Imagine being at the helm of a company with big ambitions, groundbreaking technology, and a vision so compelling that even a whisper to the outside world could ignite a race to market. Now imagine choosing, intentionally, not to announce your plans. Every decision, meeting, and product design happens under a blanket of selective secrecy. That’s the tricky and intriguing game a stealth startup plays — an approach that often divides the startup community but remains a powerful tool in the arsenal of experienced founders.

In this article, we will break down the ideas and reasoning behind why companies opt for stealth, how the approach works, and the tradeoffs associated with it.

what’s in the article

- What Is a Stealth Startup?

- Why Do Founders Choose Stealth Mode?

- Types of Stealth Startups

- Pros and Cons of Running a Startup in Stealth Mode

- How to Operate a Startup in Stealth Mode

- Conclusion

What Is a Stealth Startup?

A stealth startup is a company operating intentionally out of the spotlight, limiting public knowledge of its products, goals, or even existence. This isn’t simply about being quiet — it’s a structured process involving confidentiality agreements, closed networks, and sometimes even fabrication of the company’s true purpose to outsiders.

Picture a stealth startup founder crafting pitches behind closed doors, code being written under project codenames, and even websites obscuring the real nature of the business. The stealth startup meaning goes beyond silence; it is about control, risk mitigation, and competitive strategy at its most intense.

How Stealth Startups Differ from Traditional Startups

Traditional startups often thrive in the public eye. They are constantly and repeatedly making noise with launch announcements, product demos, and buzz-building campaigns. Their energy is invested in building communities, courting early adopters, and establishing a visible presence. Traditional startups typically operate with high publicity, utilizing public job postings for hiring and revealing their product early and frequently. They engage in broad outreach for investor pitches, and their primary risk focus is on user adoption and feedback loops.

In contrast, stealth startups maintain minimal or deliberately misleading publicity. They rely on private networks and referrals for hiring, and their product reveals are delayed and tightly controlled. Investor pitches are targeted and invitation-only, with a strong focus on competition and intellectual property (IP) protection as their main risks. Stealth startups, on the other hand:

- Limit or obfuscate public information about their work.

- Frequently operate with private code repositories and locked-down Slack channels.

- Use NDA-laden pitch decks, sharing only with carefully chosen investors.

- Delay marketing efforts until the moment is just right.

The big difference fundamentally revolves around when, how, and why a startup seeks attention.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Why Do Founders Choose Stealth Mode?

Startups often operate in hyper-competitive environments, where the smallest advantage can mean everything. But when you start a journey in stealth mode, that can seem counterintuitive in an era that rewards transparency and publicity. Yet, founders have compelling incentives for making this choice.

Avoiding Competition

Building a unique product doesn’t guarantee success; someone always has the resources to launch faster once they know what you’re planning. By keeping plans and prototypes confidential, a startup gets the chance to reach critical milestones without inciting a stampede toward the same objective.

Protecting Intellectual Property

As it always happens, being first is rather a fragile advantage. When revealing your concept too early, you can expose vital details before legal protections like patents or trade secrets are fully in place. A startup in stealth mode buys valuable time to lock down intellectual property rights, while also assessing potential weak spots in its innovation.

Gaining More Time

Public scrutiny can force a young company to rush, sometimes at the cost of product quality or strategic soundness. Operating secretly allows for more thoughtful iteration, lessening pressures from potential users, the media, or rivals.

Strategic Quiet

Staying silent can serve as an excellent negotiating tactic. Whether with investors, partners, or potential acquirers, the power of mystery is real. A stealth stage startup can command more favorable terms and attention by building anticipation.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

