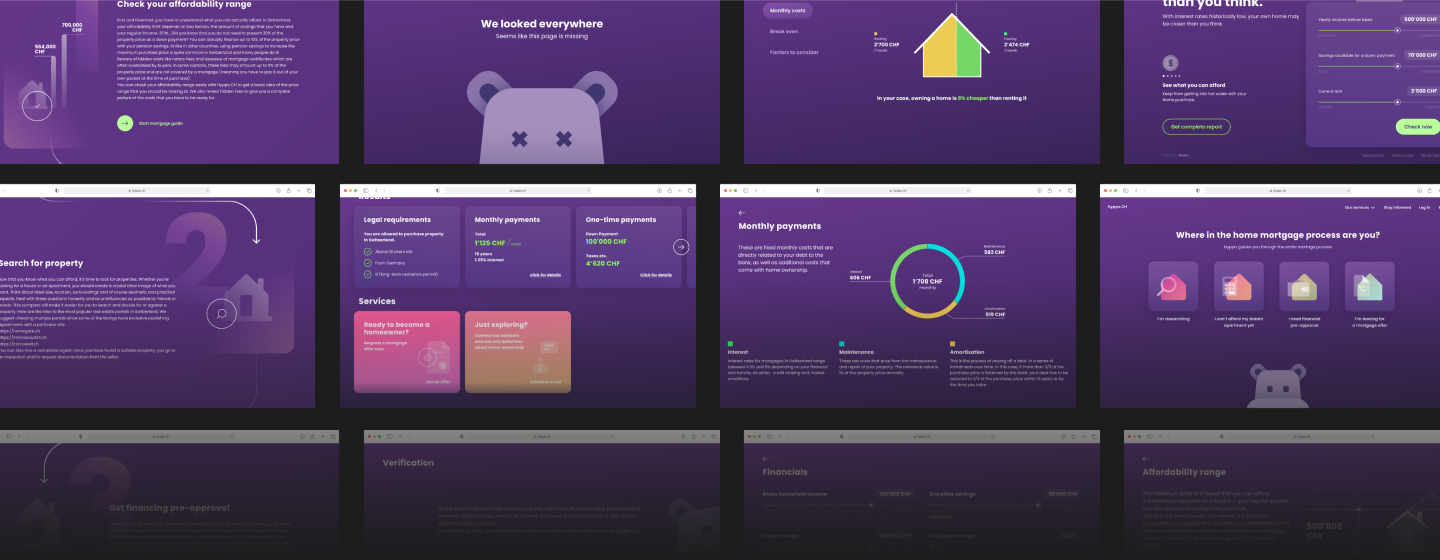

To ensure strong security ground of the app, as far as it concerns money and investment, it includes two-factor authentication, biometric authentication supported by the user devices (Touch ID, Fingerprint Sensor, Face ID, or others), and the application of 256-bit or 2048-bit standard of encryption for maintaining and sending financial records. Strong IDPS are added to handle DDoS attacks, encryption techniques, anti-spam, and phishing protection. That generally led to the user experience improvement when we added more security measures. As far as the solution is primarily for a younger audience, it caters to different users from risk-taking portfolios to safer portfolio management and has an additional level of scam protection and erroneous funding. For more experienced users, it allows goal introduction for investment and recurrent investment payments, donations.

Results

The development of an investing app has strong potential to be a profitable business as more and more people invest in the stock market and consider their investment opportunities. With our expertise on the critical points of building an investing app, the client received the great opportunity to become a player in the investment app marketplace and provide their users with customisable and vivid visuals. After making the dedicated approach to architecture buildup, the customer received the product, ready for further scaling and integration of supportive services. Taken measures on security assurance ensured the privacy-first approach starting from the design of the system, with the final outcome in the ways support is provided.

30%

of users started to better understand their financial flows

80%

retention rate in the first quarter

10%

of users made their first investment through the app