3

Complicated UX. The existing tools were not user-friendly, as they contained jargon and complicated information on Swiss mortgage regulations, resulting in a highly challenging and convoluted application process.

If you’ve got a brilliant idea, we’re here to help you build an early product version and give it a shot in the market.

If you have an existing product and team, but looking to expand the capacity and try out a new concept, we’ve got you covered.

If you know what specific product you need to drive your industry market.

If you clearly know what technology can help your business achieve goals through the product.

About the client

Keen Innovation is a fintech innovation lab, specializing in researching, developing and testing solutions for Basler Kantonalbank and Bank Cler. In collaboration with a Swiss bank, they were looking to build a solution for clients willing to get a mortgage.

The mortgage system in Switzerland presents a great challenge for future homeowners, especially if they are foreigners. Having to deal with numerous regulations, specific terms and language barriers, expats often refused the idea of getting a mortgage. To solve the problem and allow foreigners to switch from expensive renting to their own property, our client decided to build a tool that would stand out in the market and offer not just a simple calculator but an intuitive solution that would explain and facilitate the whole process of getting a mortgage.

To build such a tool and bring new customers to the bank, Keen Innovation was looking for an experienced team to help them develop a custom online platform that would facilitate and streamline the process of calculations, signing a mortgage agreement and transferring monthly payments. With such a request, they addressed EVNE Developers. Already experienced in fintech solutions, we knew what to do and immediately started implementing the client’s vision into reality.

Getting a mortgage today is a difficult task by default that comes with numerous obsolete practices. Getting a mortgage is difficult for Swiss citizens, let alone expats. And the majority of existing apps don’t seem to facilitate the process. Designed mostly for bank employees or industry professionals, such tools come with complex legal jargon that adds to user confusion. Adding the translation costs and different legal systems, applying for a mortgage seems more like a pipe dream than a real prospect for a foreigner in Switzerland.

To change it, our client aimed to build a solution that would calculate for users their chances of getting a mortgage and streamline the process from basic research to signing an agreement. At the same time, the app needed to be different from other tools. Our client’s business goal was to gain new customers that could interact with the bank digitally through the platform.

To create a unique tool that covers user needs, we needed to conduct deep market research and identify what competitors’ solutions lacked. Leveraging the JTBD (Jobs-to-be-Done) framework, we conducted several interviews with potential clients that included several user groups:

After gathering feedback, we identified key user pains to address:

To win users’ trust with our platform, we had to deliver a seamless user experience that would make the complex mortgage process as simple as possible. Here’s a brief overview of how we achieved this.

