Every year, equity crowdfunding platforms fundraise billions of dollars, with significant multi-billion dollar success stories being achieved annually. This has led to an increased demand for startup investments.

The venture capital program attracts individual and corporate investors regardless of their experience. This program goes inside venture capital to help investors equip them with the tools and knowledge needed to evaluate and monitor promising investment prospects, manage risks, and increase returns.

By following a deal flow method, participants learn the steps to successfully invest in startups. By the program’s end, they get an investor field guide – a working tool to properly analyze startups in real time.

what’s in the article

- What is Venture Capital?

- How Venture Capital Works?

- Pros and Cons of Venture Capital for Startups

- The Venture Capital Fundraising Process

- Conclusion

What is Venture Capital?

Venture capital (VC) is the process through which private investors invest in new business ventures with significant growth potential. Venture capital services, in contrast to conventional loans, which require repayment with interest, entails direct investment in startups in exchange for equity, or a partial ownership stake. This equity stake entitles the investors to some portion of the company’s future earnings and successes.

Venture capital for startups is normally given by venture capital firms or individuals with a high capacity to invest in business. Venture capitalists tend to focus on fields such as information technology, biotechnology, and health care because such fields include innovations and expansive growth to result in great returns. For instance, the initial capital investments in Uber, Airbnb, and Zoom were relatively expensive bets then; these startups however transformed into market giants earning fabulous extraordinary returns.

How Venture Capital Works?

Venture capitalists invest money into new companies to generate capital gain on their investments in later sales to the company’s stakes, and control, by buying particular stakes of stocks or shares in the more mature start-ups. When these businesses grow they need separate levels of funding to reach a new phase or introduce a new product. Let’s look at the typical stages of VC funding:

Pre-seed

Pre-seed is the earliest level of venture funding for startups which focuses on the founders and what they require to work on the initial plan, conduct market analysis, or create a model. Normally at this stage, the needed funds are generated by the founders, their families, friends, or angel investors. They are usually considerably small and the primary goal is to prove the business idea that will attract larger investors in the following rounds.

Seed Funding

Startup companies use seed financing to move from the initial idea to implementation, this means funding that is necessary for the idea fine-tuning, conducting additional research, and hiring the first team. Seed investors may include angel investors, seed-stage venture funds, and early-stage VC organizations. Its goal at this stage is to hit certain product milestones and obtain the first set of customers and a bigger round of funding.

Series A, B, C

During series A, B, and C stages, companies are bringing their business to the next level and expanding it.

- Series A: Most Series A deals involve funding for growth and the fine-tuning of the product to help create a scalable business model. For that reason, investors searching for potential stocks are considering businesses with the prospect of becoming profitable in the foreseeable future.

- Series B: During the Series B venture funding for startups, the capital is primarily for the company’s purpose of growing significantly – which could be penetrating a new market. Series B investors expect to see high financial performance and significant market growth activity.

- Series C: Series C funding assists companies in gaining to a scale, where they might be better suited to compete at a larger level, by organic growth through the use of acquisitions, international growth, or developing new products. Often companies in this stage are planning for the IPO or acquisition and Series C investors rather look forward to have lower risk with high return with the assurance of the success that has already been achieved.

Each stage of venture capital funding is important for different reasons for innovative new ventures, and venture capitalists are involved in driving the success of their portfolio companies.

Looking to Build an MVP without worries about strategy planning?

EVNE Developers is a dedicated software development team with a product mindset.

We’ll be happy to help you turn your idea into life and successfully monetize it.

Pros and Cons of Venture Capital for Startups

Venture capital (VC) can be a powerful engine for growth, providing significant capital gains and a mix of strategic inputs to young startups to scale rapidly. But like any sort of investment, it has its drawbacks that every founder should take into account before running to VCs for funding. Here’s a closer look at the pros and cons of venture capital for startups:

Advantages of Venture Capital

- Access to Significant Funding: Venture capital delivers relatively a very large amount of capital which is difficult to provide by other sources. This capital enables corporate organizations to fast-track their development, fund research and innovation, and capture market share.

- Strategic Guidance and Networking: Venture capitalists also offer special skills, as well as contacts with other companies. They regularly advise young start up owners and share with them information on the market operation, the prospects for business expansion and even personnel recruitment.

- Accelerated Growth Potential: With access to substantial capital and expert guidance, startups are validated to scale faster than by bootstrapping or other moderate venture capital funding. This rapid expansion could help place them into a category with others in their sector.

