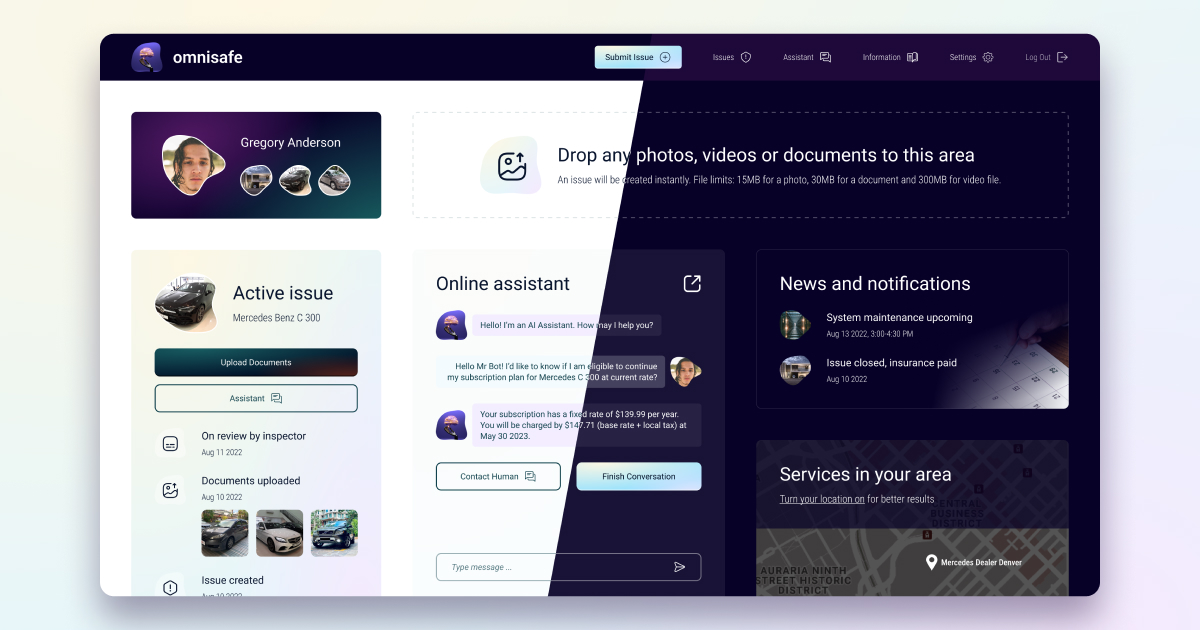

Interactive mortgage calculator web app

Web application with the primary goal to calculate the mortgage on the housing with numerous variables of payment options.

About

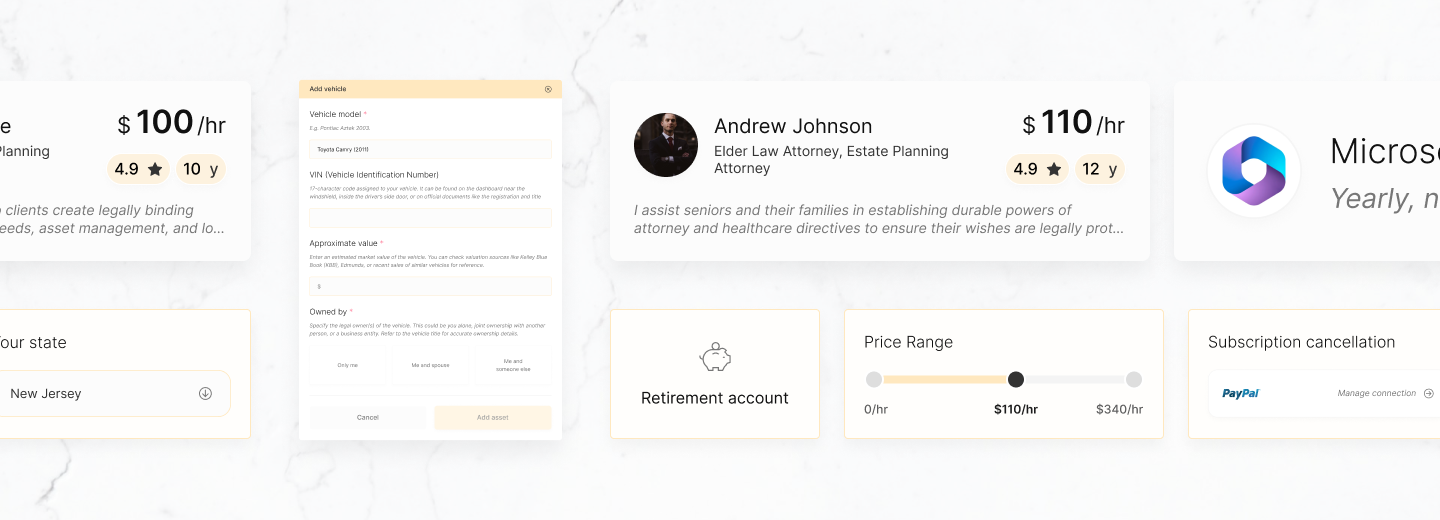

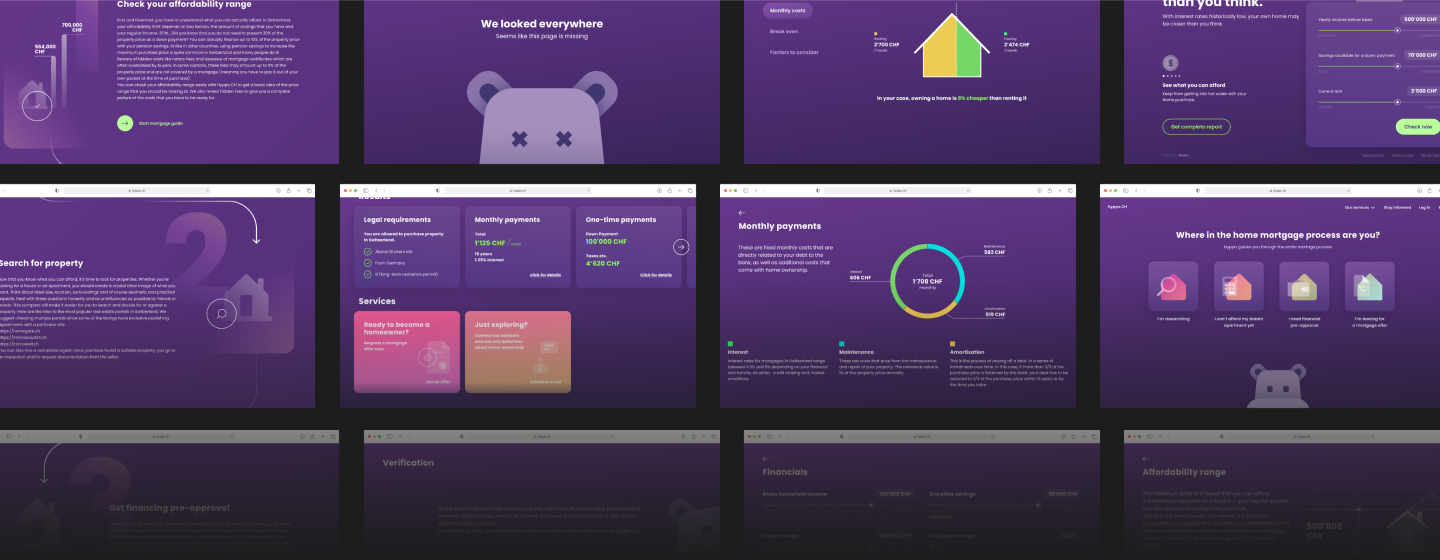

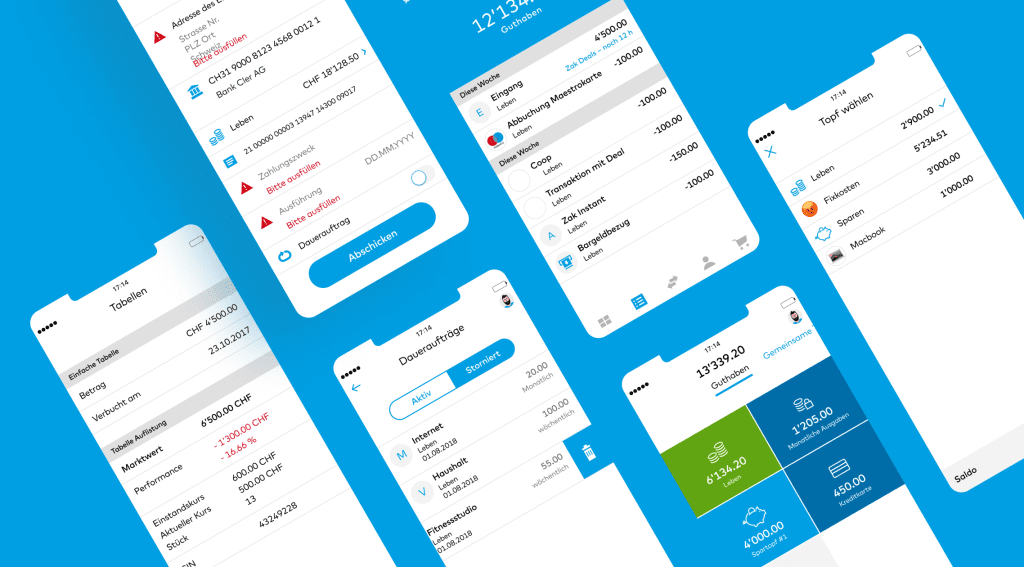

The clients' company dealing with the mortgage market of Swiss home buying faced their clients often lacked the visualisation of the mortgage calculation, so that made common mistakes. Their mortgage brokers department that assisted clients via phone calls required a great number of resources, both monetary and timely, which could be optimised with the introduction of a digital solution performing similar actions.

Challenge

Develop an interactive mortgage calculator that can be adjusted to various payment options, provide variables for items entered and allow users to communicate directly with the broker.

Solution

Within the project, the team moved from market analysis to structurization of the processes for the fast delivery of the updates. That brought a better level of user experience if compared with the existing mortgage calculator solutions and allow direct consultation with a broker and payment within it.

5

Engineers

Agile

Dev process

15+

Months

Switzerland

Market

Steps of implementation

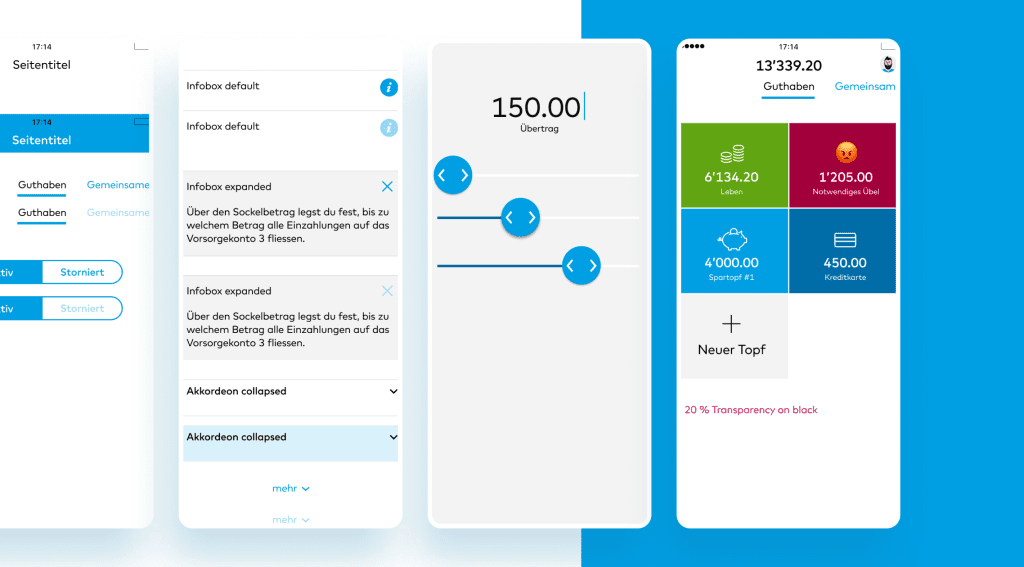

Deep analysis of the solutions, presented on the market

The analysis of the similar solutions presented in the market revealed several areas that could be improved with the newly developed calculator. Insufficient setting when only several parameters can be adjusted is one of the most common drawbacks. That is why the team prepared the prototype with numerous interactive elements and a fully customisable appearance.

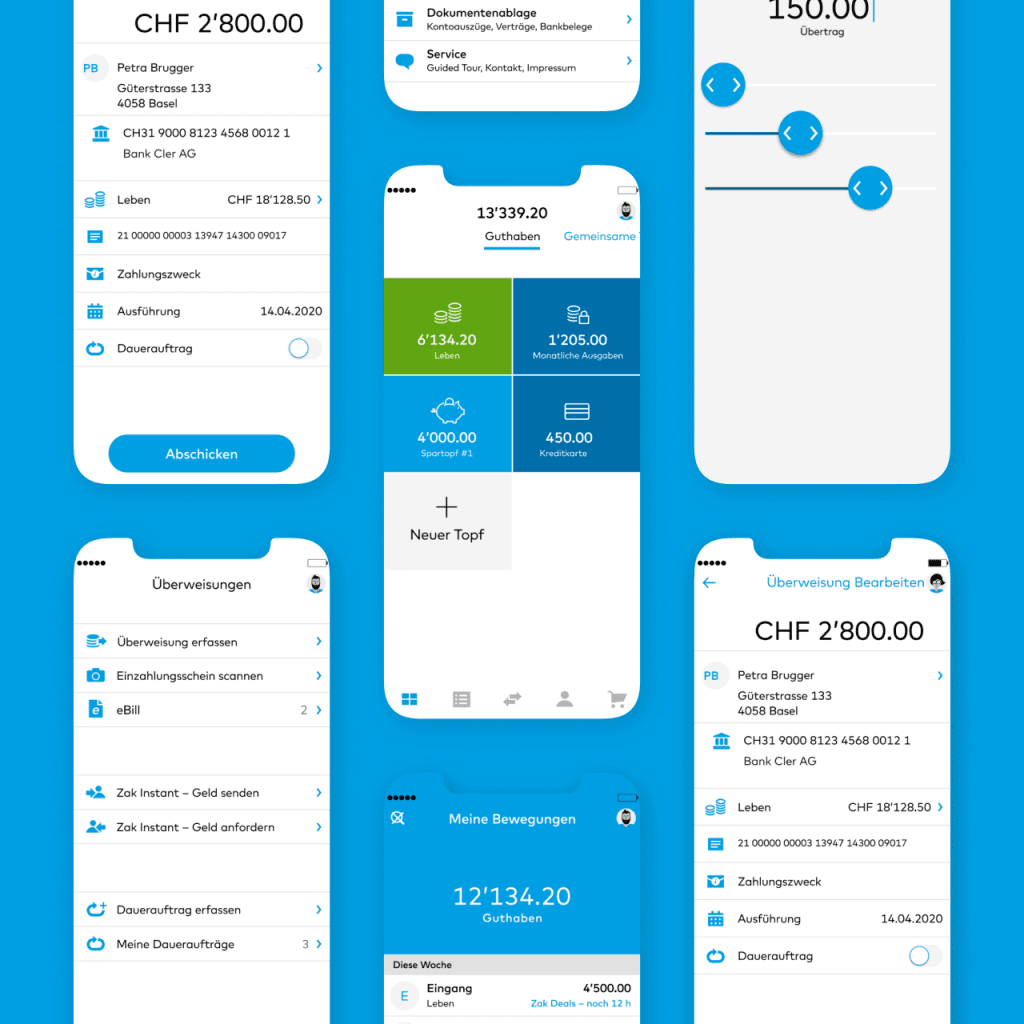

Development of the front and back of the web calculator app

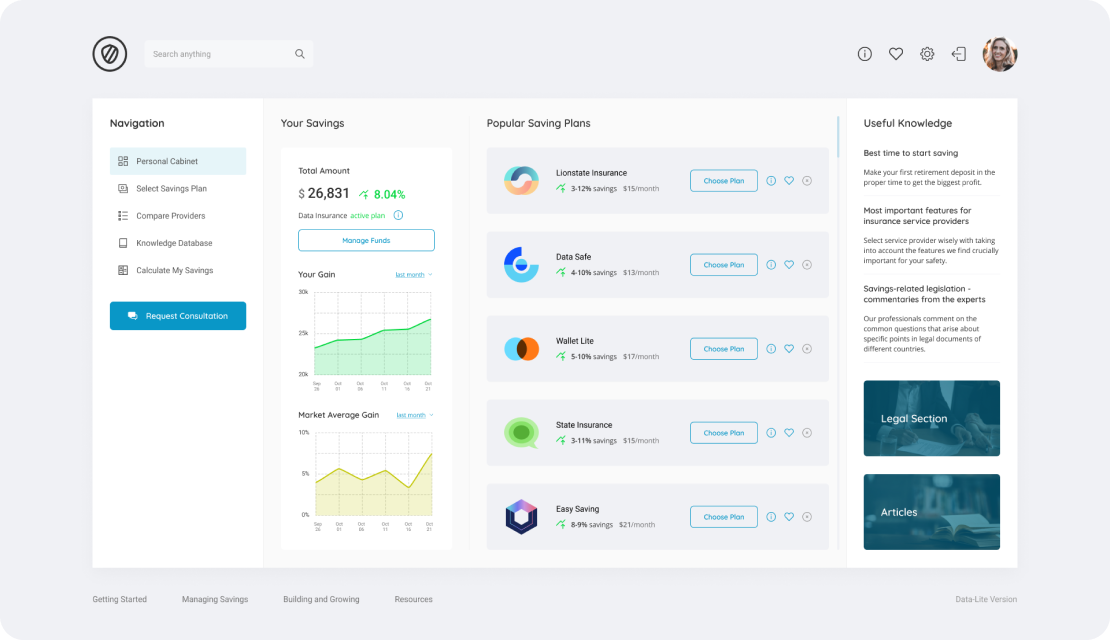

Due to the complicated system of house mortgages in Switzerland, the solution should assist users with its interface to avoid mistakes. For the back part, it should take information on proper calculations from various official resources and databases. Though the information does not include personal data, it should be protected from interception and fraud. That is why the encryption took place. The overall task was to improve the existing ideas and make them more agile for users and managers of real estate agencies. So far the team succeeded in the modular composition of the web app for future scalability. Additionally, the function of payment performing was added to the app. Users’ personal account gives the possibility to manage the calculated options, perform payments and connect with the personal broker for the actualization of information and consultancy.

Successfully passed automated testing

In addition to unit testing performed by developers, the quality assurance engineer created a bunch of thorough automated tests. That allowed deep and fast checking of the module’s interactions and their scalability. Special attention was given to a high number of adjustments to the calculator and possible conflicting items in formulas. Fast testing led to fast changes implementation in the live version of the product and their market validation.

Results

The business received a solid web app with unique features to the market of mortgage calculator solutions. The process of repetitive fast and reliable delivery was constructed with the help of automated testing. Modular structure gives opportunities to scale it faster and with fewer efforts. Together with the deep testing process, it creates the basis for future releases and further app development. The general approach to software product development shows the reliable attitude of the business to their users as they can adjust the calculator up to their needs and call for broker help within one solution.

+1,200

Requests per Week

+760

New Clients per Month

+480

Remote Sales Experts