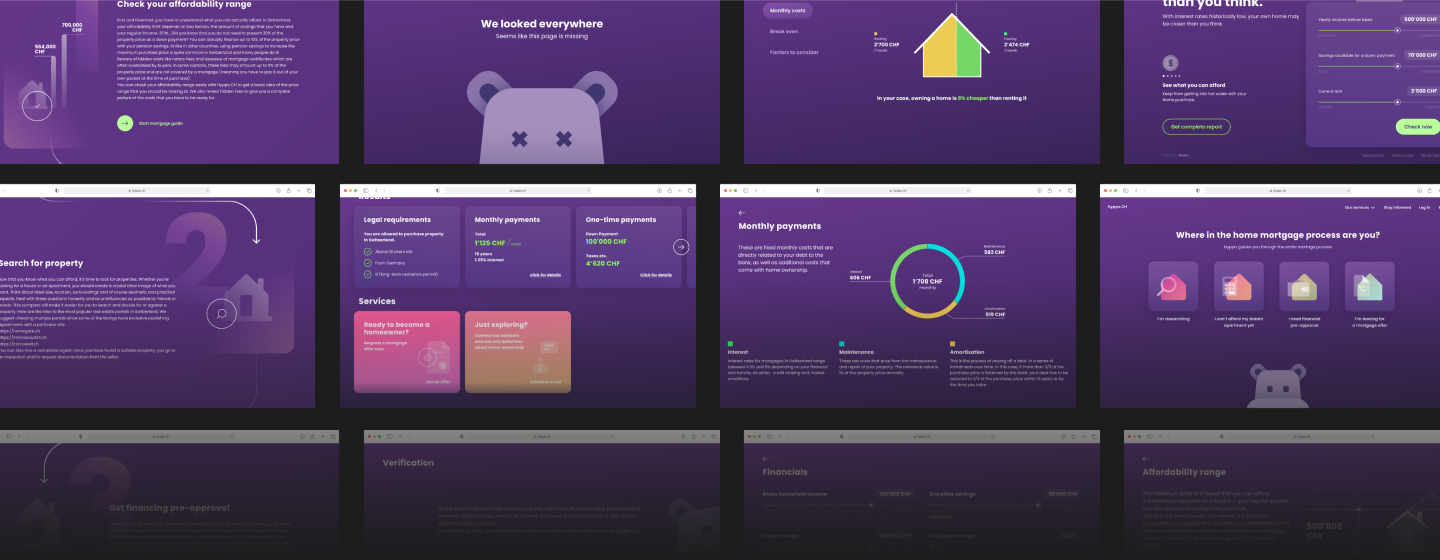

Transforming complex calculations into an interactive experience with improved UX

