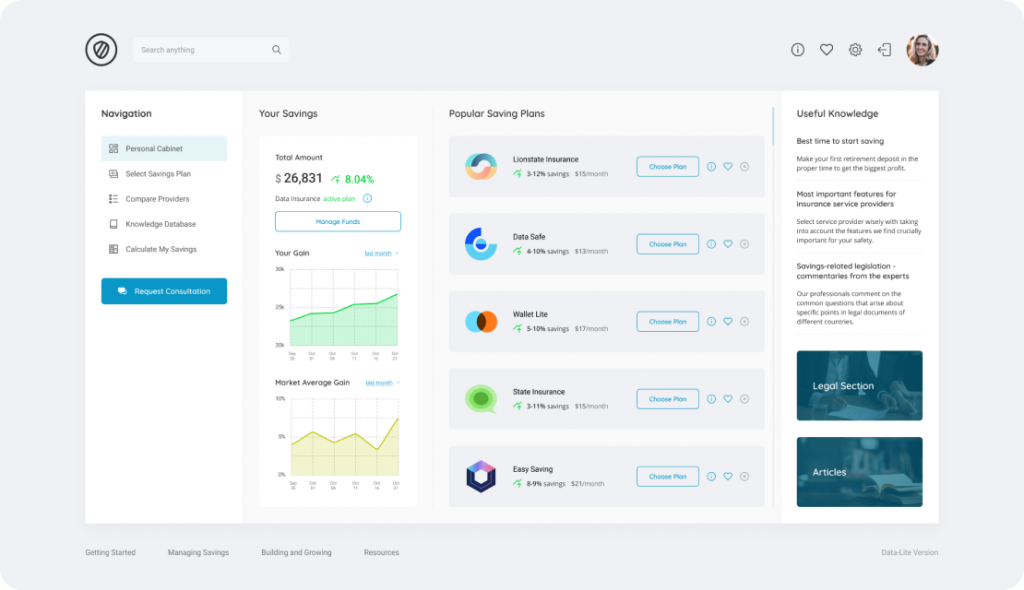

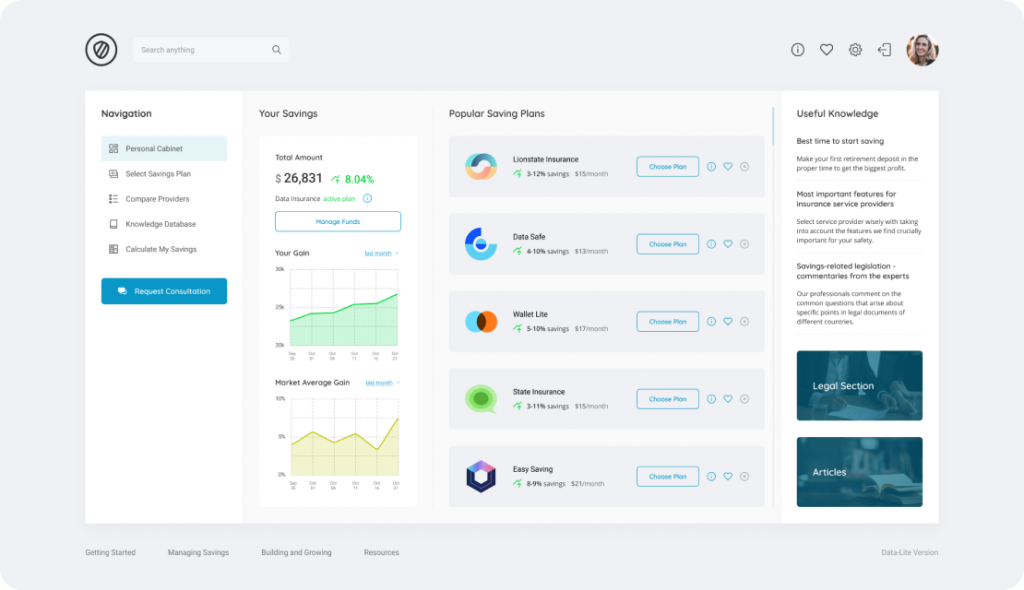

Personal cabinet

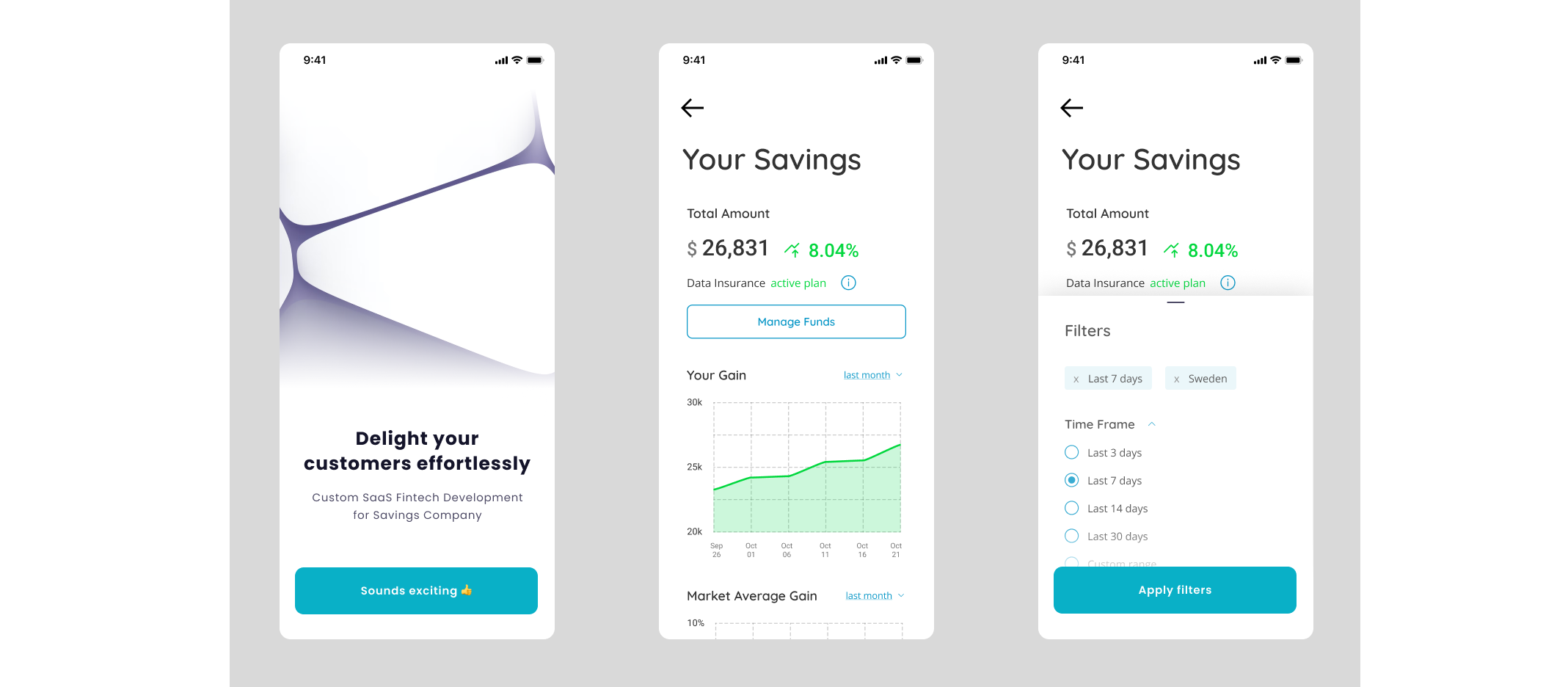

Right after signing in, the user can manage their personal profile where all the activity is saved, including statistics on the bought products and overall income.

If you’ve got a brilliant idea, we’re here to help you build an early product version and give it a shot in the market.

If you have an existing product and team, but looking to expand the capacity and try out a new concept, we’ve got you covered.

If you know what specific product you need to drive your industry market.

