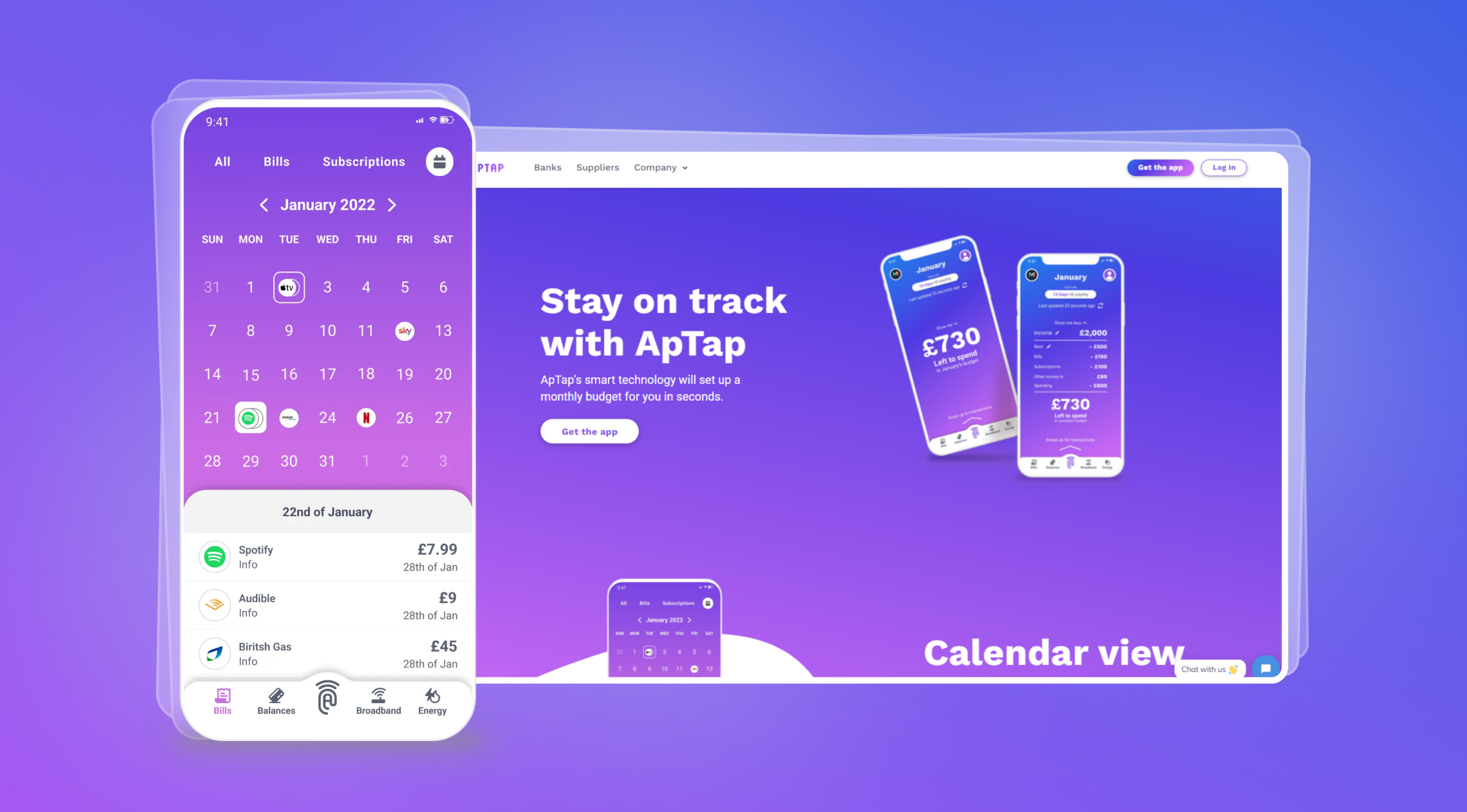

B2B SaaS for budgeting and predictions

The platform for management of companies’ finance flows, making budgeting or predictions and sharing them with investors or colleagues to reduce the time needed for critical decision-making by 3 times.

About

The customer offered budgeting services for B2C, though understanding the turbulence of the modern world and witnessing how their friends lost their business due to the pandemic and insufficient control over their capital, they decided to scale their services to B2B as well. That is why the system was designed as a platform for any company wishing to bring more certainty to their business life.