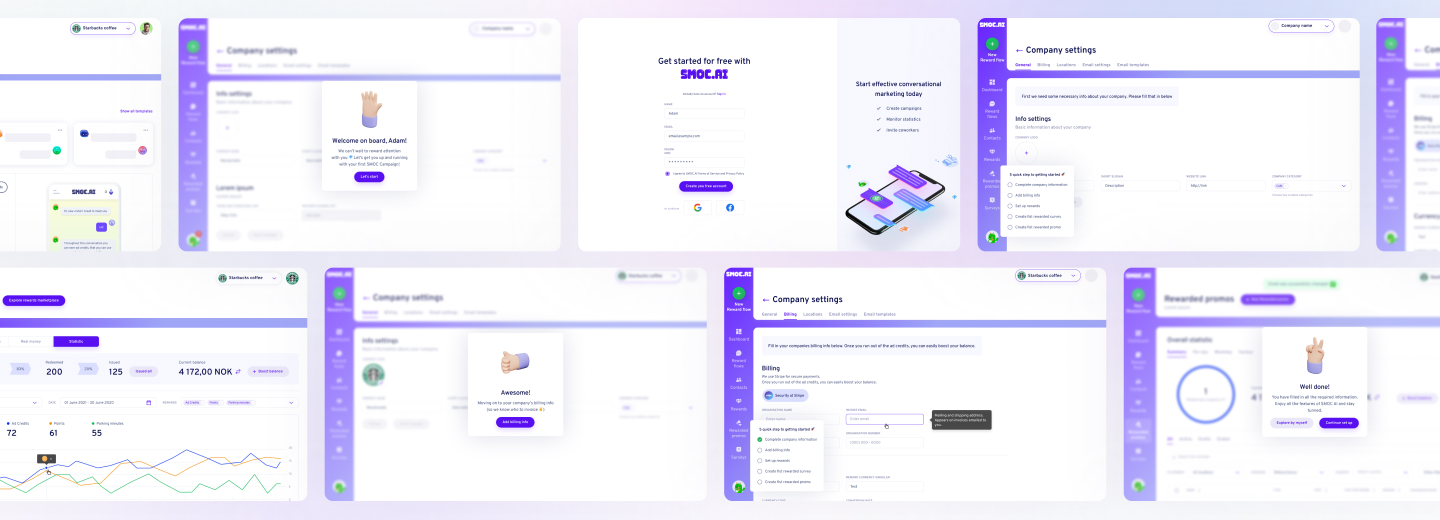

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

Types of Stealth Startups

There are different depths of stealth, with approaches tailored to match the company’s strategic needs:

Total Stealth

No external communication about the product, company mission, or even the company’s name. Operations occur in sealed environments, often with employees, service providers, and vendors bound by strict NDAs.

Partial Stealth

The company’s name and basic information might be public, but key details — especially about the product, target users, or technology — remain hidden. This allows some level of presence (a basic website, a placeholder social account) without betraying true intentions.

Internal Stealth Mode

Sometimes, even sections of a company (often within larger organizations) operate in stealth within their own walls, with certain teams or divisions shielded from the broader company’s knowledge base, reducing leaks.

| Stealth Level | External Awareness | Internal Awareness | Example Scenario |

|---|---|---|---|

| Total Stealth | None | Select team only | First-to-market, high-IP risk |

| Partial Stealth | Basic company info | Full employee base | Generic B2B software public |

| Internal Stealth | Company exists, no project info | Compartmentalized teams | Large tech company spinoff |

Pros and Cons of Running a Startup in Stealth Mode

The decision isn’t all upside. Experienced founders know to weigh both the opportunities and the pitfalls before taking the stealth route.

Advantages of Going Stealth

- Protection from copycats: Faster iterations can happen without rivals tracking your every move.

- IP security: Founders can patent discreetly, with ample time to lawyer up.

- Refined product launch: The final reveal packs a bigger punch after a period of anticipation and refinement.

- Negotiating strength: A good story, half-told, creates urgency and leverage with investors.

- Focus: Thankfully to fewer distractions from external inquiries allow teams to concentrate on building, instead of explaining.

Risks and Downsides to Consider

- Missed feedback: Early product users are an essential calibration tool. Too much secrecy, and vital market validation is lost.

- Hiring challenges: Talent acquisition is trickier when candidates can’t know what they’re signing up for.

- Network effects diminished: Building big, fast communities is nearly impossible in the dark.

- External perception of arrogance or misdirection: Some investors and partners read too much secrecy as either overconfidence or a lack of transparency.

- Investor suspicion: Without public evidence of traction, convincing backers takes extra finesse.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

How to Operate a Startup in Stealth Mode

Succeeding as a stealth startup company means crafting processes that support privacy without stifling progress. Here are a few tactics from years of building in these conditions:

- Use airtight NDAs: Everyone, from new hires to vendors, must acknowledge the stakes and accept legal responsibility for information leaks.

- Internal segmentation: Not every team member needs the full picture; compartmentalize sensitive info accordingly.

- Develop under code names: Products and features are referenced only through internal aliases, not their real-world names.

- Selective investor outreach: Your pitch list should be curated, focusing on backers who understand and accept stealth risks.

- External communication discipline: Websites, PR, and social media profiles offer only generic language or purposeful misdirection.

- Build a ‘need to know’ culture: Trust is critical, but so is discretion. Even the most promising candidate must wait for full details until after signing a comprehensive confidentiality agreement.

- Regular internal checkpoints: Since market feedback is limited, compensate by holding rigorous internal reviews with trusted advisors.

Operating in stealth isn’t about shutting out the world. It’s about controlled, thoughtful engagement aimed at maximising opportunities and minimising risks.

Conclusion

Starting a startup is not an easy task even under the most favourable conditions. Nothing to talk about when you step onto unknown grounds. Start with planning, be ready for amendments and ensure you really need such kind of complications when launching your startup.

Luckily, the market allows you to get assistance from teams such as EVNE Developers on your way to growing a strong venture.

There’s no fixed rule, as far as some startups emerge from stealth in a few months, others take years. It depends on competition, product complexity, and sensitivity to first-mover advantage. The most common range is between 6 and 24 months.

Not quite. Being in beta usually means the product is public but not fully launched, with early users providing feedback. Stealth mode is about limiting all public-facing knowledge, sometimes with no users outside the core team.

Investors base their assessments on founder reputation, market potential, and whatever non-public data they can see under NDA. The vetting often includes more face-to-face meetings and technical due diligence, with extra emphasis on team trustworthiness and defensibility of the innovation.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers