The process of launching a startup requires significant resources and entrepreneurs face major difficulties when looking for funding. The main sources of startup funding consist of venture capital and bank loans however new ventures commonly seek money from angel investors who invest cash in exchange for equity or convertible debt.

Through their capital investments angel investors provide their startups with industry expertise, mentorship, and networking opportunities. But how do you find the right angel investors for your startup? This article will show you how to find angel investors who match your business objective and how to reach out to them for potential investment.

Let’s dive in!

what’s in the article

- Who Are Angel Investors?

- How Do Angel Investors Work?

- Where to Find Angel Investors for Your Startup

- How to Attract Angel Investors to Your Startup

- How Angel Investors Add Value for Your Startup

- Angel Investors vs. Venture Capitalists

- Conclusion

Who Are Angel Investors?

So what is an angel investor? They are high-net-worth individuals who provide financial support to early-stage startups by accepting shares or debt instruments that can convert into equity. Venture capitalists keep funds from various investors and manage them but angel investors support startups by using their funds. They often invest in industries they are passionate about or have expertise in, providing not just capital but also valuable mentorship, strategic guidance, and industry networking.

Former business owners, executives, and professionals make up the population of angel investors who invest money to support startup innovations and receive a return on their investment. Angel investors for startups participate at different levels of involvement starting from financial backing while progressing to hands-on startup guidance involving problem solving and accelerated growth.

How Do Angel Investors Work?

Next, how do angel investors work? Angel investors typically fund startups at the pre-seed or seed stage when businesses are still developing their products, refining their business models, or gaining initial traction. The amount of funding that angel investors provide ranges between thousands of dollars and several million dollars based on investor risk levels and startup growth potential.

Businesses that receive angel funding must give away company shares through which investors acquire ownership positions. Some investors choose convertible debt as an alternative to equity which enables the loan to transform into company shares under mutually established funding round conditions.

Before angel investing in a startup investors conduct a thorough evaluation of market potential, financial projections, founder capabilities, and competitive advantage assessment. Beyond financial contributions, angel investors support startups by offering mentorship, professional advice, introducing them to the business network which enables the startup to grow and prevent common errors.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Where to Find Angel Investors for Your Startup

Strategic planning determines success in finding appropriate angel investors. The search for angel investors who target high-potential startups depends on your visibility at strategic locations. Here are some of the best ways to connect with angel investors and secure funding for your business.

Startup Conferences

Startup conferences provide entrepreneurs with the perfect environment to build connections with industry leaders, angel investors, and other business professionals. TechCrunch Disrupt, Web Summit, and Slush serve as events that draw investors who specifically search for upcoming startup opportunities. The conference activities include pitch competitions, panel discussions, and networking events that enable businesses to display their startups while attracting potential investors. When attending these events have a well-practiced pitch, business cards, and a specific financial requirement presentation.

Angel Investor Groups

The members of formal investment groups their resources to assist each other during startup evaluations. Each month these investment groups organize presentation sessions for business owners to showcase their startups. The most popular angel investment angel networks include the Angel Capital Association (ACA), Tech Coast Angels, and Golden Seeds. Networks providing access to investors matching your industry type and business direction will boost your investor discovery probabilities through proper research and application efforts.

Online Platforms

Startup business owners now have access to multiple online networks that simplify investor connections extending their fundraising opportunities past their direct business connections. Found on AngelList, Gust, and SeedInvest entrepreneurs can make profiles that display their business plans while attracting possible investor connections. Through these platforms, founders can find tools that help them manage fundraising activities, monitor investor engagement and terms negotiation. Your online profile for a startup presentation should demonstrate strong potential growth and a structured presentation that stands out.

Social Media and LinkedIn

Social media, especially LinkedIn, is a powerful tool for connecting with angel investors. Investors use LinkedIn, Twitter, and specialized forums to share market insights and search for new business prospects. Building a noticeable presence requires you to participate in their content and join specific startup communities while also distributing relevant information about your business. Send them a direct personalized message presenting your startup and why they might find it worthwhile.

Partner with Incubator and Accelerator

Participation in startup incubators or accelerators will provide access to powerful investment networks. Through programs such as Y Combinator, Techstars, and 500 Global entrepreneurs access mentorship services with venture capitalists, angel investors, and valuable resources. The conclusion of these programs features startup pitches at demo days that enhance investor funding opportunities. Reputable accelerator programs enhance your startup’s credibility, thus attracting more investors.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

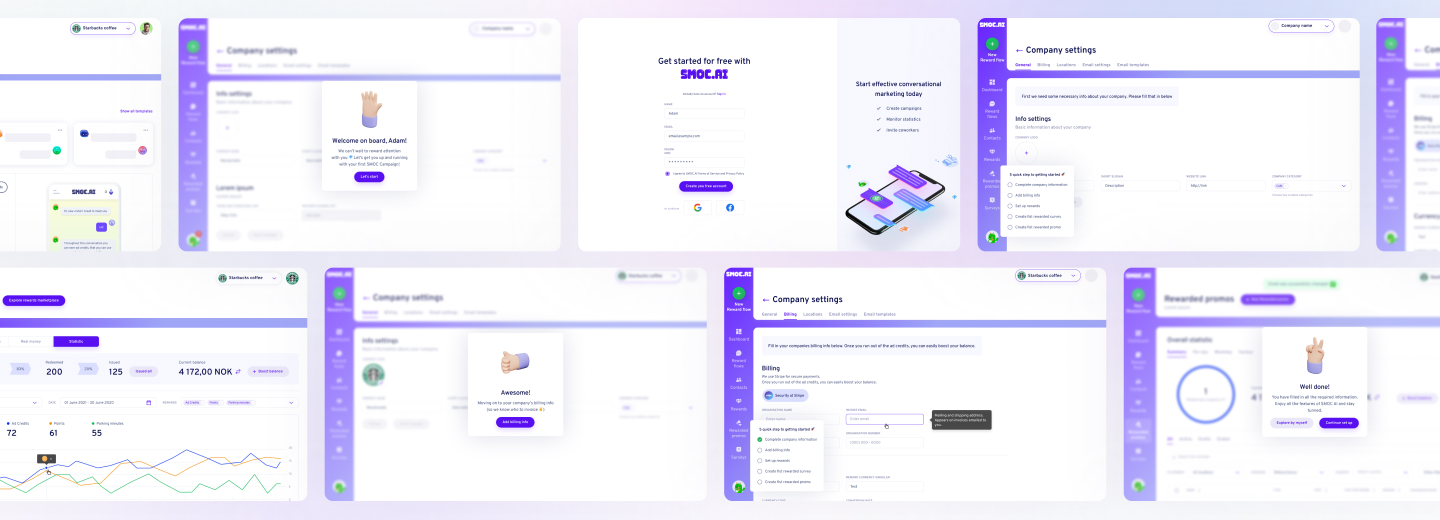

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

How to Attract Angel Investors to Your Startup

Early-stage companies looking for funding from angel investors require businesses with strong growth potential, clear vision, and detailed plans for expansion because these investors carry substantial risks when funding startups. To attract angel investors properly position your startup according to these guidelines.

Create a Clear Business Plan

To gain investor confidence you need a business plan that shows proper organization. Startup investors need to observe a detailed illustration showing your business path to revenue creation and future expansion. Your business plan should include:

- An eye-catching executive summary that highlights its main purpose and distinctive selling points.

- The detailed market analysis that demonstrates consumer demand for your business product or service.

- The different streams of revenue you have established together with your pricing system.

- Realistic financial projections that demonstrate achievable business expansion potential and investment return values.

- Your strategy for customer acquisition and retention with a complete explanation.

- A summary of team qualifications together with their ability to achieve your objectives.

Explain the Benefit from Funding You

The primary goal of angel investors goes beyond interesting concepts because they seek to fund businesses that will yield substantial financial gains. During investor pitches present solid reasons showing that business funding is a profitable investment. Highlight:

- Your prospective market scale and development prospects.

- Your competitive advantage and how your startup differentiates itself.

- Important achievements including early profits, user expansion, strategic partnerships, and pilot project success.

