Financial reporting

Automating repetitive tasks, the app allows you to easily insert financial data using a reporting template.

If you’ve got a brilliant idea, we’re here to help you build an early product version and give it a shot in the market.

If you have an existing product and team, but looking to expand the capacity and try out a new concept, we’ve got you covered.

If you know what specific product you need to drive your industry market.

If you clearly know what technology can help your business achieve goals through the product.

To build an advanced fintech product, we first analyzed the market to understand what features the competitors were missing. In close collaboration with our client, we found out that other financial tools lacked forecasting features, which were essential for enhanced analytics, limiting the functionality of the existing solutions to simple reporting.

Armed with this knowledge, we started building wireframes for the future web app. Also, we had to ensure that users could easily navigate the system. So we conducted several A/B tests, showing wireframes to testing groups, and receiving feedback from more than 150 users. Based on their feedback and additional market research, we delivered UI and UX that fully responded to the user’s needs.

Unifying all these features in a single app, we built a highly customizable finance management tool with such key modules:

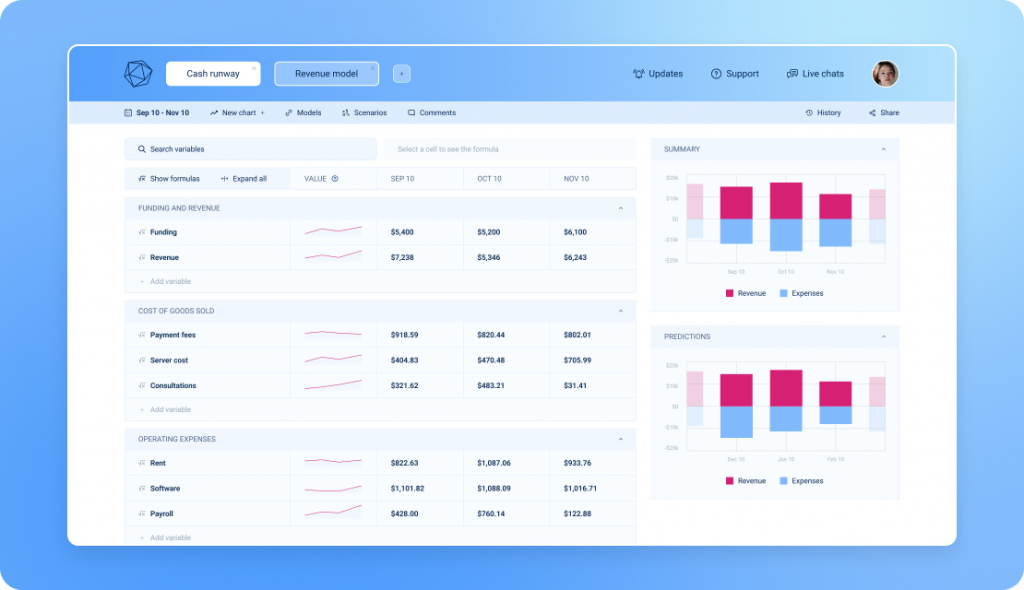

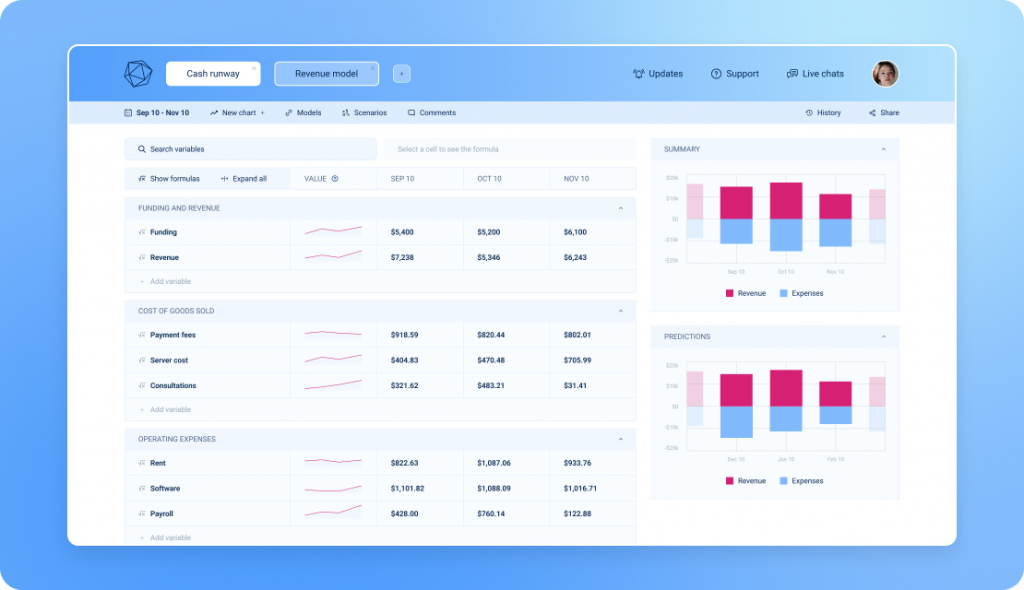

Automating repetitive tasks, the app allows you to easily insert financial data using a reporting template.

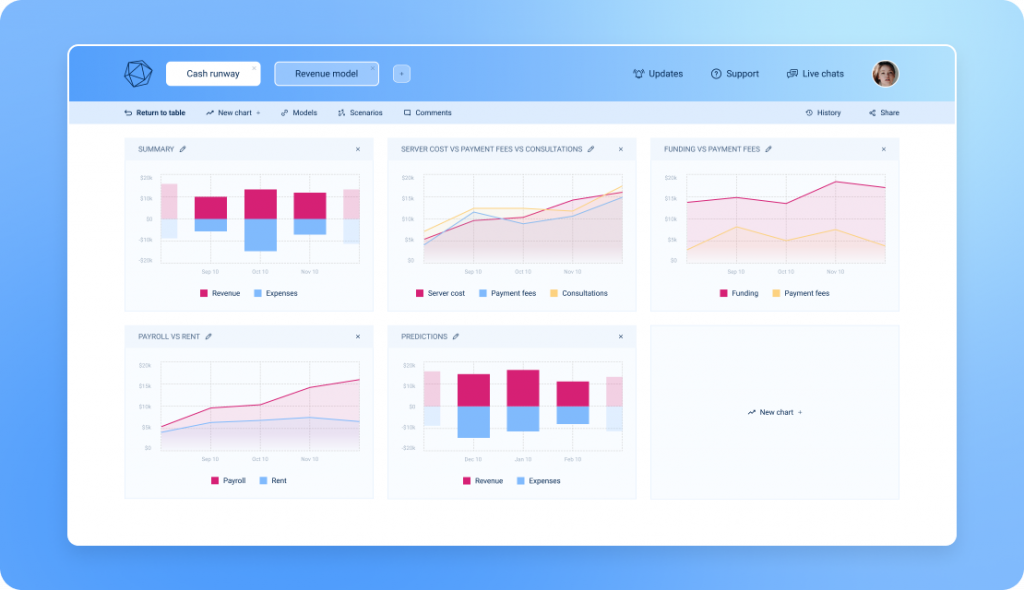

Once the data is inserted, the user can get valuable insights by analyzing data displayed on a customizable dashboard.

The forecasting module allows users to see the outcome of the current expenses, sales, and revenue. Inserting the available data, users get a highly probable forecast and can adjust the budget to avoid undesirable results or enhance positive outcomes.

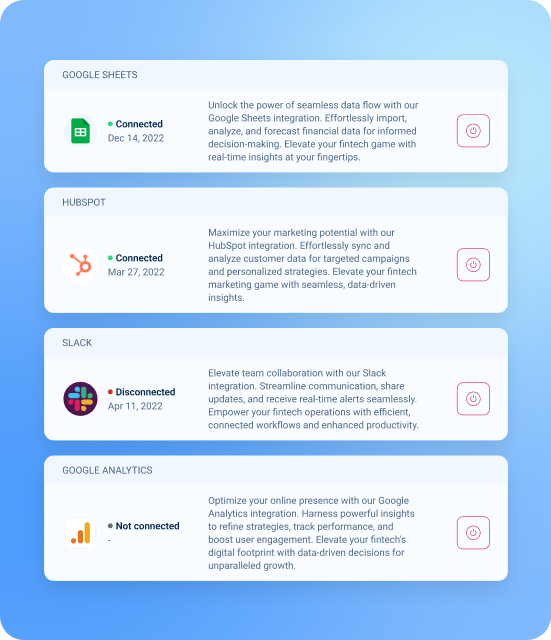

We wanted to deliver an app that would fully cover the needs of a broad range of users. That’s why we implemented integrations with various third-party tools, allowing businesses to streamline data export and import.