- Enhanced Credibility: VC involvement is supposed to enhance the credibility of a startup as it signifies it as a part of a VC firm or as a credibility of investment from the firm. This validation can help in acquiring more fund, attracting quality talents, and increase customer trust.

Minuses of Venture Capital

- Equity Dilution: To receive startup venture funding, founders have to allow the venture capitalist to have some ownership in the business, meaning that they would have little control over some business decisions. Far from that, in multiple funding stages, entrepreneurs often see their ownership in their own companies shrink.

- Loss of Autonomy: Any such VC brings along with it, some extent of control or say from the investor’s side. There are potential issues that venture capital startup funding wants to exercise a certain level of control over critical decisions, product management, and operational strategies that take decisions from the founder’s autonomy

- Pressure for Rapid Growth: Angel and venture investors expect high returns, which may lead to pressure on startups to scale quickly, sometimes at the expense of sustainable growth. This may lead to founders experiencing a great deal of pressure in order to achieve the required high-performance targets.

- Exit Expectations: VC investors are anticipating high returns within a specific time on the investment made through selling of stock on the public offer or through an acquisition. This can create additional pressure on the startup and may force founders to consider exit strategies sooner than they might otherwise prefer.

While VC funding may be enticing for many founders, merely issuing stocks is not enough and founders should consider the pros and cons to decide whether taking venture capital funding for startup is right for them.

Proving the Concept for FinTech Startup with a Smart Algorithm for Detecting Subscriptions

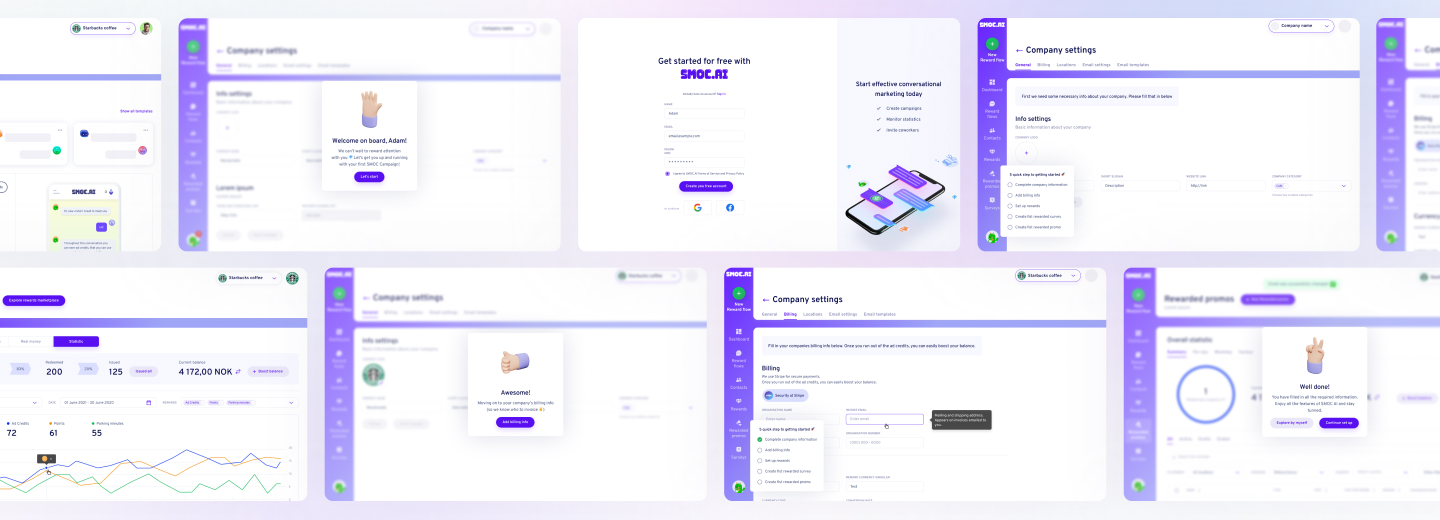

Scaling from Prototype into a User-Friendly and Conversational Marketing Platform

The Venture Capital Fundraising Process

Securing venture capital involves a structured process of fundraising that would attract only qualified investors and get across the potential of a start-up to gather the capital required for its growth. All the steps are important to build the overall investment story that will help attract investors. Here’s a breakdown of the stages involved:

Prepare a Compelling Pitch Deck

The pitch deck is the cornerstone of initiating any venture capital sourcing activities and is the first thing startup VC will get to see about you. This should include:

- the description of the problem your startup solves or the need it fulfills;

- the proposition you are presenting;

- market size;

- business proposition;

- competition and basic financial metrics.