- Acquisition options, IPO capabilities, or future funding opportunities.

The investors need evidence that their funds are being allocated to achieve business expansion and deliver profit goals.

Pict Deck Showcase

Your startup pitch should present a compelling visual design along with brief content to show investors an appealing story about your business. Essential slides include:

- Problem statement – What issue are you solving, and why does it matter?

- Solution – How does your product or service address this problem?

- Market opportunity – The size and potential of your target market.

- Business model – How you plan to make money.

- Traction – Key metrics, user growth, partnerships, and milestones achieved.

- Competitive advantage – What makes you stand out from competitors?

- Go-to-market strategy – How you will acquire customers and scale.

- Financial projections – Revenue, expenses, and projected growth over the next few years.

- Team – The expertise of your founding team and key hires.

- Investment ask – How much funding do you need and how it will be used?

A concise pitch deck with 10-12 slides should present a clear compelling narrative. When practicing your pitch maintain high self-confidence because you need to respond effortlessly to any investor inquiries.

How Angel Investors Add Value for Your Startup

Early-stage businesses can benefit from experienced investors because they provide both industry connections, strategic direction and solve startup challenges to speed up expansion. The following list outlines essential ways that angel investors generate value in addition to monetary contributions:

- Mentorship and Expertise – Several angel investors maintain entrepreneurial and industry expertise which provides essential guidance and mentorship to startups. Their extensive knowledge about handling business obstacles, scaling operations, and knowledge of missteps will enable you to make better business decisions.

- Networking Opportunities – Through their wide business relationships angel investors provide entrepreneurs with access to various crucial networking connections which include present, prospective customers, and business partners.

- Credibility and Market Validation – Your startup’s market position will improve when you get an angel investor who validates your business concept. The involvement of leading investors tells the market that your business demonstrates the acquisition of customers, skilled employees, and additional investors.

- Support in Fundraising – Getting funding support from angel investors enables startups to secure better positioning for upcoming investment rounds. The investor will show you how to perfect your presentation, how to get angel investors, how to work with venture capitalists, and what steps to take before approaching later funding rounds.

- Long-Term Commitment – The investment commitment of angel investors extends beyond typical lending periods because they pursue your business success personally. Their investment strategy centers on sustained development rather than short-term profitability.

Need Checking What Your Product Market is Able to Offer?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Angel Investors vs. Venture Capitalists

Startups receive funding from both angel investors and venture capitalists (VCs) who differ in their operating methods as well as investment amounts and levels of participation.

Funding & Investment Size

Angel investors provide amounts ranging from $10,000 to $1 million making their investments in early-stage startups with their funds. VCs oversee investment pools that distribute sizable capital between $1 million to $100+ million toward established businesses.

Stage & Equity Stake

The investment period for angels begins at pre-seed and seed stages while their equity ownership remains comparatively small. The investment timing of VCs occurs in Series A and beyond while they secure substantial ownership percentages.

Decision Speed & Involvement

Quick investment decisions accompany direct mentorship support from angel investors. VCs usually demand extensive investigation before investing.

Risk & Exit Expectations

Angels demonstrate more willingness to fund untested start-ups by being willing to wait longer for their exits. VCs look for substantial returns within a particular investment period through acquisitions or initial public offerings.

New companies which need guidance should seek angel investors but established businesses requiring large capital inflows will find better support from VCs. Most startups initiate their funding journey through angel investments before moving onto VC capital.

Conclusion

Now you know better how to find angel investors with the help of strategy, networking, and a strong pitch. The right backers become accessible through attending events combined with online platforms and investor group participation. Your growth will experience acceleration through both mentorship services and industry connections provided by angel investors in addition to their financial backing. Stay proactive, refine your pitch, and build relationships to secure the support your startup needs.

Industries like AI, fintech, e-commerce, HealthTech, and GreenTech offer high growth potential and innovation opportunities in 2025.

The startup expenses in e-commerce, software development, digital services, and consulting are lower than those pricing in the biotech and manufacturing industries.

Assess your skills, market interest, competitive landscape, price structures, and market developments. Small audiences should validate your idea before you make any major financial investment.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers