Admin

The Admin role has access to all functionalities. In case a user has made any errors or mistakes while using the system, the Admin has the authority to rectify those mistakes and ensure the accuracy and integrity of the data.

If you’ve got a brilliant idea, we’re here to help you build an early product version and give it a shot in the market.

If you have an existing product and team, but looking to expand the capacity and try out a new concept, we’ve got you covered.

If you know what specific product you need to drive your industry market.

If you clearly know what technology can help your business achieve goals through the product.

To solve the problem of slow and inaccurate reporting of car accidents, our client, a US-based insurance company, decided to digitize its reporting process. This process was traditionally done manually by both insurance agents and car accident victims.

When people manually fill out accident reports, they often make mistakes or leave out important details, such as the car color or the exact location. These errors can cause problems in processing claims, determining fault, and resolving insurance issues efficiently.

They partnered with EVNE Developers to implement the solution.

Our client faced two major challenges: creating client settlements manually was slow, and human error caused numerous problems in insurance reports, which delayed the claims process. Their goals were to speed up client settlement processing and reduce the amount of manual work creating insurance reports.

We kicked off the project by building an accident reporting solution, breaking down the scope of work into manageable sprints where we delivered working functionality every two weeks. Our team, consisting of business analysts, UI/UX designers, front-end and back-end developers, project managers, QA specialists, and DevOps engineers, worked together on the project.

Once we had the initial solution ready, we saw an opportunity to enhance the product’s capabilities and proposed implementing a navigation application to help drivers avoid dangerous streets.

Overall, our efforts not only resulted in the successful development of the AI-powered accident reporting solution and a navigation app but also supported the client in transitioning to a SaaS business model, facilitating their growth and expansion.

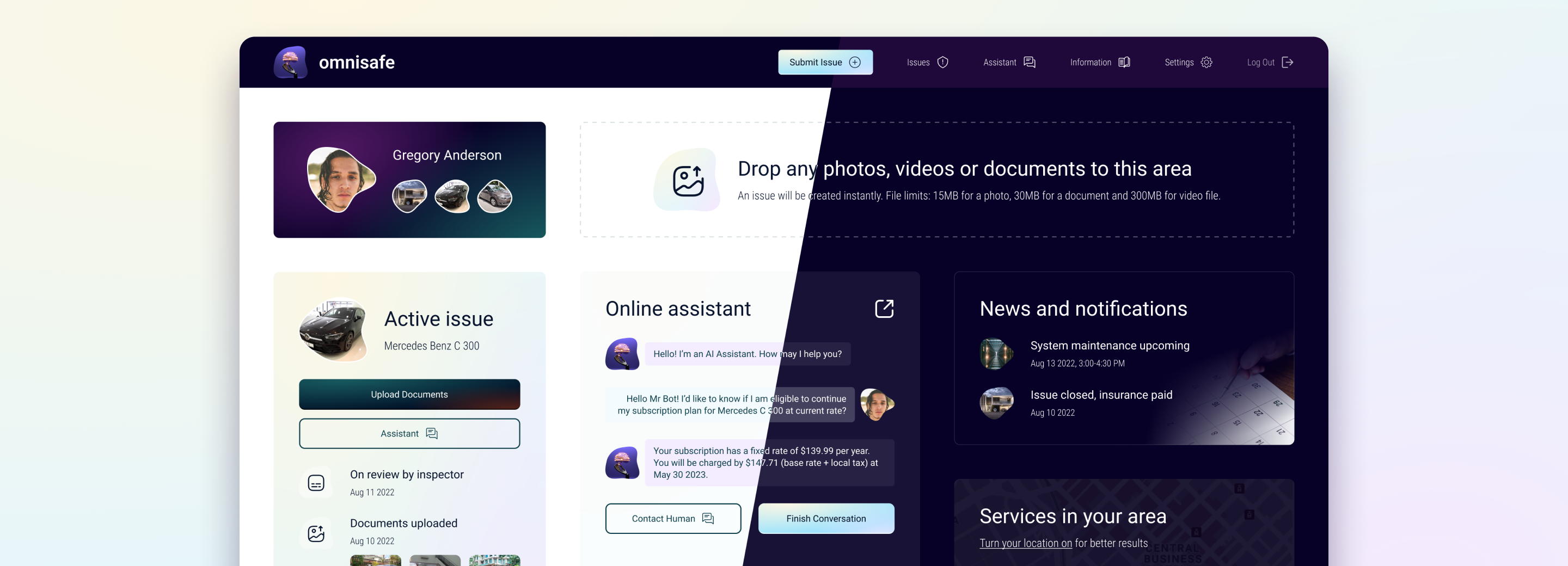

We solved the problem of manual paperwork by creating a digital platform that allowed insurance claim representatives and drivers to automatically enter information at the accident scene, instead of using physical documents.