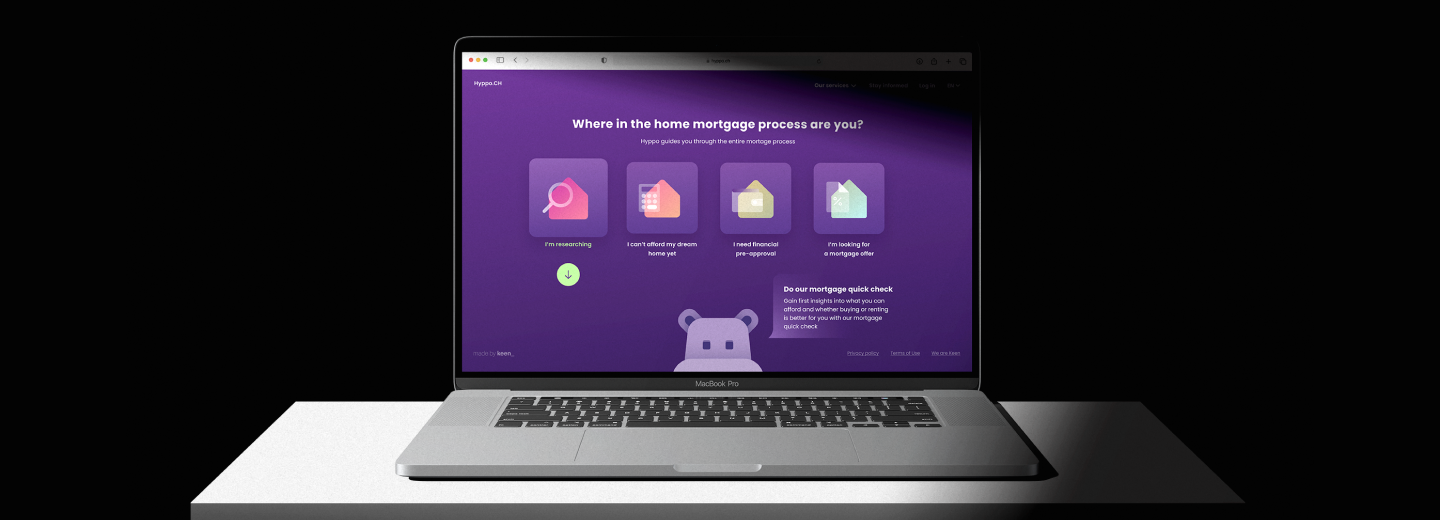

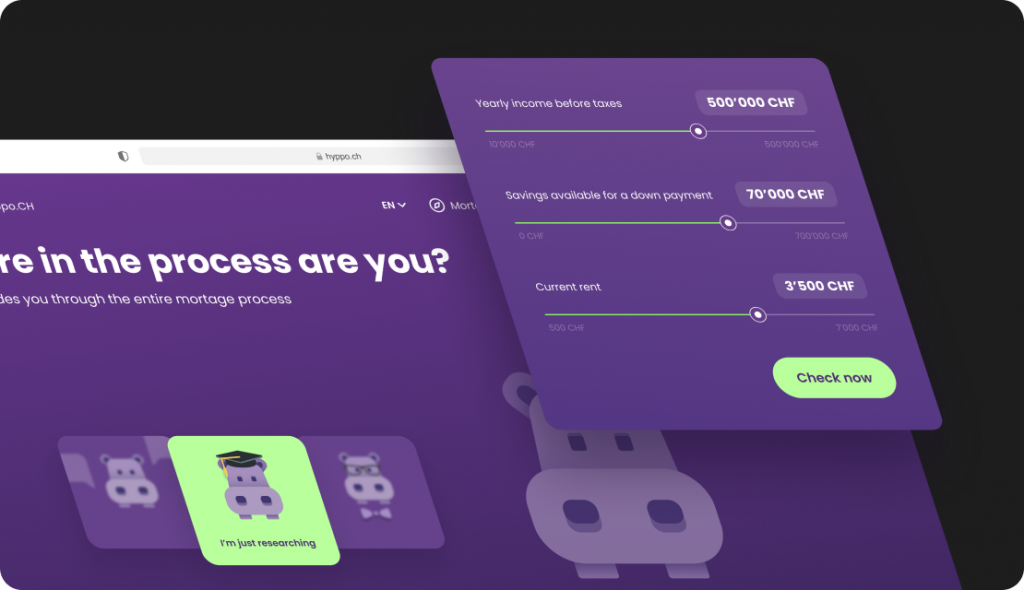

First of all, we had to make sure that the mortgage calculation process is delivered in the simplest way possible so that users wouldn’t feel overwhelmed. So we created a simple and pleasant UI with Hyppo, a little guide that encourages the user to stay longer on the platform.

To make a complicated process more accessible for users, we built a UX flow in a way that prevents mistakes and risks. For example, the system keeps users from making mistakes in the settings with additional pop-up questions “Are you sure?..” and such. With this, we cultivated the habit of app usage, enabling the users to configure the application by themselves and stay on the platform longer. Leveraging this approach, we implemented the following functionality:

In order to not bombard users with questions at the start, we created a landing page with an interactive dashboard. Inserting several key aspects, the user can see immediate results that encourage them to upload other required data.

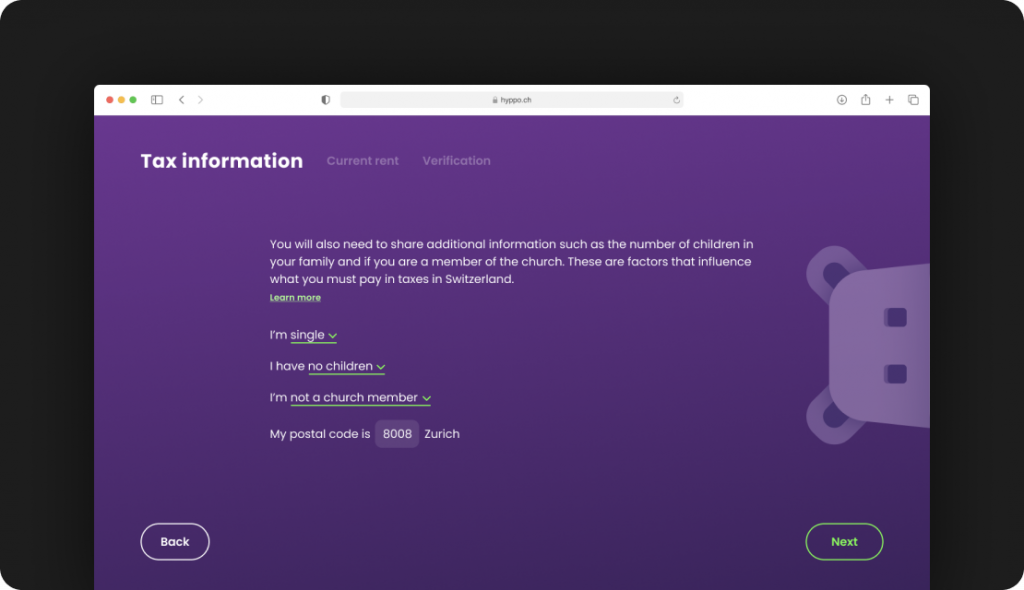

When the user understands the general concept, the guide takes them through an entire questionnaire, asking all the needed questions and allowing them to choose among the available responses when possible.