Challenge

As a SaaS solution, the system had to allow broadening the services of the client and improve the market positioning as a reliable B2B service provider. Having no financial plan or budget in place with clear tracking by digital means in real-time can cause stress and overwhelm not only the company owners but also its processes and activities. The introduction of analytical and predictive models had to assist with overcoming the stress level even more.

Solution

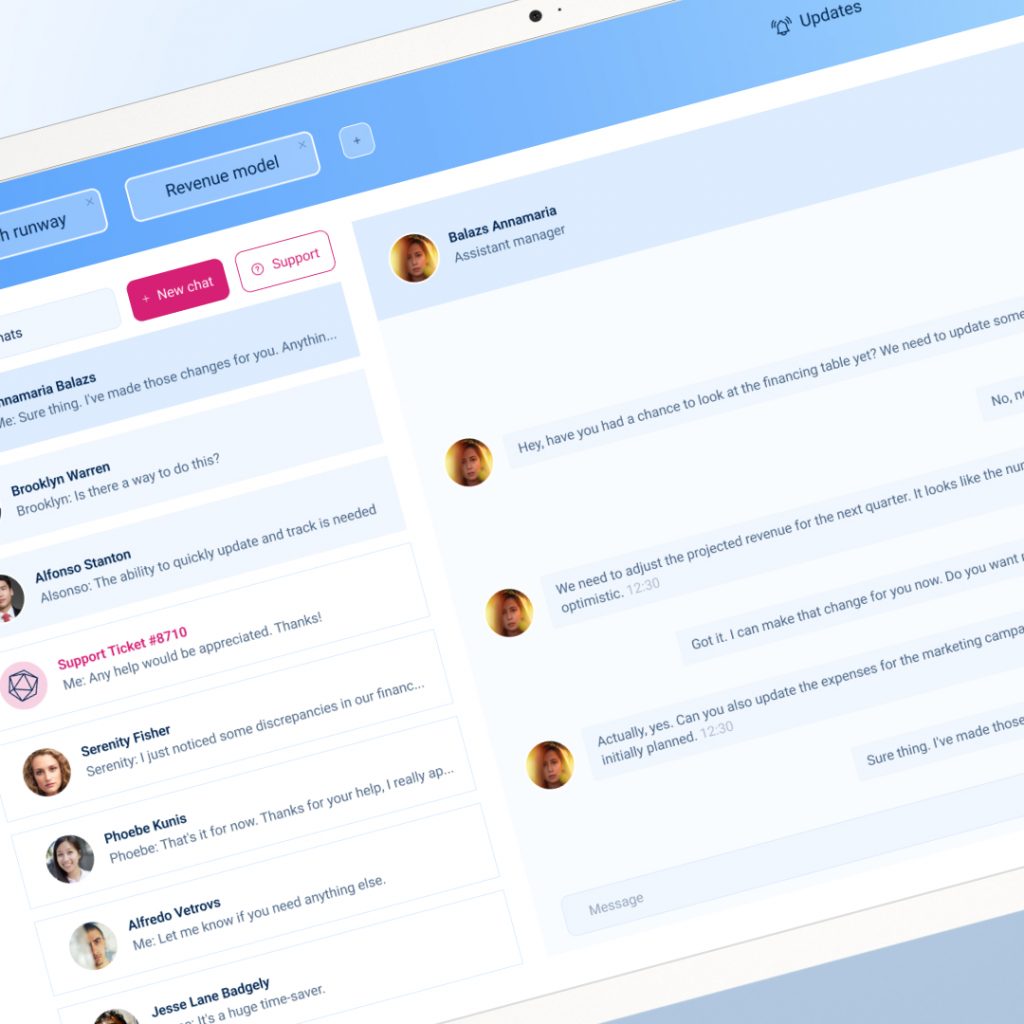

Customisation, user-friendliness, and clear algorithms for predictions were placed as core objectives in the course of the development. In addition, the system should take the information from external resources through protected channels and stay secure at every stage of data use.

