Making financial services engaging is challenging since they’re all about tables, charts, and data. Nonetheless, businesses across all industries are trying to boost client engagement through digital solutions, and fintech is no different. One approach is to include gamification in financial products. Game-like features help financial institutions engage users more effectively and turn ordinary procedures into rewarding and fun activities.

At EVNE Developers, we understand what it involves. As an app development company, we create gamified financial software that is both efficient and engaging.

In this article, we’ll go into financial gamification in depth and share our expertise in the field. We’ll also look at the benefits and great examples of finance gamification.

What is Gamification In Finance?

Gamification is the process of integrating game elements into nongame environments, such as financial services, to boost user engagement. Gamification in finance entails transforming routine financial operations into milestone-based tasks and reward-type activities that are simplified and entertaining using gaming principles similar to interactive games.

Thanks to gamification, the financial industry benefits from increased client involvement and understanding of banking products and services. Besides, it increases the entertainment value of the customer experience. People who take part in these activities receive instant gratification, and some banks even integrate social cooperation, multi-app integration, and a variety of other benefits to improve service and brand awareness.

If you’re skeptical about gaming as a solution to a significant financial issue, you should reconsider. Many major financial institutions have already gamified their services and got higher retention rates with their apps/growth in the customer’s valuation of the brand.

Benefits of Gamification In Finance:

Gamification of financial institutions has several benefits for both banks and their clients, ranging from increased customer engagement and loyalty to drawing new investments into your organization. Here is our list of gamification advantages:

New clients

The development of financial gamification is a new interesting approach to communicating and interacting with potential consumers. Attracting customers with a high-quality banking app that offers more than just traditional features with statistics and figures is smart. This way, you’ll increase brand awareness and the reputation of an innovative financial organization.

Data collection empowerment

You can use digital solutions to examine data on existing bank clients and gain important insights into their behavior. As a result, it may assist your team in creating strategies for future financial app development growth and advancement.

Digital transformation

Today, keeping up with fintech innovations is essential for banks. Every stakeholder, including the bank’s board, management, workers, and customers, may benefit from game solutions as a starting point for the digital transformation process.

Enhanced customer engagement

Clients spend more time using the mobile banking app and interacting with the bank’s services due to the gaming introduction. It can include interactive onboarding, earning rewards, bonuses, interactive calendar events, or badges.

Awareness of new services and products

Forget about traditional advertising if your target audience accepts that with understanding. Banks may use games for advertising and efficiently sharing information about their latest updates and services with their clients. Colorful popups, notifications, or interactive roadmaps on new features are great options.

Financial literacy

People do not always understand financial notions such as debt, investments, and inflation. Gamification finance can boost knowledge about financial themes, streamline banking operations, and improve clients’ financial literacy. Quizzes and games, in fact, may be used to elaborate on a topic. As a result, clients may make more informed decisions about their bank accounts.

Basic Gamification Principles

Wherever financial gamification is used, good implementation adheres to a few key principles:

Goals

Goals must be achievable with reasonable effort. Users become bored if they are too easy and frustrated if they are too complicated.

Rules

The rules must be clear and fair to all users. They should encourage rather than discourage.

Challenges

Challenges must relate to the goals that users achieve when solving them.

Feedback

Positive and consistent feedback is required. It should motivate users to work harder to achieve the app’s milestones and goals.

Points, badges, and leaderboards are common game components. However, businesses can use the above ideas in a variety of ways.

Companies That Use Gamification in Finance Industry

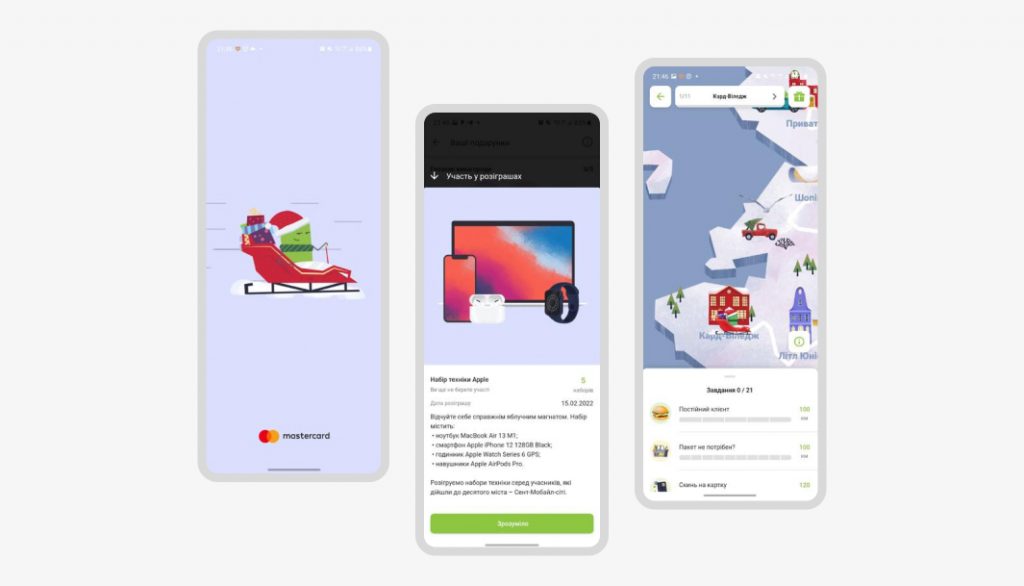

Monobank

Monobank is an online banking platform that combines several strategies to give entertaining services to its consumers. Customers receive frequent rewards from the bank, which makes spending financially advantageous. Another gamified element of Monobank is the possibility for customers to transfer money to other cards by shaking their phones.

PNK Bank

PNC Bank launched a Virtual Wallet to encourage clients to increase their savings. This Virtual Wallet functions as both a checking and a savings account. Punch the Pig is one of its main attractions. This interactive widget appears on the person’s screen as a piggy bank when interacting with the wallet, encouraging the consumer to transfer money into a savings account.

BBVA

Gamification (BBVA Games) is a strategy used by digital bank BBVA to attract clients to use their online services. The bank has created a virtual economy in which consumers are rewarded through a point system. BBVA even earned an award for its gamification finance and gained the confidence of over 100,000 individuals in less than a year. Customers may be able to win music tracks, movies, and tickets through the game.

SmartyPig

SmartyPig is a gamified productivity tool that helps users achieve their financial objectives. If a user wants to buy a new automobile, SmartyPig will serve as a piggy bank. Users may create a savings goal in the SmartyPig App and have money automatically transferred from their bank account to that goal. As users add to their savings, the progress bar rises.

PayPal

PayPal is a major provider of digital financial services for personal, family, and company money management. PaypalMe, one of its gamification approaches, is a powerful tool that provides users who receive money from friends and companies with a free and personalized landing page. It’s a terrific and easy way for freelancers to be paid.

Conclusion

Gamification finance is an excellent way to boost user engagement and increase customer loyalty. The right gamification elements may improve userflow and transform tedious tasks into rewarding and fun activities.

Gamification is definitely a growing trend, and those who adopt it properly will reap the advantages. Your project might begin with a simple gamification idea or a complex gamification UX concept. Whatever your present situation is, we at EVNE Developers would love to add gamification elements to your current or future finance product. Contact us Info@evnedev.com with your idea, and we’ll make it a reality.