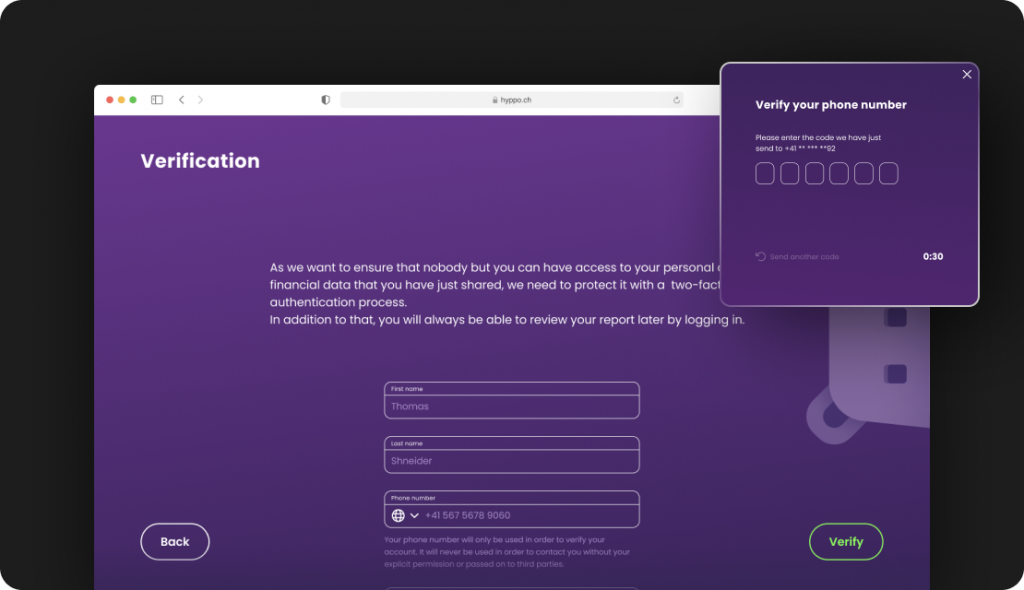

After filling in the form, the user account is automatically created with saved data that is protected with obfuscation and encryption.

The user can request a consultation or send the application directly to the bank. Connected through Oracle API, we transmit the user data directly to the bank consultants. In case of a positive response, the user can sign the agreement and transfer payments through the system.