Furthermore, even a great pitch deck must be narrative and explain not only how much and how your business can add value to investors, but also why you and your co-founders believe in the success of your business. Support your ideas with graphics, case studies, and short statistics and always try to remember that having a good pitch deck at your disposal can increase your likelihood of getting funding greatly. Check our pitch deck consulting page for more details.

Build a Target List of Investors

Finding investors is a very extensive and systematic process since investors vary depending on the kind of business being ventured. First of all, establish the names of the venture capital firms or individual investors that fit your industry or those who invested in companies at the same level of growth as yours. Such criteria include:

- the investor’s focus area will define the type of investment opportunity that the investor targets;

- preferred stage of investment will help determine how ready an investment is before the investor can invest in it;

- geographical reach will help determine the location where the investment opportunity is located within the country and the overall portfolio of the investor.

Create your list of these specifics, and any other person who may know them or others that could provide referrals. Going out for investors who know your industry of business brings high chances of attracting them more so they have something to offer to the growth of your business through advice, connections, and knowledge.

Initial Meetings and Investor Pitches

Following the creation of a target list is to schedule meetings in which your pitch will be delivered. These meetings are important because this is when you can show your pitch deck, talk about your start-up opportunity, and answer any questions the investor may have.

Be as ready as you can be – make sure your business proposition is completely detailed, and presented with metrics if available, and you should well describe how the funds will be used. Subscribers will expect not only the profit forecast but also the expertise, the business awareness, and the strategic plan. You need to ensure that they come out of the meeting with one thought in their mind, that is the opportunity you’re offering and that you are capable of making it a reality.

Due Diligence Process

If there is interest after the pitch is presented the investor will go on to do their due diligence to ensure that the information given to them is correct. It is usually an extensive analysis of your business, financial records, legal compliance, market niche, patents, and more crucially, business strategies, and policies.

There might be a need to present documents like financial statements, legal papers, and even customer information to obtain precision and study the risk levels. Analyzing due diligence it would be sensible to state that sometimes it may be a true test; therefore, it would be helpful to be clear, methodical, and keen on providing every piece of necessary data.

When the due diligence is successfully done it makes the investors have more confidence in you and also depicts professionalism and prepared to take the company to the next step which is closing the deal.

Finalizing the Deal

Once due diligence of venture capital startup funding is complete, it is now possible to sit down and agree on the various investment conditions. This usually entails writing the term sheet and the matters that arise out of the investment including the amount that is intended to be invested, the percentage ownership, and the composition of the board among others. When that is done, legal advisors will draft up the agreement and the money will be channeled to your startup. Such a stage signifies the development of a strategic partnership which will then proceed to the growth process. VC fundraising is not an easy process but with the right planning and determination or business consulting services it opens doors to great partnership and the much needed capital for a startup’s vision.

Conclusion

Venture capital is a powerful tool for startups seeking rapid growth, it provides the necessary funds as well as expertise and connections to grow in the right way. Despite the challenging nature of obtaining VC funding, awareness of all the stages of investment—preparing the perfect pitch deck all the way through due diligence—enables the founders to properly attract the right VC and bargain for more favorable terms.

But VC is far from perfect and involves some drawbacks – loss of control and the need to experience higher growth rates. VC may not always be the ideal funding method for founders, individuals should weigh and determine if VC funding fits their plans and objectives.

Often, startups fail at fundraising because they do not properly prepare or do not approach the process with the right mindset, framing the partnerships as the valuable means and ends of sustainable and successful development.

Venture capital (VC) is a form of private equity investment in early-stage companies with high growth potential. VC firms provide capital and expertise in exchange for an equity stake in the company.

You should consider venture capital when:

- Your business has a high growth potential and requires significant capital to scale.

- You need access to experienced investors who can provide strategic guidance and connections.

- You’re willing to give up some ownership in your company in exchange for funding.

About author

Roman Bondarenko is the CEO of EVNE Developers. He is an expert in software development and technological entrepreneurship and has 10+years of experience in digital transformation consulting in Healthcare, FinTech, Supply Chain and Logistics.

Author | CEO EVNE Developers