5

Engineers

Agile

Dev process

20+

Months

US

as target market

Pecularities of implementation

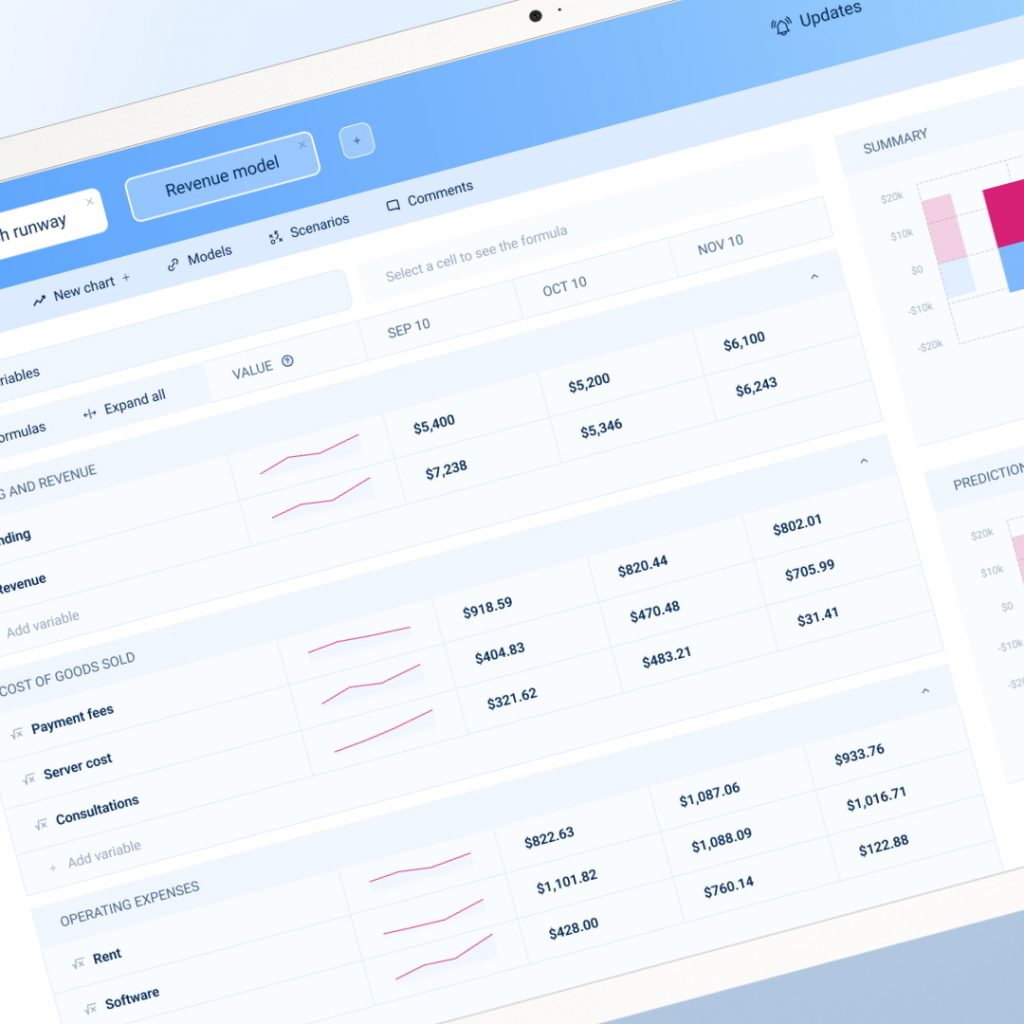

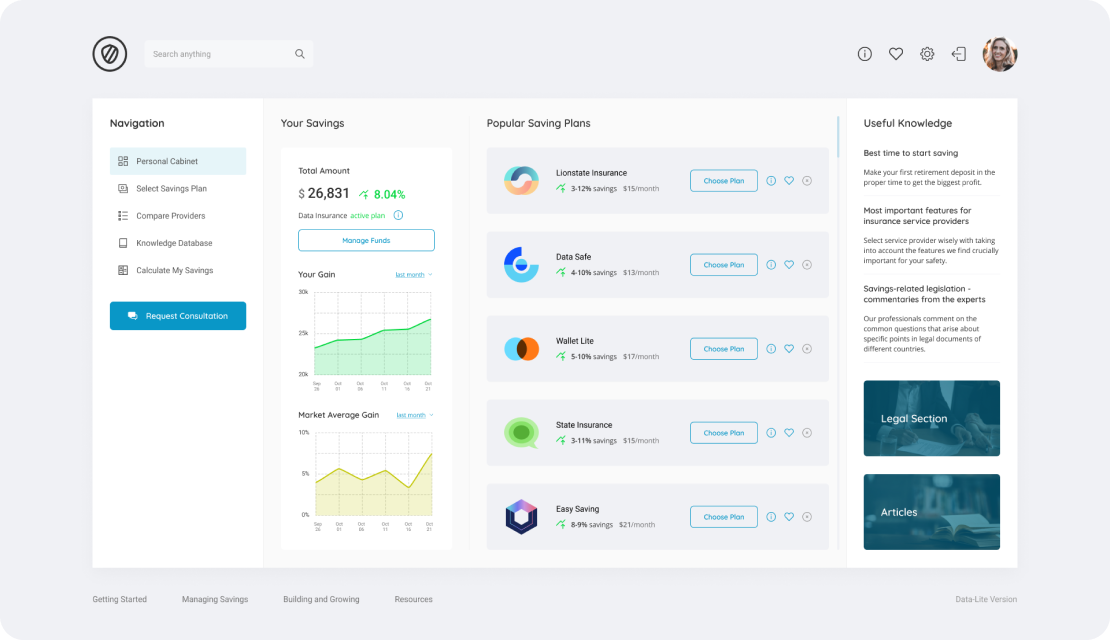

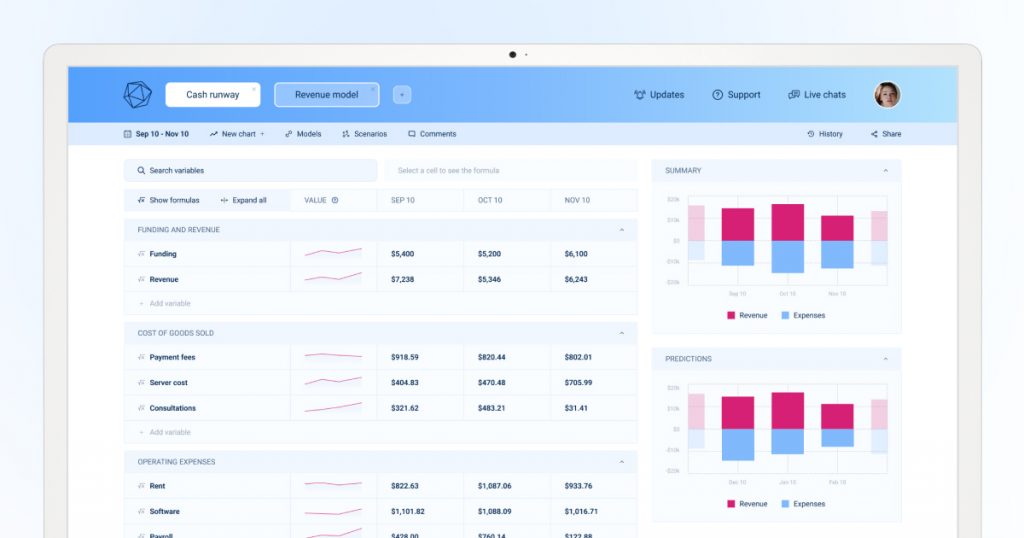

Deliberate calculations for holding the budget clear

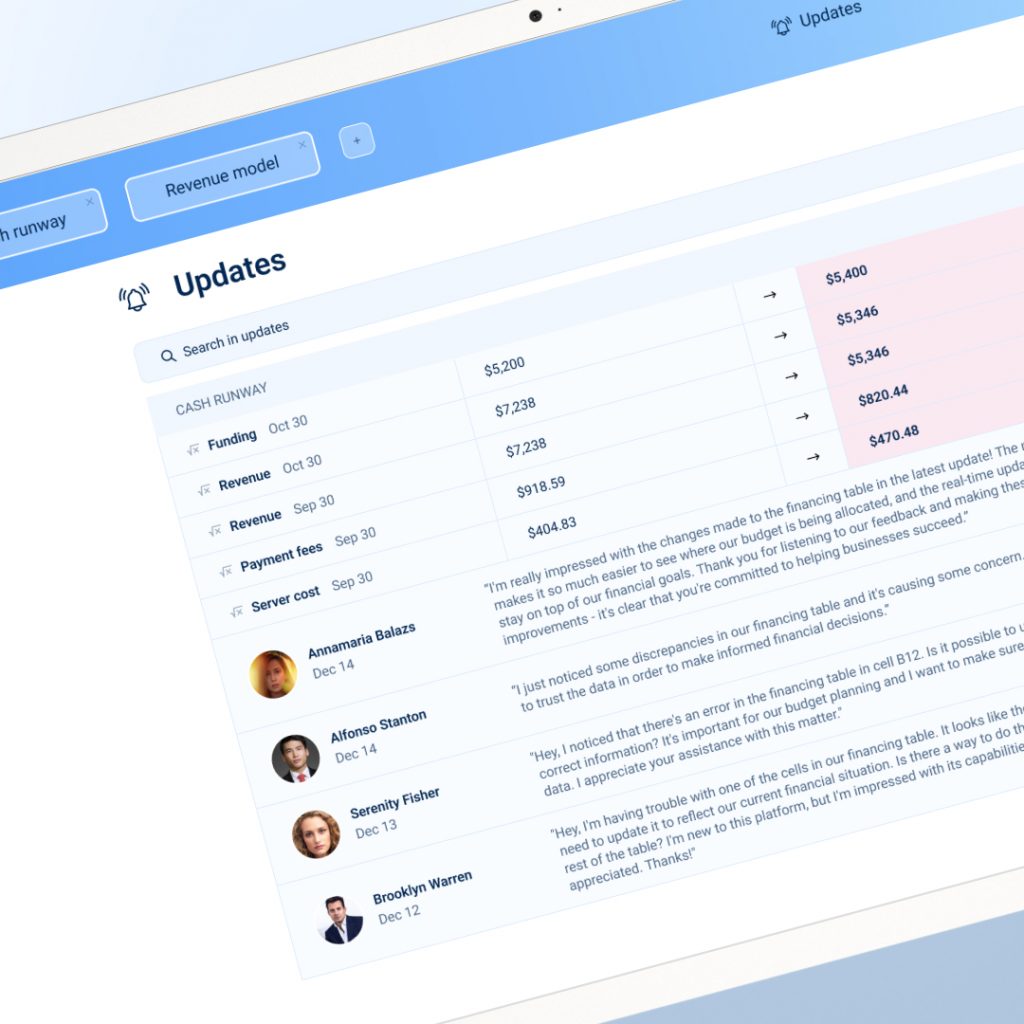

The financial planning module was made to cover several directions of financial flow management within the company: budgeting, strategic planning, project planning, consolidation, separation of expences, and management accounting. All modes are updated in-rea time in case the budgeting factors change or any fluctuations happen with the market. Detailed planning within this module allows planning any activities that can happen with customisable fields that can suit the needs of any company. This part of the system is greatly bound to the prediction module as each point of the table has risks and forecasts.

Making predictions work for your risk management

Analytical models that take both internal and external data are able to provide assumptions for any case connected to budget flows. Together with a simple interface with lots of instructions and assistive options, the platform allows making customised reports with the use of the advanced instrument of check and evaluation. To provide the necessary level of security, the data is collected through several APIs to the protected server. It allows access to free historical stock data, financial news, fundamentals, trades, quotes, aggregates, reference data, and news on company-related operations or financial market events.