Our system integrates with the NAIC Registry, which provides access to the Vehicle Identification Number (VIN) for each car involved in an accident. The VIN serves as a unique identifier and contains crucial details about the car, including its license plate and color. By leveraging this integration, we automatically retrieve accurate information about the vehicles involved in the accident, eliminating the potential for errors in recording such details.

To provide valuable context for the accident reports, we also access information about the driver by integrating the solution with the client’s ERP system.

The accident reporting solution caters to three main user roles: Admin, Insurance Agents, and Users.

The Admin role has access to all functionalities. In case a user has made any errors or mistakes while using the system, the Admin has the authority to rectify those mistakes and ensure the accuracy and integrity of the data.

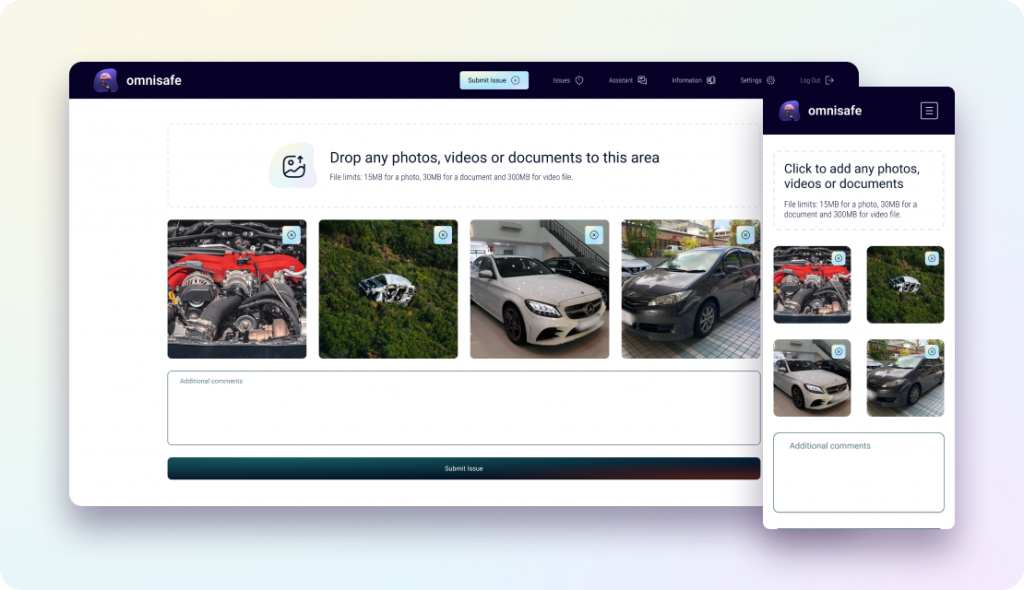

The Insurance agents are the primary users of the system. They process inquiries and reports from drivers involved in car accidents, including photos or any other relevant details, to create accident reports.

These are individuals who have been involved in car accidents. They input relevant information about the accident. This includes details such as the location, description of the incident, and any supporting photos or documents.

To follow privacy rules and safeguard sensitive information, we needed to blur other cars’ numbers and faces in images taken at the scene of an accident.

We first tried using an image editor to let users blur images manually. But this approach was slow and error-prone, so we looked for a better and more precise solution.

DALL-E is an AI model by OpenAI that uses deep learning to generate images. We integrated DALL-E into our system and trained it for better results. With DALL-E’s skills, our system can spot and blur out license plates and faces in images automatically and quickly. This helps us follow privacy rules while saving time and avoiding errors.

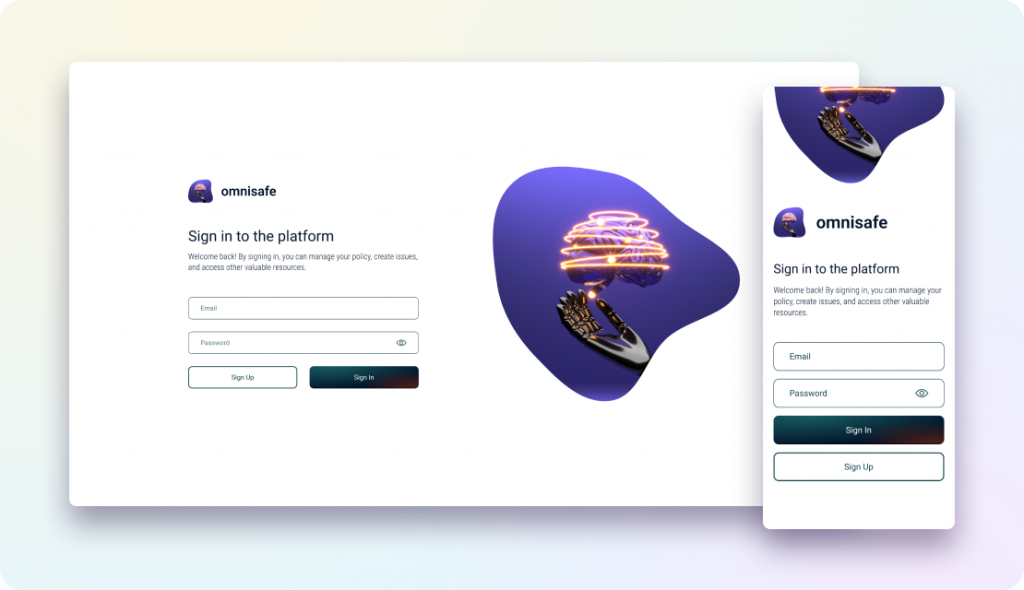

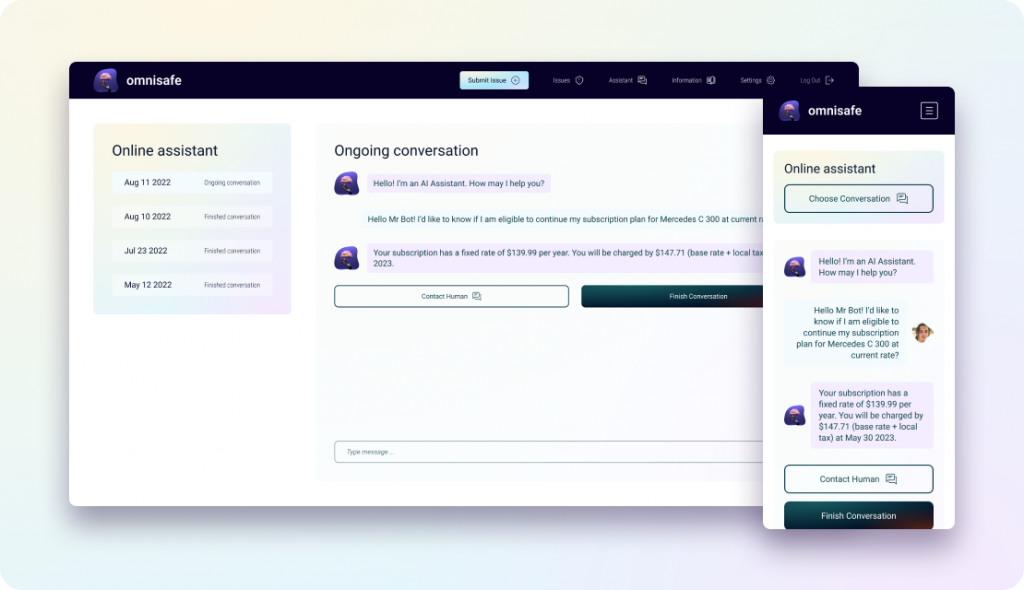

To enhance user support and reduce reporting time, we implemented an AI-powered chatbot within the accident reporting system. This chatbot serves as a virtual assistant, providing valuable information and guidance to both agents and users. Users can interact with the chatbot through voice commands, and not only through text inputs.

We sorted potential user queries into three main categories: accidents involving people, platform functionality, and accident reports. To train the AI model on accident reports, we used pre-existing reports provided by our client.

This way, the chatbot can answer a range of queries, including instructions on what to do in the event of an accident, how to create different types of client settlements, and how to make changes or edits on the accident reporting platform.

After the accident reporting platform went live, and we started monitoring the performance and usage, we identified a pattern revealing a high frequency of accidents on a particular highway. We saw the need for a solution and trained our AI model to learn to spot areas with lots of accidents and mark them as risky zones.

We had two options for applying this information:

We showed both options to our client and they loved the second one. So we got to work on the navigation app.

To make the development process more cost-effective, we used React Native. This framework allowed us to create a cross-platform minimum viable product (MVP), compatible with both iOS and Android devices.

The navigator app communicates with the API from the accident reporting platform and uses AI to draw routes and guide drivers, helping them avoid the identified dangerous streets.

By implementing this separate app, we wanted to give drivers real-time information to choose their routes wisely. We also integrated the chatbot into the navigator to provide drivers with valuable information regarding road safety, including updates related to road regulations and changes to street signs.

As the product evolved, it transitioned into a Software-as-a-Service (SaaS) model to offer the accident reporting solution to more insurance companies. During this transition, we introduced several key features and enhancements.

By digitalizing the accident reporting process, we successfully accomplished the client’s objectives of reducing the time required to create client settlements by 30% and minimizing problems in insurance reports by 60%. However, the impact of our solution extended beyond these metrics.

Operational Efficiency

Our accident reporting solution reduced the time required to create client settlements by 30% and minimized problems in insurance reports by 60%.

Improved user confidence

The integration of the chatbot provided drivers and insurance agents with easy access to crucial information during accidents, making them feel informed and confident.

Driver safety

The navigator app enhanced driver safety by enabling them to avoid dangerous zones on the road. This resulted in a reduction in the number of accidents and created a safer driving environment.

Business growth

Our contribution in shifting the product to a SaaS model contributed to the client’s business growth.

We can help you transform your business digitally with ease. Share your challenges with us, and we’ll work with you to find a customized solution that suits your needs.