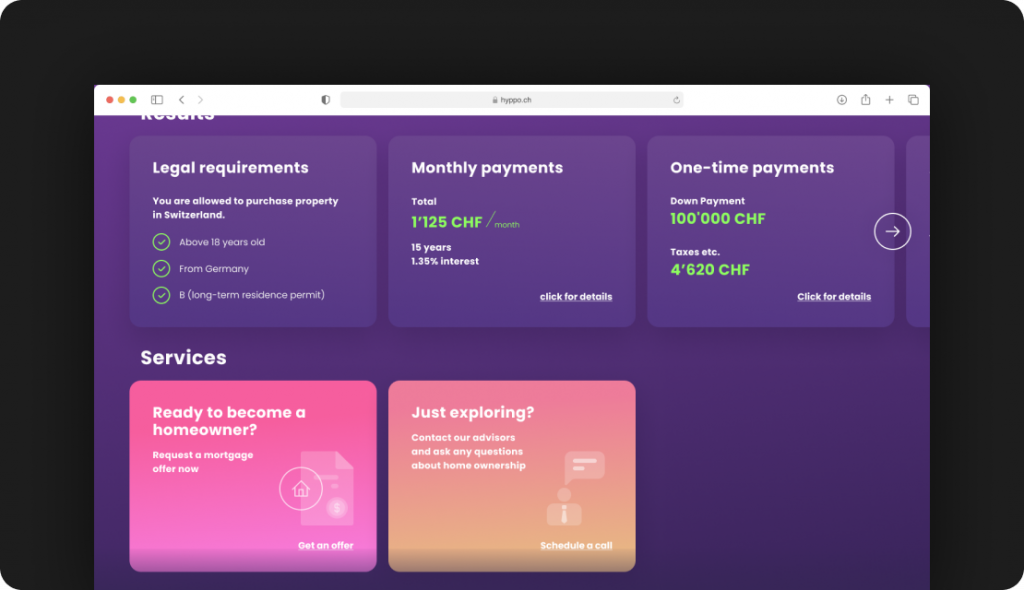

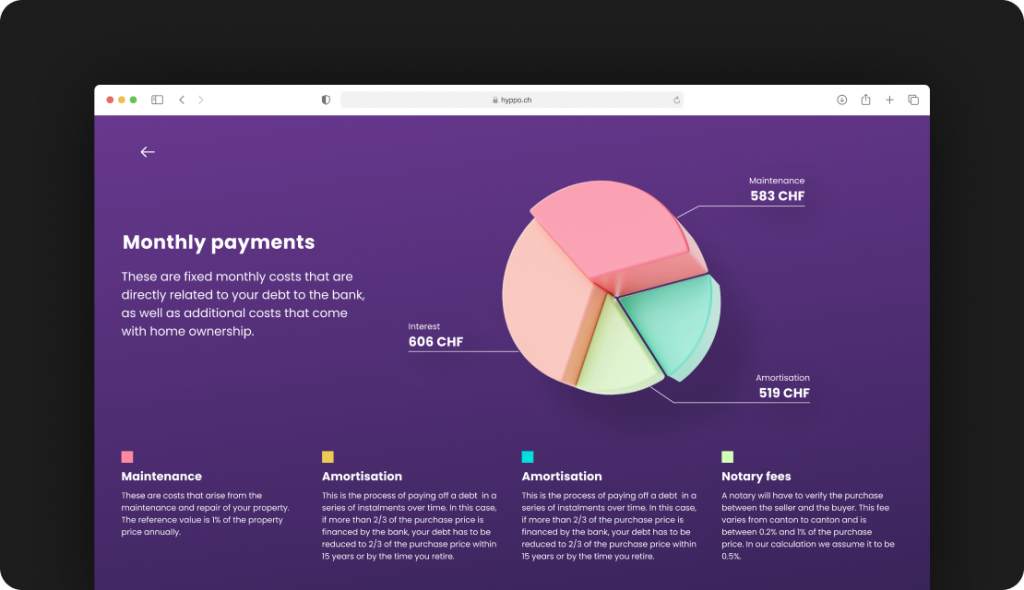

When all the data is inserted, the solution provides a custom dashboard with results based on the uploaded documents. The user sees all the needed information with a precise probability of getting a mortgage.