Analytics with numerous charts for better reporting

The system was designed to provide flexible visualisation of the business process of budgeting formation, planning, forecasts, and data predictions. Each business can adjust its working space in the way they particularly need and see only the required scope of information – charts, dashboards, reports, schematics, and KPI boards. Upon the necessity, the system based on the internal algorithms can build the interconnections among charts for deeper evaluation. The workspace has a specialised training flow with numerous assistance windows for inexperienced users.

Results

The developed platform allows companies to build, manage and evaluate their financial system with specialised analytical and predictive features. The modules of the system were built based on the performed analysis of the market and existing competitors to fit the niche and suit business goals. Being adjustable, the solution can cover the needs of the companies of small businesses from any domain. With real-time updates company's management gets an opportunity to react in the least possible periods to introduce necessary budgeting fixes as soon as possible before the occurrence of any harm. As for critical decisions, it can save up to 3 times less time due to automated processes and predictive analytical and risk assessment models.

3 times

less time for critical decision making

80%

of prediction models come true

40+

options for charts adjustment

Testimonials

200+

Clients Already Served

EVNE Developers, LLC developed a custom software system for a financial services company. They did programming, QA, design, and project management before the delivery of new features. The client was happy with the results they delivered. EVNE Developers, LLC created the complex SaaS solution that grew the product's target metrics. They performed well in both communication and project development. The team delivered in a timely manner with a smooth and efficient workflow.

A real estate agency registry has hired EVNE Developers, LLC to build a сustom portal allowing users to get real estate information in their area. The team also performs intermediate user and manual testing. Since launching the platform built by EVNE Developers, LLC, the client started getting more than 1,000 users monthly with a retention rate of more than 70%. The unique features and the clear UX make users stay longer. The team clearly understands the client's vision for the platform and delivers.

Aidan Perkins

Managing Director, Real Estate Agency RegistryEVNE Developers, LLC has developed an e-learning app for an educational facility. The team has been involved designing the app's UI/UX and functions and implementing the company's key vision for the product. "They are great both on the personal and professional levels."