If you clearly know what technology can help your business achieve goals through the product.

About the client

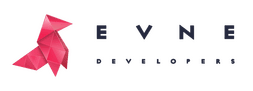

The new platform had to match the established brand identity of the business. We collaborated with our client on the UI and UX design, aiming to preserve the existing clients, migrate them to a web portal, and appeal to a new customer base. We created an experience that was familiar and consistent with the already known.

After we approved the look and feel, the next step was to define the functionality of the desired solution. The client gave us a detailed brief on what features they wanted to see on the platform and we further enriched this information through thorough user research.

To build a user-friendly portal, our business analyst and UX architect did detailed UX research that allowed us to create a seamless experience for the users. We defined what exact features are needed and how to implement them in the most convenient way.

Finally, based on our research, we successfully delivered a versatile SaaS solution with the following features:

Right after signing in, the user can manage their personal profile where all the activity is saved, including statistics on the bought products and overall income.

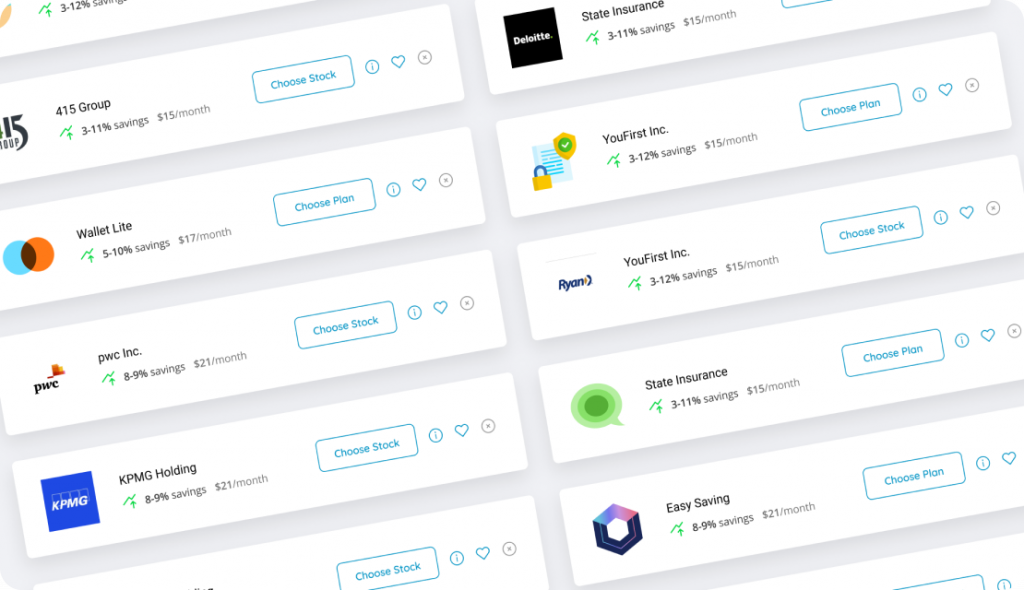

The main feature is a catalog of available stocks and funds to invest in. Starting with the top options at the moment, the catalog presents ratings of products set by the users themselves. Enhanced with search and filters, it allows users to easily find the right options based on specific parameters.

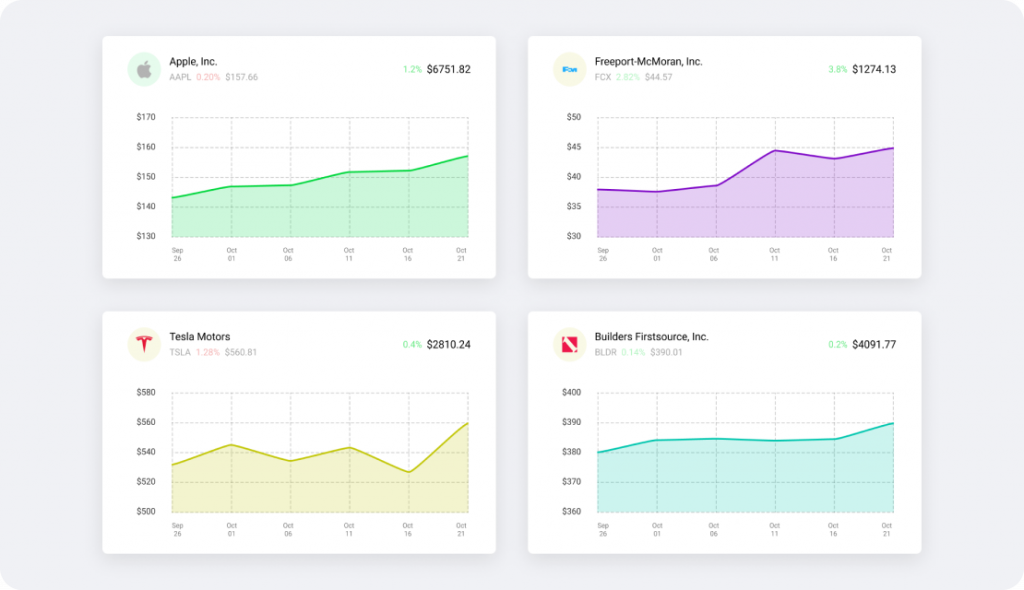

A user can view detailed stats on any stock. This info includes its past performance, with historical data showing how it’s gone up or down on average during a certain period.

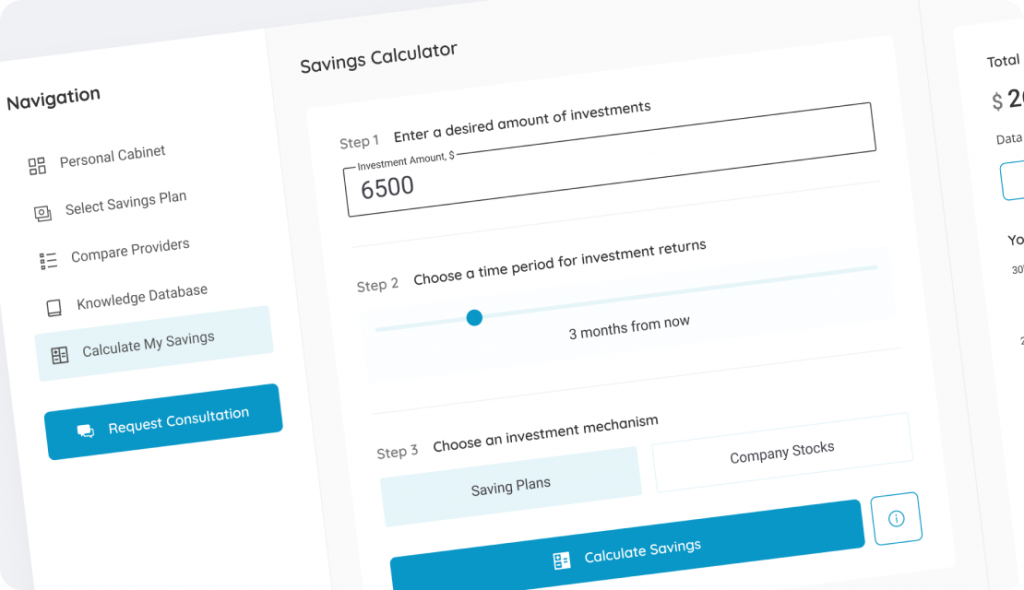

To help users see the probable outcomes of their investments, we added a calculator where they can input their investment sum and calculate an approximate profit percentage. Based on historical data, the calculator estimates returns over a needed period, from several days to 5 years.

We faced several challenges while developing and deploying these features. Discover how we managed to find the right solutions and deliver the final result.

To enhance a weak website into a scalable solution, we first had to improve the architecture. Being based on a monolithic architecture, the existing tool lacked the flexibility that would allow us to add more features and improve the website. To solve this challenge, we started scaling the architecture, gradually turning it into a microservices-based structure.

By transforming the static website into a flexible solution, we prepared the foundation for further development, making it possible for the platform to scale cost-efficiently and almost without limits.

The first feature that we had to build was a calculator that would show users how much money they can get after investing a specific sum. The calculator uses analytics and historical data to provide results with high accuracy. The user can enter the amount they want to invest in a product and see the projected returns for up to 5 years.

Besides forecasting, the calculator can be used to find a product that can help users earn the desired sum. For example, the user enters specific parameters such as the sum they’re going to invest, the desired outcome and the period of time. Based on the market situation, the calculator shows a list of products for potential investment. As market stocks can be hard to predict, we implemented three types of products that have different quotes and interest rates:

The user can choose between different types of investment, each with its own trade-off between risk and reward. Higher returns are possible but less likely, while lower returns are more stable but less profitable. In each case, the platform warns users about all possible outcomes so that they can make an informed decision. For retirement funds, the probability of getting an expected return is around 95%, for stocks it’s around 75%. Leveraging the calculator and the dashboard that shows detailed statistics, users can decide on how to invest their money while avoiding unnecessary risks.

The next challenge we had to tackle was data security. Working on a fintech solution, we had to ensure that the personal data wouldn’t get leaked. We also had to make sure the platform collected only essential information that was necessary for its functionality.

We made sure that all the personal data collected was securely encrypted and depersonalized so even in the case of a cyber-attack there was no risk of leaking any personal info.

We used the data we collected to create a system that can track and understand user behavior. This helps us to improve the platform and make it more user-friendly. Though the user data is anonymous, it gave us insights into what filters are used the most and what products are the most popular. Based on it, we continued to refine the solution, making UX more intuitive and seamless.

We used the data we collected to create a system that can track and understand user behavior. This helps us to improve the platform and make it more user-friendly. Though the user data is anonymous, it gave us insights into what filters are used the most and what products are the most popular. Based on it, we continued to refine the solution, making UX more intuitive and seamless.

To facilitate product search and their comparison, we implemented filters that help users find the most suitable products. Users can set filter options such as financial conditions, the stock’s position, the growth of product capitalization and so on.

To help users share their investment experiences, we allowed them to rate the products they invested in. Based on the rating, the platform shows what products are in demand right now, which helps to decide whether they’re worth investing in or not. Through user ratings and filters, we managed to build a transparent system that helps users easily compare and choose financial products.

When we started working on the platform, it was designed to offer only the company’s own services. But after we started the development process, it was decided to move to the SaaS model, our client started developing partnerships with other financial services. To allow third-party companies to add their products to the platform, we enabled data sharing through an API.

We created a platform that lets users pick any pension fund or investment option in Sweden, with a wide range of services tailored to their needs. The platform became an independent solution that attracted numerous customers and helped our client to scale their business even further.

The investment platform we built allowed our client to reach both goals: it improved the experience for current customers while also drawing in a multitude of new clients by providing them with the ideal solution to effectively manage and grow their savings. Now our client has an in-house team that continues to work on the platform, adding new features and transforming the platform into a social network where people can invest, earn and share their experiences.

100% user base increase within a year

The new solution we developed helped our client double their user base in a year, growing from 150K to 300K users.

10K sold products in the first year

The platform we built quickly became popular in Sweden and allowed our client to sell more than 10K products in the first year.

Scalable SaaS platform

By enhancing the existing website and shifting to a microservices architecture, we turned the platform into SaaS that continues to grow.

Business Development Officer,

Savings Management Company

“EVNE Developers is proactive, responsive, and have a versatile team to tackle the diverse needs of a project in the financial domain. They take into account overall dependencies for successful project operation instead of just doing the tasks assigned. Thinking about the product’s future is one of the core points they took into account when making important decisions. They are honest and upfront about any issues and always come up with solutions, not problems.

EVNE Developers can help you build a cost-effective yet scalable product that will allow you to meet user needs and grow your business. Tell us about your goals and we’ll gladly discuss possible solutions that align with your vision.