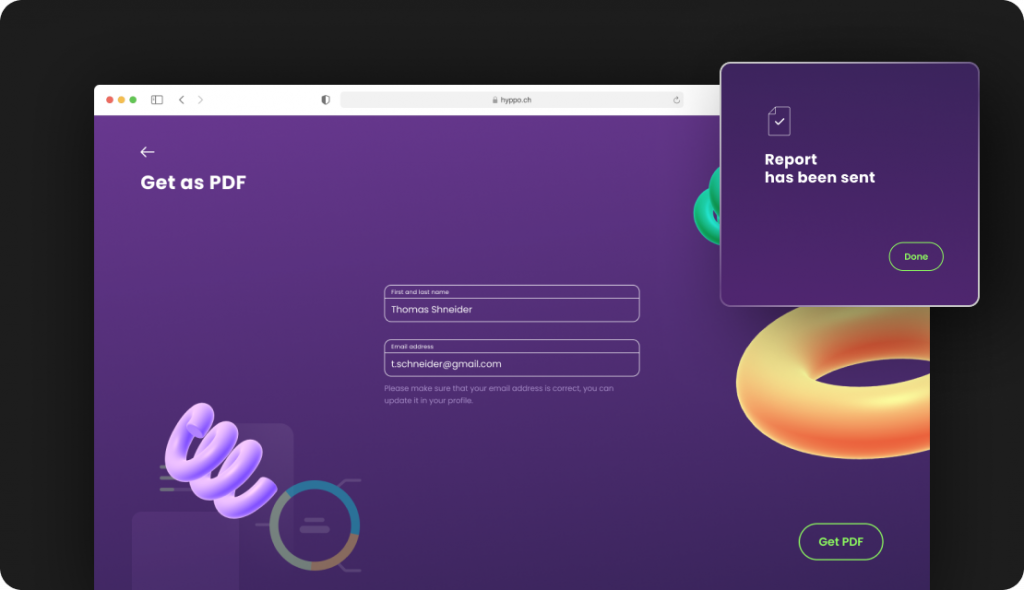

The report can be exported in a PDF format and used at the bank as a proof that the person is fully eligible for a mortgage. Reports created by the app can serve almost as notarized documents since they include all the needed information based on the official documents.

With the functionality presented in a simple form, we delivered an app that allows to make all calculations within a single platform, get a tailor-made report and easily overcome all the mortgage nuances. During the development phase, we had to overcome several other challenges – here’s how we did it.

We had to design the mortgage calculator to collect all the relevant information about users’ personal data. This way, the result would be customized for each user. So, we added various variables to determine the probability of getting a mortgage.

The main variables that determine the results included such factors as:

Adding all possible options, we made calculations change depending on the users’ data.

After the results are calculated, the user gets a personalized report that can be exported in a PDF format and used as proof of their eligibility for a mortgage agreement. The report serves as a notarized document that can be accepted in any bank, providing the same exact probability of getting a mortgage as the user could receive at the official financial institution.

After implementing the calculator functionality, we had to make sure the solution works as intended in every case. So we conducted a separate phase of testing, both manual and automated.

We started with unit testing to verify that each unit of code acts as expected and produces the correct output. As the platform deals with payments and personal data, we implemented penetration testing that involves simulating real-world hack attacks to identify potential vulnerabilities and security flaws. Finally, we leveraged Cucumber testing to check if the tool shows the correct percentage with different variables.

Through numerous tests, we ensured that the tool provides only trustworthy results that are in full compliance with the data provided by the user.

After we completed the app and the platform began to attract customers, our client recognized the advantages of the product and made a strategic decision to offer the application to other banks. To allow it, we extracted the core functionality and provided it as a white-label tool. The calculator allowed our client to open a new revenue stream, offering it as a separate tool that could enhance existing solutions.

The platform we developed allowed our client to successfully accomplish their primary objective of enhancing the user experience, simplifying the complex mortgage process for expats who wanted to buy a home, and attracting new customers to the bank. Featured on such platforms as FinTechNews, the solution became popular in Switzerland and gained a wide range of users.

User-friendly interface

The tool we built makes the user flow as convenient as possible, taking the user through every stage of the mortgage process from data collection to transferring monthly payments.

Steady flow of clients

Our solution helped the bank gain new customers and effectively address user problems, offering features that other tools lacked and making the mortgage process much simpler and quicker.

New revenue stream

The calculator that we built became a white-label tool, allowing other banks to enhance their own solutions and provide a streamlined experience for their clients.

Open Innovation Manager

at Keen Innovation AG

Hyppo answers the most important questions that people ask themselves when it comes to buying property – what can they actually afford, and does it make sense to buy. We’ve taken it one step further by tailoring this innovation to foreign nationals and expats who have to jump extra hurdles in the homeownership process in Switzerland. The fact that this solution meets the needs of this specific target audience makes it both extremely unique and wonderfully helpful.

EVNE Developers have been building products for startups and established businesses for years, empowering their growth and profitability. Tell us more about your project and we’ll discuss how to best implement it.