To build a solution that fits different businesses of various domains and scales, we had to overcome a number of challenges. Here are some details.

The first engineering challenge that we had to solve was planning the structure of the future solution. The transition from B2C to B2B model meant that we had to redesign the structure and internal logic of the tool, focusing on businesses rather than individuals.

To optimize the tool for the B2B sector, we considered all common scenarios and created several user roles with access to different types of reports. For example, a cashier may only need to use simple tables, while a manager needs access to more detailed analytics dashboards. We considered different cases and gave users the possibility to get access to the most suitable reports depending on their job title and domain.

When signing in, the user chooses the type of their business and based on the size and the company type opts for one of the several options:When signing in, the user chooses the type of their business and based on the size and the company type opts for one of the several options:

The user roles cover the common scenarios for SMBs, with flexible permissions that can be adjusted as required for different situations. This feature was crucial since companies’ workflows vary, with some of them having up to 12 different user roles.

We designed a flexible solution for SMBs to provide a financial management system that could accommodate various needs.

To cover the majority of use cases, we focused on several domains that have similar ways of financial reporting:

Our first goal was to automate data input, so we started with building reporting forms. To streamline the data collection process, we created 40+ reporting templates for different types of companies that allowed us to greatly speed up the data input process.

Still, in some cases, some users may need additional modules, like the Market analysis page. To cover more potential situations, we introduced adaptable templates, offering versatility through a mix of relevant templates based on the business category.

For example, one of the additional blocks that we created is the Human Resources module that allows users to collect data about employees, their salaries, primes, and leaves. For retail companies, we added a template for inserting expenses on keeping a shop (purchases, rent, depreciation costs, and so on).

Finally, when data is inserted, it is presented on the dashboard. The more data is entered, the more accurate are the forecasts. These projections identify the trouble spots that can result from wasteful spending.

Our thorough work on templates and data collection resulted in a tool that allows various companies to focus on enhanced data analysis instead of manual work.

After finishing our work on the core functionality such as reporting, analytics and forecasting, we had to add extra features to address the needs of different businesses. Realizing that we can’t put too many features into a single app as this will affect the performance, we decided to work on integrations and connect the system with common solutions that would extend the functionality.

Now the system allows integration with numerous apps, including:

The integrations allowed us to enhance initial financial functionality with additional modules such as Human Resources, Marketing, and Sales Analytics. For IT companies, we integrated time trackers to automatically gather data on the hours spent on specific projects and estimate the budget accordingly.

Integrating with the most efficient tools on the market, we let users combine their favorite tools with our platform, reaching the most optimal results. Overcoming all mentioned challenges, EVNE developers delivered a one-of-a-kind app for financial analytics that transformed the way businesses manage their financial flows.

We developed a centralized financial management system, letting businesses improve the way they track and analyze their expenses and revenue. Our client was happy with the result, as the transition to a B2B business model worked well, drawing new clients and opportunities for future development.

Reduced reporting and analytics time by 3x

We cut down the average time spent on reporting and analytics by 3 times, allowing users to switch from Excel to our tool and speed up their work processes.

Financial forecasting with 75% accuracy

The solution we helped deliver lets businesses sort out their finances and identify problems with the help of forecasts which are accurate in 75% of cases if all the needed data is inserted.

Successful B2B market entry

Our client gained a new revenue stream by scaling the tool for the B2B market, which persuaded 25% of all users to switch from their old financial tools to ours.

CEO, Financial Services Company

“We got a complex SaaS solution that generates clients for us. Target metrics of the product continue to grow gradually after each new update. As for the maintenance, if the system stops running smoothly, EVNE Developers come to solve this issue asap and with great devotion as if it was their own product. They presented us with the capability to deal with our clients in the best way and get personal profit from the services.”

EVNE Developers is a strong software development team with a product mindset and a track record of successfully scaling minimum viable products (MVPs) into robust and scalable solutions.